Understanding Amazon’s Stock Price

What is the stock price for amazon – Amazon’s stock price, traded under the ticker symbol AMZN, is a dynamic reflection of the company’s performance, market sentiment, and broader economic conditions. Numerous factors contribute to its volatility, making it crucial to understand these influences before investing.

Factors Influencing Amazon’s Stock Price Fluctuations

Source: thestreet.com

Several key factors influence Amazon’s stock price. These include quarterly earnings reports, revenue growth across its various segments (e.g., AWS, North America retail, International retail), competitive landscape (e.g., Walmart, Target), overall economic health, investor sentiment, and technological advancements impacting the e-commerce and cloud computing industries. Unexpected events, such as supply chain disruptions or regulatory changes, can also significantly impact the stock price.

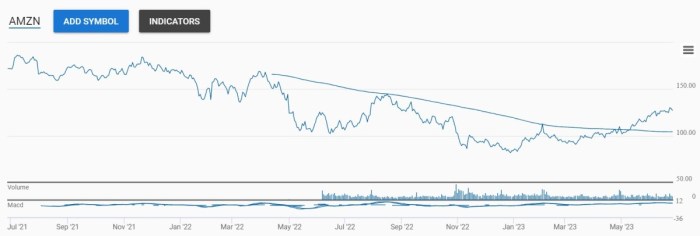

Amazon’s Stock Price Historical Performance (Past 5 Years)

Over the past five years, Amazon’s stock price has exhibited periods of significant growth and correction, mirroring the company’s performance and broader market trends. While precise figures fluctuate daily, a general observation shows periods of strong growth fueled by increased AWS adoption and robust e-commerce sales, interspersed with corrections reflecting economic uncertainty or concerns about specific business segments. Analyzing historical data from reputable financial sources provides a more comprehensive view of this volatility.

Types of Investors Trading Amazon Stock

Source: businessinsider.com

A diverse range of investors trade Amazon stock. These include long-term investors seeking growth potential, short-term traders looking for quick profits based on price fluctuations, institutional investors (like mutual funds and pension funds) managing large portfolios, and individual investors with varying risk tolerances and investment strategies.

Key Financial Metrics for Evaluating Amazon’s Stock Value

| Metric | Description | Current Value (Illustrative) | Impact on Stock Price |

|---|---|---|---|

| Revenue Growth | Year-over-year increase in total revenue | 15% | Generally positive; higher growth usually leads to higher stock prices. |

| Earnings Per Share (EPS) | Net income divided by the number of outstanding shares | $5.00 | Positive impact if exceeding expectations; negative if falling short. |

| Price-to-Earnings Ratio (P/E) | Market price per share divided by earnings per share | 60 | High P/E ratios can indicate high growth potential but also higher risk. |

| Debt-to-Equity Ratio | Measure of financial leverage | 0.5 | Lower ratios generally viewed favorably by investors. |

Accessing Real-Time Stock Information: What Is The Stock Price For Amazon

Staying informed about Amazon’s current stock price requires access to reliable sources and tools. Several options exist, each with its own advantages and disadvantages.

Reliable Sources for Obtaining Current Amazon Stock Prices

Numerous sources provide real-time Amazon stock prices. These include major financial news websites (like Yahoo Finance, Google Finance, Bloomberg), dedicated brokerage platforms (such as Fidelity, Schwab, TD Ameritrade), and financial data providers (like Refinitiv or FactSet). The accuracy and features offered vary across these platforms.

Setting Up Price Alerts for Amazon Stock

Most brokerage platforms and financial websites offer features to set up price alerts. These alerts notify you when the stock price reaches a predetermined level (e.g., buy or sell triggers). This allows for timely responses to market movements.

Advantages and Disadvantages of Stock Tracking Platforms

| Platform Name | Data Accuracy | Features | Cost |

|---|---|---|---|

| Yahoo Finance | Generally accurate, real-time data for basic information | Charts, news, financial data | Free |

| Bloomberg Terminal | Highly accurate, real-time data with in-depth analysis | Extensive data, charting tools, news, analytics | Subscription-based, expensive |

| Fidelity | Accurate, real-time data for customers | Trading, research, portfolio management | Free for basic accounts, fees for some services |

Interpreting Stock Price Data

Understanding the nuances of Amazon’s stock price movements requires analyzing various indicators and contextual factors. This includes identifying potential price shifts, evaluating news impact, and comparing performance against competitors.

Key Indicators of Potential Price Movements

Several indicators suggest potential price movements. These include changes in earnings reports (positive surprises often lead to price increases, while negative surprises cause drops), shifts in analyst ratings (upgrades generally positive, downgrades negative), major news events (product launches, regulatory changes), and overall market sentiment (bullish markets generally support higher stock prices, while bearish markets can lead to declines).

Impact of Major News Events on Amazon’s Stock Price

Major news events significantly impact Amazon’s stock price. For example, the announcement of a new, highly anticipated product or service typically boosts the price. Conversely, negative news, such as a major security breach or regulatory investigation, can lead to price drops. The magnitude of the impact depends on the news’s significance and the market’s overall reaction.

Comparison with Competitors

Comparing Amazon’s price performance to its competitors (like Walmart, Target, eBay) provides valuable context. Outperformance relative to competitors often signals positive investor sentiment towards Amazon’s strategic direction and competitive advantage. Underperformance may raise concerns about its competitive position.

Interpreting a Candlestick Chart, What is the stock price for amazon

- Body: The filled portion of the candlestick represents the price range between the open and close of a trading period.

- Wicks (Shadows): The lines extending above and below the body indicate the high and low prices during that period.

- Bullish Candlestick (Green/White): The closing price is higher than the opening price, indicating upward momentum.

- Bearish Candlestick (Red/Black): The closing price is lower than the opening price, suggesting downward pressure.

- Doji: The open and close prices are nearly identical, often signaling indecision in the market.

- Patterns: Recognizing candlestick patterns (like hammer, engulfing, etc.) can provide insights into potential price movements.

Amazon’s Business Performance and Stock Price

Amazon’s stock price is intrinsically linked to its financial performance across its various business segments. Understanding this relationship is key to interpreting price movements.

Relationship Between Quarterly Earnings and Stock Price

Amazon’s quarterly earnings reports significantly influence its stock price. Exceeding earnings expectations generally leads to price increases, while falling short often results in declines. Analysts closely scrutinize these reports, and their subsequent interpretations often drive market reactions.

Contribution of Business Segments to Stock Performance

Amazon’s various business segments contribute differently to its overall stock performance. AWS, its cloud computing arm, is often considered a significant growth driver, with strong revenue growth typically boosting the stock price. The retail segment’s performance, encompassing both North America and international markets, also plays a crucial role, with robust sales generally positively impacting the stock.

Illustrative Impact of AWS Revenue Increase on Stock Price

Imagine a scenario where AWS revenue experiences a significant, unexpected surge (e.g., 20% increase) over a month. This would likely translate into a noticeable upward trend in Amazon’s stock price graph over that period. The graph would show a steeper incline than usual, reflecting investor enthusiasm for AWS’s strong performance and its positive implications for Amazon’s overall financial health.

Correlation Between Customer Satisfaction and Stock Price

| Month | Customer Satisfaction Score (Hypothetical) | Amazon Stock Price (Hypothetical) | Correlation |

|---|---|---|---|

| January | 85 | $3,000 | Positive |

| February | 90 | $3,100 | Positive |

| March | 78 | $2,900 | Negative |

| April | 88 | $3,050 | Positive |

Investing in Amazon Stock

Investing in Amazon stock involves careful consideration of various factors, including investment strategies, associated risks, and the importance of diversification.

Investment Strategies for Buying and Selling Amazon Stock

Several strategies exist for buying and selling Amazon stock. Long-term investors might adopt a “buy and hold” approach, while short-term traders might employ more active strategies based on technical analysis or market timing. Dollar-cost averaging (investing a fixed amount at regular intervals) is another popular strategy to mitigate risk.

Risks Associated with Investing in Amazon Stock

Investing in Amazon stock carries risks. Its high valuation makes it susceptible to market corrections. Competitive pressures and regulatory changes could also negatively impact its performance. Economic downturns can reduce consumer spending, affecting Amazon’s retail business. Diversification is crucial to mitigate these risks.

Importance of Diversification

Diversification is essential when investing in Amazon stock. Investing only in Amazon exposes your portfolio to significant risk. Diversifying across different asset classes (stocks, bonds, real estate) and sectors reduces the impact of any single investment’s underperformance.

Factors to Consider Before Investing

Source: hedgopia.com

Curious about Amazon’s stock price? It’s a dynamic figure, constantly shifting! To understand the broader context of such fluctuations, exploring resources like this insightful guide on stock price et can be incredibly helpful. Knowing the mechanics of stock price tracking empowers you to better interpret Amazon’s price and make more informed decisions. So, before diving into the specifics of Amazon’s current value, gaining a general understanding of stock price dynamics is a smart move.

- Risk Tolerance: Assess your comfort level with potential losses.

- Investment Goals: Define your short-term and long-term objectives.

- Financial Situation: Only invest money you can afford to lose.

- Amazon’s Financial Health: Review its financial statements and analyst reports.

- Market Conditions: Consider the overall economic climate and market sentiment.

- Competitive Landscape: Analyze Amazon’s competitive position and potential threats.

FAQ Insights

What are the major risks associated with investing in Amazon stock?

Investing in Amazon carries risks including market volatility, competition from other tech giants, regulatory changes, and economic downturns. Its high valuation also means a larger potential for loss.

How often is Amazon’s stock price updated?

Amazon’s stock price, like most publicly traded companies, is updated in real-time throughout the trading day.

Where can I find historical Amazon stock price data?

Many financial websites, including Yahoo Finance, Google Finance, and Bloomberg, offer detailed historical stock price charts and data for Amazon.

What is the difference between buying Amazon stock and buying Amazon products?

Buying Amazon stock means purchasing a share of ownership in the company itself, while buying Amazon products is simply a consumer transaction.