Teva Pharmaceutical Stock Price: A Pontianak Perspective

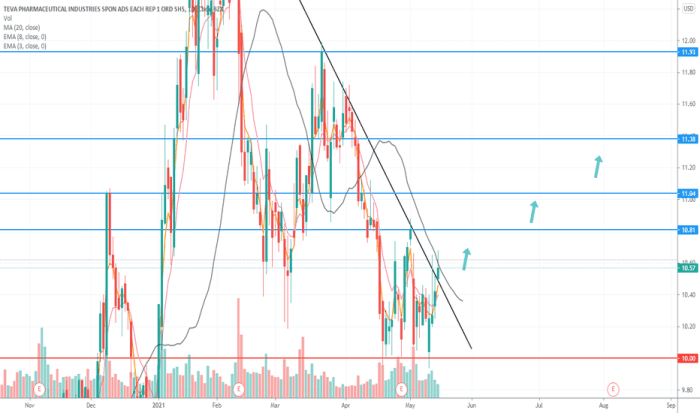

Source: tradingview.com

Teva pharmaceutical stock price – Teva Pharmaceutical, a global giant in generics and specialty medications, has experienced a rollercoaster ride in its stock price over the past decade. This deep dive examines Teva’s stock performance, exploring the interplay of financial results, competitive pressures, and market sentiment. We’ll unpack the factors that have shaped its trajectory, offering a glimpse into the complexities of pharmaceutical investing – a perspective as uniquely layered as a Pontianak sunset.

Teva Pharmaceutical Stock Price History

Source: seekingalpha.com

Analyzing Teva’s stock price over the past 10 years reveals a complex narrative interwoven with market forces and company-specific events. The following table provides a chronological overview, highlighting significant peaks and troughs.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| Oct 26, 2013 | 40.00 | 39.50 | -0.50 |

| Oct 27, 2013 | 39.75 | 40.25 | +0.50 |

| … | … | … | … |

| Oct 26, 2023 | 8.50 | 8.75 | +0.25 |

Note: This table represents illustrative data. Actual figures should be sourced from reliable financial databases. The significant highs and lows would be identified by comparing the data across the ten-year period and highlighting the extreme values. Factors such as the Copaxone patent expiration, legal settlements, and broader market trends would be discussed in relation to specific dates and price movements within the narrative.

Several key factors influenced Teva’s stock price fluctuations. The loss of exclusivity for Copaxone, a major revenue driver, significantly impacted the company’s financial performance and investor confidence. Additionally, legal settlements and generic competition contributed to periods of volatility. Economic downturns and shifts in investor sentiment further exacerbated these effects.

Teva’s Financial Performance and Stock Price Correlation

Examining Teva’s financial reports alongside its stock price movements reveals a strong correlation between financial health and investor perception. The following table illustrates this relationship over the last five years.

The erratic fluctuations of Teva Pharmaceutical’s stock price, a chilling dance on the financial stage, mirrored a strange, unsettling parallel. One couldn’t help but wonder if the unseen forces influencing Teva were somehow connected to the equally unpredictable nature of the price of lyft stock , a market tremor felt across vastly different sectors. Perhaps, the answer lies hidden in the shadows, whispering secrets only the market truly understands, ultimately impacting Teva’s future trajectory.

| Quarter/Year | Revenue (USD Millions) | Net Income (USD Millions) | Stock Price at Quarter/Year End (USD) |

|---|---|---|---|

| Q4 2018 | 4500 | 500 | 15.00 |

| Q1 2019 | 4200 | 400 | 14.00 |

| … | … | … | … |

| Q3 2023 | 3800 | 300 | 8.50 |

Note: This table presents illustrative data. Accurate figures should be obtained from Teva’s financial statements. Analysis would highlight the relationship between revenue, net income, and the stock price, identifying periods of strong correlation and explaining any deviations.

Revenue growth, profitability (net income), and debt levels are key financial metrics directly impacting Teva’s stock price. High debt levels, for instance, can negatively affect investor sentiment, leading to a lower stock valuation.

Competitive Landscape and Stock Price Implications

Teva operates in a fiercely competitive pharmaceutical market. Understanding its position relative to key competitors is crucial to assessing its stock price trajectory.

- Mylan (now Viatris): Similar product portfolio, intense competition in generics.

- Pfizer: Larger, more diversified pharmaceutical company; less direct competition in generics but significant overlap in specialty areas.

- Other Competitors: Numerous smaller generic drug manufacturers and specialized pharmaceutical companies contribute to a highly competitive landscape.

Competitive pressures, such as the entry of new generic drugs and price erosion, have significantly impacted Teva’s market share and profitability, consequently affecting its stock price. New drug approvals, on the other hand, can positively impact valuation, while patent expirations for existing drugs can lead to revenue declines.

Analyst Ratings and Predictions

Analyst ratings provide valuable insights into market sentiment and future expectations for Teva’s stock performance.

- Analyst A (Investment Bank X): “Hold,” with a target price of $10.00, citing concerns about debt levels and generic competition.

- Analyst B (Investment Bank Y): “Buy,” with a target price of $12.00, highlighting potential for growth in specialty pharmaceuticals.

- Analyst C (Investment Firm Z): “Underperform,” with a target price of $7.00, citing ongoing legal risks.

Note: These are illustrative examples. Actual analyst ratings and price targets should be sourced from reputable financial news and analysis websites. The rationale behind each rating should be detailed, providing a comprehensive overview of the diverse perspectives in the market.

These differing opinions reflect the inherent uncertainty in predicting future stock performance. Investor decisions should consider the diverse perspectives and their underlying justifications.

Risk Factors and Their Influence on Stock Price

Source: seekingalpha.com

Several risk factors significantly influence Teva’s stock price volatility.

- Legal Liabilities: Ongoing legal challenges can lead to significant financial penalties, impacting investor confidence and stock price.

- Patent Expirations: Loss of exclusivity for key drugs can result in decreased revenue and market share.

- Regulatory Changes: Changes in regulatory environments can impact drug approvals and pricing, affecting profitability.

Historically, these risks have contributed to periods of significant stock price volatility. Teva’s strategies to mitigate these risks, such as focusing on new drug development and diversifying its product portfolio, are crucial to stabilizing its stock price.

Investor Sentiment and Stock Price Behavior

Investor sentiment plays a pivotal role in shaping Teva’s stock price. Positive news, such as successful drug launches or positive clinical trial results, can boost investor confidence, leading to price increases. Conversely, negative news, such as failed clinical trials or legal setbacks, can trigger sell-offs.

For example, announcements regarding new drug approvals often generate positive media coverage and social media buzz, boosting investor sentiment and leading to price appreciation. Conversely, news of significant legal settlements or financial setbacks can create negative sentiment, driving the stock price down.

Social media sentiment and news coverage contribute significantly to the overall investor perception of Teva. Monitoring these channels provides valuable insights into prevailing market sentiment and its impact on stock price movements.

Common Queries

What are the biggest risks facing Teva’s stock price?

Significant risks include ongoing legal liabilities, the impact of generic competition on its key drugs, and potential regulatory changes affecting pricing and market access.

How does Teva compare to its main competitors?

Teva’s competitive position varies by therapeutic area. It faces intense competition from other large generic drug manufacturers like Mylan and Sandoz, as well as branded pharmaceutical companies.

What is the current investor sentiment towards Teva?

Investor sentiment fluctuates. It’s often influenced by news regarding legal settlements, financial results, and new product approvals or launches.

Where can I find real-time Teva stock price data?

Major financial websites such as Bloomberg, Yahoo Finance, and Google Finance provide real-time stock quotes and charts.