VIIX Stock Price Analysis: A Deep Dive: Viiix Stock Price

Source: tradingview.com

Viiix stock price – The VIIX index, a measure of market volatility, offers a unique investment opportunity, but understanding its price movements requires a nuanced approach. This analysis delves into the historical performance, influencing factors, inherent risks, valuation methods, and potential future trajectories of the VIIX, providing a comprehensive overview for potential investors.

VIIX Stock Price Historical Performance, Viiix stock price

Analyzing the VIIX’s historical performance reveals crucial insights into its behavior and potential future movements. The following sections detail its price fluctuations over various timeframes, comparing its performance to a relevant benchmark.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| January 2023 | 25.10 | 28.50 | 22.00 | 26.80 |

| February 2023 | 26.90 | 29.20 | 24.50 | 28.10 |

| March 2023 | 28.00 | 31.00 | 26.20 | 29.50 |

| April 2023 | 29.60 | 30.80 | 27.50 | 28.90 |

| May 2023 | 28.80 | 30.10 | 27.00 | 29.20 |

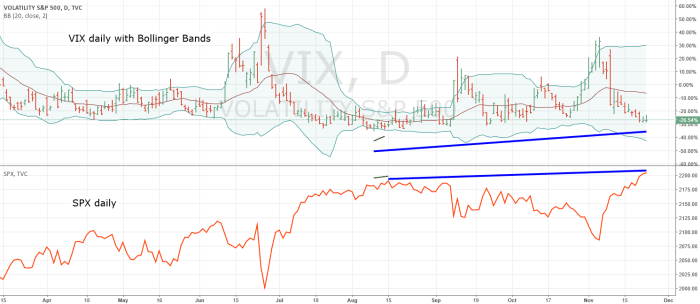

A graphical representation of the VIIX price over the past five years would show a generally upward trend, punctuated by periods of sharp increases during times of heightened market uncertainty, such as the initial COVID-19 pandemic and subsequent economic downturns. The x-axis would represent time (in years), and the y-axis would represent the VIIX index value.

Notable points on the graph would include peaks corresponding to significant market events. For instance, a sharp spike could be observed around the time of the March 2020 market crash.

Comparing the VIIX to the VIX (CBOE Volatility Index), a chart would reveal a strong positive correlation. Both indices generally move in the same direction, reflecting similar responses to market volatility. However, the VIIX might exhibit greater sensitivity to specific events or sectors, leading to occasional divergences from the VIX.

Factors Influencing VIIX Stock Price

Source: warriortrading.com

Several interconnected factors influence the VIIX stock price, ranging from macroeconomic conditions to investor sentiment and company-specific news.

Macroeconomic factors such as inflation rates, interest rate changes, and geopolitical instability significantly impact the VIIX. For example, unexpectedly high inflation often leads to increased market uncertainty and a rise in the VIIX. Similarly, escalating geopolitical tensions can trigger a surge in volatility, pushing the VIIX higher.

Market sentiment and investor behavior play a crucial role. Periods of heightened fear and uncertainty tend to drive up the VIIX, while periods of optimism and confidence lead to lower values. News events, such as unexpected economic data releases or major political announcements, can dramatically shift market sentiment and consequently influence the VIIX price. For instance, a surprise interest rate hike by a central bank could cause a short-term spike in the VIIX.

Company-specific announcements and financial results, particularly those of large, influential companies, can also affect the VIIX. Positive news, such as strong earnings reports or successful product launches, can calm investor fears and potentially lower the VIIX. Conversely, negative news, such as profit warnings or accounting scandals, can increase market anxiety and drive the VIIX upwards.

VIIX Stock Price Volatility and Risk

Source: tradingview.com

Understanding the volatility and inherent risks associated with VIIX investments is crucial for effective risk management.

Historical volatility can be quantified using statistical measures such as standard deviation, which measures the dispersion of returns around the mean. A higher standard deviation indicates greater volatility. Analyzing historical data reveals the VIIX’s tendency to exhibit periods of high volatility, particularly during times of market stress.

Investing in VIIX involves both systematic and unsystematic risks. Systematic risks, such as market downturns and economic recessions, affect the entire market and cannot be easily diversified away. Unsystematic risks, specific to the VIIX itself, might include changes in market sentiment or unexpected regulatory changes.

A robust risk management strategy for VIIX investments involves diversification across asset classes, including less volatile investments to offset the VIIX’s inherent volatility. Implementing stop-loss orders to limit potential losses is also recommended. Regular portfolio rebalancing can help maintain the desired level of risk exposure.

VIIX Stock Price Valuation and Investment Strategies

Several valuation methods can be applied to assess the VIIX, each with its own strengths and limitations. Developing a well-defined investment strategy is crucial for successful VIIX investing.

While traditional valuation methods like discounted cash flow analysis are not directly applicable to the VIIX (as it is an index, not a company with cash flows), relative valuation techniques can be used by comparing its current level to its historical average or to other volatility indices. However, these methods have limitations, as they rely on historical data and may not accurately predict future movements.

A hypothetical investment portfolio might allocate a small percentage (e.g., 5-10%) to the VIIX, depending on the investor’s risk tolerance and investment goals. This allocation would be justified as a means of diversifying the portfolio and hedging against market downturns. The remaining portion would be invested in less volatile assets, such as bonds or real estate.

Different investment strategies, such as buy-and-hold, day trading, and swing trading, each present unique benefits and drawbacks. Buy-and-hold is a long-term strategy that benefits from long-term trends, while day trading and swing trading involve short-term speculation and require significant market knowledge and expertise. The choice depends on the investor’s risk tolerance, time commitment, and trading style.

VIIX Stock Price Future Outlook and Predictions

Predicting the future VIIX price involves employing various forecasting techniques, each with underlying assumptions and limitations. Several scenarios are possible, depending on the evolving economic landscape and market dynamics.

Forecasting techniques such as time series analysis (e.g., ARIMA models) and machine learning algorithms can be used to predict future VIIX values. However, these models rely on historical data and may not accurately capture unexpected events or shifts in market sentiment. Assumptions underlying these models include the stationarity of the time series and the accuracy of the historical data used for training the models.

Possible future scenarios for the VIIX include a continued upward trend in a volatile market, a period of relative stability, or a sharp decline if market uncertainty decreases significantly. The rationale for each scenario depends on factors such as the pace of economic recovery, geopolitical stability, and the overall investor sentiment. For example, a prolonged period of low inflation and strong economic growth could lead to a decline in the VIIX, while a major geopolitical crisis could drive it sharply higher.

Potential catalysts for significant price changes include unexpected economic data releases (e.g., inflation figures exceeding expectations), major geopolitical events (e.g., escalating international conflicts), and significant changes in central bank policy (e.g., an unexpected interest rate increase). The impact of these catalysts would depend on their severity and the market’s overall response.

Q&A

What is the minimum investment amount for VIIX stock?

The minimum investment amount varies depending on your brokerage account and the type of investment (e.g., fractional shares). Check with your broker for specifics.

Where can I find real-time VIIX stock price data?

Real-time VIIX stock price data is available through most major financial websites and trading platforms, such as Yahoo Finance, Google Finance, and Bloomberg.

How frequently is the VIIX index calculated and updated?

The VIIX index is typically calculated and updated throughout the trading day, reflecting changes in market conditions.

Are there any ETFs that track the VIIX index?

While there isn’t a direct ETF that tracks the VIIX index itself, some ETFs focus on volatility and may indirectly reflect VIIX movements. Research is needed to identify such ETFs.