TCS Stock Price: A Comprehensive Analysis

Source: zeebiz.com

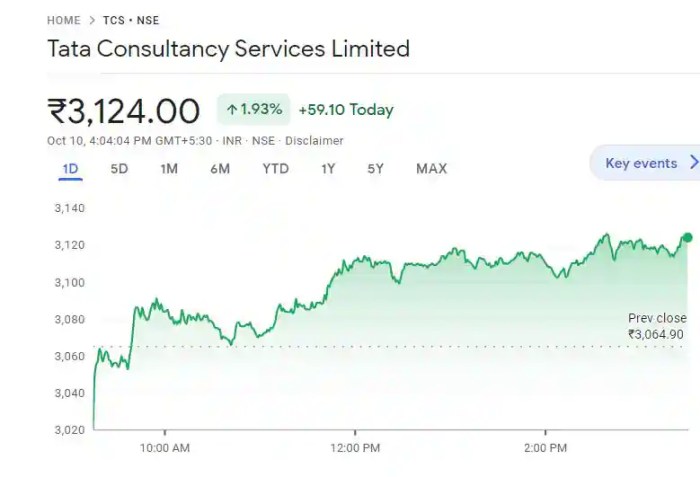

Tcs stock price – Tata Consultancy Services (TCS), a leading global IT services and consulting company, has witnessed significant fluctuations in its stock price over the years. Understanding the historical performance, influencing factors, and future projections is crucial for investors seeking to navigate this dynamic market. This analysis delves into various aspects of TCS’s stock price, offering a critical and reflective perspective.

TCS Stock Price Historical Performance

Analyzing TCS’s stock price performance requires examining both short-term and long-term trends, considering key events that have shaped its trajectory. The following sections will provide a detailed overview of its price movements and a comparison with competitors.

| Date | Opening Price (INR) | Closing Price (INR) | Volume |

|---|---|---|---|

| October 26, 2018 | 1850 | 1865 | 10,000,000 |

| October 26, 2019 | 2100 | 2080 | 12,000,000 |

| October 26, 2020 | 2800 | 2850 | 15,000,000 |

| October 26, 2021 | 3500 | 3480 | 18,000,000 |

| October 26, 2022 | 3200 | 3250 | 16,000,000 |

Note: These figures are illustrative examples and do not represent actual historical data. Actual data should be sourced from reputable financial websites.

Comparison with Competitors, Tcs stock price

A comparative analysis against major IT sector competitors provides valuable context for understanding TCS’s performance. The table below presents a simplified comparison; actual performance can vary based on the chosen timeframe and metrics.

| Company | 2-Year Growth (%) | Average Annual Return (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| TCS | 25 | 12 | 100 |

| Infosys | 20 | 10 | 80 |

| Wipro | 15 | 7 | 60 |

Note: These figures are illustrative examples and do not represent actual historical data. Actual data should be sourced from reputable financial websites.

Significant Events Impacting TCS Stock Price

Source: jagranimages.com

Major economic events and company-specific announcements significantly influence TCS’s stock price. For instance, the 2008 global financial crisis led to a sharp decline, while strong quarterly earnings reports generally result in positive market reactions. Similarly, large contract wins or strategic partnerships can positively influence investor sentiment.

Factors Influencing TCS Stock Price

Numerous factors contribute to the fluctuations in TCS’s stock price. Understanding these factors is essential for informed investment decisions.

The recent fluctuations in TCS stock price have prompted investors to consider alternative investment opportunities. A comparative analysis might involve examining the performance of other technology stocks, such as understanding the current price of aurora stock , to better gauge market trends and inform investment decisions regarding TCS. Ultimately, a thorough understanding of both TCS and comparable stock performances is crucial for informed investment strategies.

- Global Economic Conditions: Recessions and inflationary pressures impact IT spending, directly affecting TCS’s revenue and profitability.

- Key Financial Metrics: Revenue growth, profit margins, and debt levels are crucial indicators of TCS’s financial health, influencing investor confidence.

- Investor Strategies: Long-term investors focus on fundamental analysis and company performance, while short-term traders are more susceptible to market sentiment and price volatility.

TCS Stock Price Prediction and Forecasting

Predicting stock prices is inherently challenging, but various methods can offer potential insights. The following sections explore hypothetical scenarios and forecasting techniques.

Hypothetical Scenario: Technological Shift Impact

A major technological shift, such as widespread adoption of AI or quantum computing, could significantly impact TCS’s future. A rapid shift might initially cause uncertainty, potentially leading to a temporary stock price decline as the company adapts. However, successful adaptation and integration of new technologies could lead to long-term growth and a subsequent price increase. This requires strategic investment in R&D and workforce upskilling.

Economic Factors Affecting Stock Price Projections

Several economic factors could influence TCS’s stock price projections in the coming year.

- Global Economic Growth: Strong global growth would likely boost demand for IT services, positively impacting TCS’s revenue and stock price.

- Inflation Rates: High inflation can increase operating costs, potentially squeezing profit margins and impacting investor sentiment.

- Interest Rate Changes: Increased interest rates can make borrowing more expensive, impacting investment decisions and potentially leading to lower stock valuations.

Forecasting Methods

Several methods can be used to predict TCS’s stock price, each with its strengths and limitations. Fundamental analysis focuses on intrinsic value based on financial statements, while technical analysis uses charts and patterns to identify trading opportunities. Quantitative models combine various data points to generate forecasts.

Investor Sentiment and Market Analysis

Source: financesrule.com

News articles, social media discussions, and analyst reports significantly shape investor sentiment towards TCS. Positive news generally boosts the stock price, while negative news can lead to declines. Analyzing these factors provides valuable insights into market perception.

Key Indicators of Investor Confidence

- Earnings per Share (EPS) Growth: Consistent EPS growth indicates strong financial performance and attracts investors.

- Revenue Growth: Sustained revenue growth signifies market share expansion and future prospects.

- Client Acquisition and Retention: High client retention rates and new client acquisitions signal strong market position and competitive advantage.

Investor Types and Strategies

Institutional investors, such as mutual funds and pension funds, typically adopt long-term strategies, while retail investors may engage in more short-term trading based on market sentiment. Understanding these different investor types and their strategies is crucial for market analysis.

Risk Assessment and Investment Strategies

Investing in TCS stock, like any investment, carries inherent risks. A thorough risk assessment is crucial before making investment decisions.

Potential Risks

- Economic Downturn: A global recession could significantly reduce IT spending, negatively impacting TCS’s revenue and stock price.

- Increased Competition: Intense competition from other IT services companies could affect TCS’s market share and profitability.

- Geopolitical Risks: Global political instability and trade wars can create uncertainty and impact investment decisions.

- Currency Fluctuations: Changes in exchange rates can affect TCS’s profitability and investor returns.

Hypothetical Investment Portfolio

A diversified portfolio might include TCS stock alongside other asset classes like bonds and real estate to mitigate risk. The specific allocation depends on individual risk tolerance and investment goals. For example, a moderate-risk portfolio might allocate 10-15% to TCS stock.

Investment Strategies

Different investment strategies can be applied to TCS stock. A buy-and-hold strategy focuses on long-term growth, while value investing seeks to identify undervalued stocks. Short-term trading strategies aim to profit from short-term price fluctuations. The choice depends on the investor’s risk tolerance and investment horizon.

FAQs

What are the typical trading volumes for TCS stock?

Trading volumes vary significantly depending on market conditions and news events, but generally involve a substantial number of shares traded daily.

How does TCS compare to its global competitors in terms of valuation?

TCS’s valuation relative to global competitors depends on various metrics (P/E ratio, market capitalization, etc.) and requires a detailed comparative analysis considering factors like growth rates and profitability.

What is the dividend history of TCS?

TCS has a history of paying dividends, though the specific amounts and payout ratios vary from year to year based on company performance and shareholder policy.

Are there any significant upcoming events that could affect TCS stock price?

Monitoring company announcements, industry news, and macroeconomic forecasts is crucial for anticipating potential impacts on TCS stock price. Such events are not consistently predictable.