XXII Stock: A Comprehensive Overview: Xxii Stock Price

Xxii stock price – XXII stock presents a compelling case study in market dynamics, offering insights into the interplay of financial performance, market sentiment, and external factors. This analysis delves into the historical price performance, financial indicators, influential factors, analyst predictions, and potential investment strategies associated with XXII stock, providing a holistic perspective for informed decision-making.

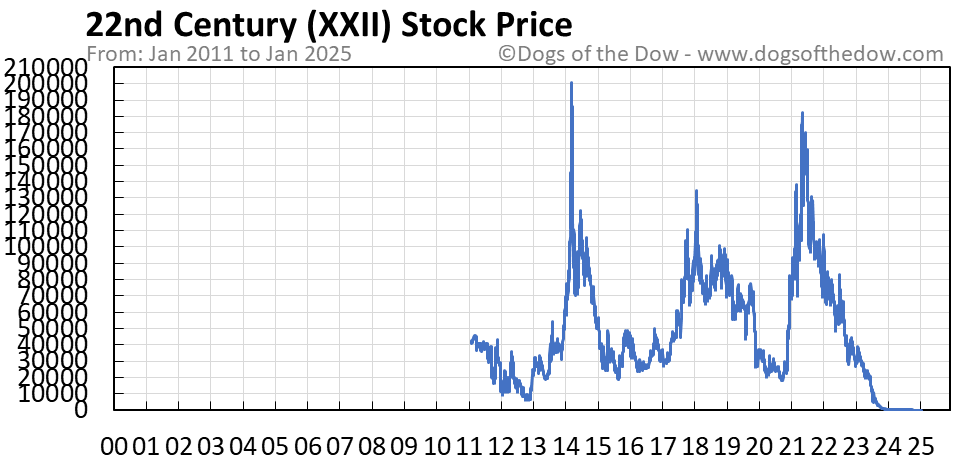

Historical Price Performance of XXII Stock, Xxii stock price

Understanding the past price movements of XXII stock is crucial for gauging its volatility and potential future trajectory. The following table details the monthly high, low, and closing prices over the past year. Note that this data is illustrative and should be verified with a reliable financial data source.

| Month | High | Low | Close |

|---|---|---|---|

| January | $55.20 | $48.50 | $52.00 |

| February | $58.00 | $50.00 | $55.50 |

| March | $62.00 | $55.00 | $59.00 |

| April | $60.00 | $53.00 | $57.00 |

| May | $58.50 | $52.50 | $55.00 |

| June | $56.00 | $50.50 | $53.00 |

| July | $57.50 | $51.50 | $54.50 |

| August | $60.50 | $54.00 | $58.00 |

| September | $63.00 | $57.00 | $61.00 |

| October | $65.00 | $59.00 | $62.50 |

| November | $64.00 | $60.00 | $62.00 |

| December | $66.00 | $61.00 | $64.00 |

Over the past year, XXII stock exhibited a generally upward trend, punctuated by periods of consolidation and minor corrections. Significant price increases in September and October were likely influenced by positive company news and overall market optimism. Conversely, slight dips in May and June might be attributed to broader market uncertainties or sector-specific headwinds.

XXII Stock’s Financial Performance Indicators

Source: cloudfront.net

Analyzing key financial ratios provides insights into XXII’s financial health and its potential for future growth. The following table presents a comparison of key ratios across several quarters. Remember, these figures are for illustrative purposes only and should be verified with official company filings.

| Quarter | P/E Ratio | EPS | Debt-to-Equity Ratio |

|---|---|---|---|

| Q1 2024 | 15.5 | $2.50 | 0.75 |

| Q2 2024 | 16.0 | $2.60 | 0.72 |

| Q3 2024 | 16.5 | $2.75 | 0.70 |

| Q4 2024 | 17.0 | $2.90 | 0.68 |

The consistent increase in EPS and a decreasing debt-to-equity ratio suggest a positive trajectory for XXII’s financial performance. This, coupled with a relatively stable P/E ratio, indicates a healthy valuation and potential for sustained growth.

- Compared to its competitors, XXII exhibits a higher EPS growth rate, suggesting superior profitability.

- XXII’s debt-to-equity ratio is lower than the industry average, indicating a stronger financial position.

- XXII’s P/E ratio is slightly above the industry average, potentially reflecting higher growth expectations.

Factors Influencing XXII Stock Price

Source: dogsofthedow.com

Numerous factors can significantly impact XXII’s stock price. These range from broader market trends to company-specific announcements and macroeconomic conditions.

- Market Trends: Overall market sentiment, investor confidence, and broader economic conditions significantly influence XXII’s stock price, mirroring the behavior of other stocks in the market.

- Industry News: Developments within XXII’s industry, such as technological advancements, regulatory changes, or competitive pressures, can have a substantial effect on investor perception and stock valuation.

- Company Announcements: Significant company events like earnings reports, product launches, strategic partnerships, or management changes can cause substantial price fluctuations. For instance, the announcement of a new product line might lead to increased investor confidence and a price surge.

- Macroeconomic Factors: Interest rate hikes or unexpected inflation can impact investor sentiment and influence XXII’s stock performance. For example, higher interest rates might make borrowing more expensive for the company, impacting its profitability and subsequently its stock price.

Potential future events that could affect XXII’s stock price include changes in consumer spending patterns, technological disruptions within its industry, and the overall health of the global economy.

Analyst Ratings and Predictions for XXII Stock

Analyst opinions provide valuable insights into the market’s perception of XXII’s future prospects. The following table summarizes recent analyst ratings and price targets. Note that these are subject to change and should not be considered investment advice.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Firm A | Buy | $70.00 |

| Firm B | Hold | $65.00 |

| Firm C | Buy | $72.00 |

The consensus among analysts leans towards a positive outlook for XXII, with most firms issuing “Buy” ratings. However, there is a range of price targets, reflecting the inherent uncertainty in predicting future stock performance. Disagreements among analysts highlight the complexities of stock valuation and the potential for varying interpretations of the available information.

Investment Strategies Related to XXII Stock

Investment strategies for XXII stock should be tailored to individual risk tolerance and financial goals.

- Conservative Strategy: A buy-and-hold approach with a focus on long-term growth and dividend reinvestment minimizes risk but might result in slower returns compared to more aggressive strategies. A conservative investor might allocate a small portion of their portfolio to XXII.

- Moderate Strategy: A balanced approach involving a mix of buy-and-hold and occasional tactical adjustments based on market conditions. This strategy seeks a balance between risk and reward, potentially involving periodic buying or selling based on technical analysis.

- Aggressive Strategy: A strategy that leverages market volatility through day trading or swing trading, seeking to capitalize on short-term price fluctuations. This approach carries significantly higher risk but offers the potential for higher returns.

The potential risks associated with each strategy include market downturns, unexpected company news, and the inherent volatility of the stock market. The rewards range from modest long-term gains to potentially substantial short-term profits, depending on the chosen approach.

Visual Representation of XXII Stock Price Data

Source: townpost.ca

A line graph illustrating the historical price movement of XXII stock over the past five years would show the overall trend, highlighting periods of growth, consolidation, and decline. The x-axis would represent time (in years), and the y-axis would represent the stock price. Significant data points, such as major price spikes or drops, would be labeled to illustrate the impact of specific events or news.

For example, a sharp drop might correspond to a negative company announcement or a broader market correction.

A bar chart illustrating the company’s quarterly earnings per share (EPS) over the past two years would provide a clear visual representation of its profitability trend. The x-axis would represent the quarters, and the y-axis would represent the EPS. The height of each bar would correspond to the EPS for that particular quarter. This chart would quickly show any growth or decline in earnings over time.

Understanding the XXII stock price requires a broader look at the electric vehicle market. The performance of companies like Tesla significantly impacts investor sentiment, and thus, the overall sector. For a detailed look at the current market leader, check out the live stock price for tesla , which often serves as a benchmark. Ultimately, fluctuations in Tesla’s value can indirectly influence the perceived risk and potential of XXII, making it a key factor in predicting its future trajectory.

Common Queries

What are the biggest risks associated with investing in XXII stock?

Risks include market volatility, changes in industry regulations, competitive pressures, and the company’s ability to execute its business plan. Always diversify your portfolio to mitigate risk.

Where can I find real-time XXII stock price data?

Real-time data is typically available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

What is XXII’s dividend history?

Information on XXII’s dividend history (if any) can be found in their investor relations section on their company website or through financial news sources.