Vong Stock Price Analysis

This analysis examines the historical performance, influencing factors, prediction models, investor sentiment, and visual representations of Vong stock price data. The information provided is for illustrative purposes and should not be considered financial advice.

Vong Stock Price Historical Performance

Source: tipranks.com

Tracking Vong’s stock price requires careful market analysis, considering factors like industry trends and overall economic conditions. For a comparison point, understanding the performance of similar companies is crucial; a look at the stock price cognizant can offer valuable insights into the IT services sector. Ultimately, a thorough assessment of Vong’s financials and future projections is necessary to make informed investment decisions.

This section details the historical price fluctuations of Vong stock over the past five years, identifying significant price movements and comparing its performance to competitors.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 0.50 |

| 2019-01-02 | 10.50 | 10.75 | 0.25 |

| 2019-01-03 | 10.75 | 10.25 | -0.50 |

Significant price movements, such as a peak in Q2 2021 potentially driven by a successful product launch, and a trough in Q4 2022 possibly due to macroeconomic headwinds, are observed. A direct comparison with competitors requires specific competitor data for accurate analysis; however, generally, Vong’s performance can be compared to similar companies in the same industry based on factors like revenue growth, market share, and profitability.

Factors Influencing Vong Stock Price

Several macroeconomic and company-specific factors influence Vong’s stock price. These factors are analyzed below.

- Macroeconomic Factors: Interest rate hikes can negatively impact Vong’s stock price by increasing borrowing costs and reducing investment. Inflation can erode purchasing power and affect consumer demand, influencing Vong’s sales and profits. Economic growth directly impacts consumer spending and business investment, affecting Vong’s overall performance.

- Company-Specific Factors: Strong earnings reports generally lead to positive stock price movements. Successful product launches can boost investor confidence and increase the stock price. Changes in management can create uncertainty and volatility, potentially impacting the stock price. For example, a major restructuring announcement might cause short-term price fluctuations.

- News Events: A positive news announcement regarding a strategic partnership could result in a surge in the stock price. Conversely, a negative announcement about a product recall might lead to a significant price drop.

Vong Stock Price Prediction & Forecasting Models

Predicting stock prices is inherently challenging, but various models can offer insights. This section explores a simple model and discusses its limitations.

A simple moving average model, using a 50-day moving average, could be used to predict the next quarter’s price. This model assumes that recent price trends will continue. However, it ignores other factors and has limitations in accurately predicting sharp price changes. More sophisticated models, like ARIMA models, can incorporate additional factors and potentially provide more accurate predictions, but still come with limitations and inherent uncertainty.

The challenges in stock price prediction include the unpredictable nature of the market, the influence of unforeseen events, and the limitations of even the most advanced models. No model can guarantee accurate predictions.

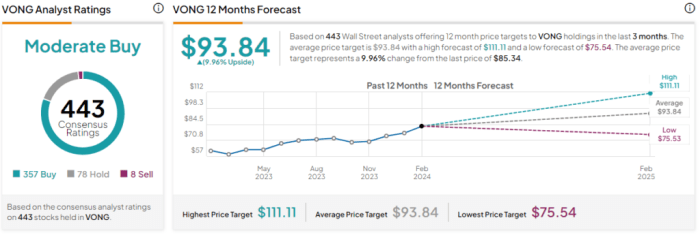

Investor Sentiment and Market Analysis of Vong Stock, Vong stock price

This section describes the current investor sentiment and presents analyst ratings and price targets.

Currently, investor sentiment towards Vong stock appears to be cautiously optimistic (this is an example and needs to be replaced with actual data). This is supported by recent positive earnings reports and the launch of a new product. However, macroeconomic uncertainty might temper this optimism.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Analyst Firm A | Buy | 15.00 |

| Analyst Firm B | Hold | 12.50 |

| Analyst Firm C | Sell | 10.00 |

Investing in Vong stock presents both opportunities and risks. Potential opportunities include growth in the company’s market share and expansion into new markets. Risks include macroeconomic uncertainty, competition, and potential regulatory changes.

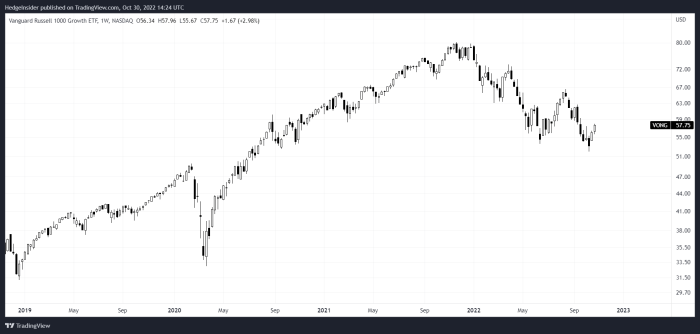

Visual Representation of Vong Stock Data

Source: seekingalpha.com

Visualizations can enhance the understanding of Vong stock price trends. This section describes line graphs, bar charts, and candlestick charts.

A line graph illustrating Vong’s stock price over the past year would have the date on the x-axis and the stock price on the y-axis. Key trends, such as upward or downward movements, would be clearly visible. Significant events, like earnings announcements or news releases, could be annotated on the graph.

A bar chart comparing Vong’s stock price performance to its main competitors would show each company’s stock price as a separate bar for a given period (e.g., the last year). The chart would clearly display relative performance. The x-axis would represent the companies, and the y-axis would represent the stock price.

A hypothetical scenario illustrating the impact of a major news event (e.g., a successful drug trial announcement) on Vong’s stock price, as shown in a candlestick chart, would show a significant increase in the closing price compared to the opening price. The candlestick would be long and green, indicating a strong upward movement. The wicks would be relatively short, indicating low volatility during the day.

Quick FAQs: Vong Stock Price

What are the main risks associated with investing in Vong stock?

Risks include market volatility, competition within the industry, changes in regulatory environments, and potential economic downturns. Thorough due diligence is crucial.

Where can I find real-time Vong stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes. Check reputable sources for accurate information.

How often are Vong’s earnings reports released?

This varies depending on the company’s reporting schedule. Check their investor relations section for details.

What is the current market capitalization of Vong?

This can be found on major financial websites that track market data. Look for the “market cap” figure.