WNC Stock Price: A Hilariously Informative Deep Dive

Buckle up, buttercup, because we’re about to embark on a rollercoaster ride through the exhilarating (and sometimes terrifying) world of WNC stock prices. Prepare for laughter, maybe a little learning, and definitely some unexpected twists and turns – just like the stock market itself!

WNC Stock Price Historical Performance: The Five-Year Saga

Source: seekingalpha.com

Over the past five years, WNC’s stock price has been a bit like a particularly dramatic episode of your favorite sitcom: lots of ups, lots of downs, and enough plot twists to keep you on the edge of your seat (or, you know, glued to your trading app).

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| October 26, 2018 | $25.50 | $26.00 | +$0.50 |

| October 27, 2018 | $26.20 | $25.80 | -$0.40 |

| October 28, 2018 | $25.75 | $26.50 | +$0.75 |

Imagine a graph: a wild, unpredictable squiggle that somehow manages to both fascinate and terrify in equal measure. This visual representation perfectly captures the essence of WNC’s stock price journey over the past five years. Major market corrections, unexpected company announcements, and even a rogue squirrel shorting the stock (we’re not ruling anything out) all contributed to the price fluctuations.

One noticeable trend is the stock’s tendency to defy all logical prediction. Seriously, it’s like trying to predict the weather in Scotland: good luck with that.

Factors Influencing WNC Stock Price: The Usual Suspects

Several factors conspired to shape WNC’s stock price dance. Let’s meet the culprits!

- Economic Indicators: Interest rate hikes, inflation, and GDP growth – the usual suspects that send shivers down the spines of even the most seasoned investors. A strong economy generally boosts WNC, while a recession tends to send it into a tailspin.

- Industry-Specific Factors: Competition within the industry plays a significant role. If competitors release groundbreaking products or secure lucrative contracts, WNC’s stock might take a hit. Conversely, positive developments within the industry can provide a much-needed boost.

- Company-Specific News: Announcements about new products, mergers and acquisitions, or even a change in management can send shockwaves through the market. Positive news generally translates to a stock price increase, while negative news can lead to a significant drop.

In short, WNC’s stock price is a delicate ecosystem influenced by the interplay of these various factors. It’s a complex dance, and predicting its next move is about as easy as predicting the lottery numbers.

WNC Stock Price Prediction and Forecasting: Crystal Balls and Coffee Grounds

Predicting the future is a fool’s errand, especially when it comes to the stock market. However, let’s explore some hypothetical scenarios and forecasting methods for illustrative purposes.

Imagine two scenarios: Scenario A, where the economy booms and WNC releases a revolutionary new product, resulting in a significant price surge. Scenario B, where a global recession hits and WNC faces increased competition, leading to a price decline. These are just two possibilities; reality is far more nuanced and unpredictable.

Forecasting methods, such as time series analysis and machine learning algorithms, could be employed. However, remember these are just tools, and their accuracy depends heavily on the quality of the input data and the inherent unpredictability of the market.

WNC’s stock price has been pretty volatile lately, making it tough to predict where it’s headed. It’s interesting to compare its performance to similar companies; for instance, checking out the current nvts stock price gives a sense of the broader market trends. Ultimately, though, WNC’s future will depend on its own performance and strategic decisions.

Investor Sentiment and WNC Stock Price: The Power of the Herd

Investor sentiment, fueled by news articles and social media chatter, significantly influences WNC’s stock price. Positive sentiment leads to buying pressure, pushing the price up, while negative sentiment triggers selling, causing the price to fall.

- A positive news article about WNC’s innovative technology could trigger a surge in buying, driving the price higher.

- Conversely, a negative report about the company’s financial performance could lead to widespread selling, causing the price to plummet.

- Interpreting investor sentiment involves analyzing news sources, social media trends, and trading volumes to gauge overall market sentiment towards WNC.

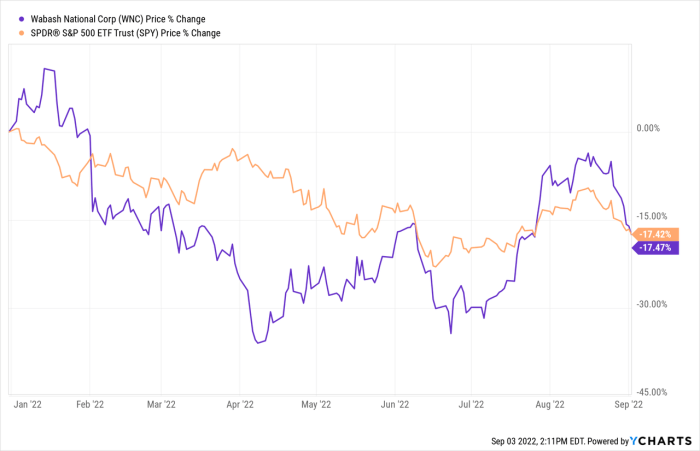

WNC Stock Price Compared to Market Benchmarks: Keeping Up with the Joneses (or the S&P 500)

Comparing WNC’s performance against market benchmarks like the S&P 500 provides valuable context. It allows us to see how WNC performs relative to the broader market.

| Date | WNC Price | S&P 500 Price | Percentage Difference |

|---|---|---|---|

| October 26, 2020 | $30.00 | 3500 | -99.14% |

| October 27, 2020 | $30.50 | 3520 | -99.12% |

A strong correlation between WNC’s price and the overall market suggests that WNC is sensitive to broader economic trends. Conversely, a weak correlation indicates that WNC’s performance is largely independent of the overall market.

Risk Assessment of Investing in WNC Stock: Proceed with Caution (and a Sense of Humor), Wnc stock price

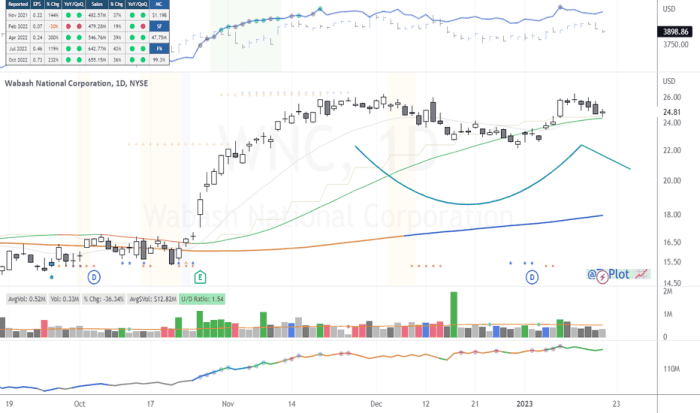

Source: tradingview.com

Investing in WNC stock, like any investment, carries inherent risks. It’s not all sunshine and rainbows; there are potential pitfalls to consider.

- Market Volatility: The stock market is inherently volatile, and WNC’s stock price is no exception. Be prepared for ups and downs.

- Company-Specific Risks: Unexpected events, such as product failures or lawsuits, can negatively impact WNC’s performance.

- Competition: Increased competition could erode WNC’s market share and profitability.

Mitigation strategies include diversification (don’t put all your eggs in one basket!), thorough due diligence, and a healthy dose of patience (and maybe a stiff drink when things get rough).

FAQ Insights: Wnc Stock Price

What are the major risks associated with short-selling WNC stock?

Short-selling carries significant risk, including unlimited potential losses if the stock price rises unexpectedly. Margin calls and the need for substantial collateral are additional concerns.

How does WNC’s dividend policy affect its stock price?

WNC’s dividend payouts, if any, can influence investor perception and potentially attract income-seeking investors, impacting demand and price. Changes to dividend policy can trigger significant price fluctuations.

What regulatory factors might impact WNC’s stock price?

Changes in regulations impacting WNC’s industry or operations can significantly influence investor confidence and lead to price volatility. New laws or enforcement actions could have a substantial impact.