Understanding UNH Stock Price Fluctuations

Stock price unh – UnitedHealth Group (UNH) stock, a behemoth in the healthcare industry, has experienced a rollercoaster ride in recent years. Understanding the factors driving its price volatility is crucial for any investor. This section delves into the key influences shaping UNH’s stock performance, offering a comprehensive overview of its past performance and potential future trajectories.

Factors Influencing UNH Stock Price Volatility

Several factors contribute to UNH’s stock price fluctuations. Changes in healthcare regulations, impacting reimbursement rates and operational costs, significantly influence profitability and investor confidence. The company’s own financial performance, including earnings reports and revenue growth, plays a pivotal role. Furthermore, macroeconomic conditions like interest rate hikes and inflation affect investor sentiment towards the entire market, including UNH.

Major news events, such as significant acquisitions or regulatory changes, can trigger immediate and substantial price movements.

Impact of Major News Events on UNH’s Stock Price, Stock price unh

Significant news directly impacting UNH often translates to immediate stock price reactions. For example, announcements concerning major mergers and acquisitions, new product launches, or significant contract wins typically lead to positive price movements. Conversely, news regarding regulatory investigations, lawsuits, or unexpected financial setbacks can result in sharp declines. The market reacts swiftly to information that affects the company’s future prospects.

Comparison of UNH’s Price Performance to Competitors

Comparing UNH’s stock price performance against its main competitors within the healthcare sector provides valuable context. While direct comparisons require detailed financial analysis and consideration of varying business models, a general overview reveals that UNH’s performance often reflects broader trends in the industry. Periods of strong industry growth tend to positively influence UNH’s stock price, while sector-wide challenges may lead to correlated downturns.

Historical Overview of UNH’s Stock Price

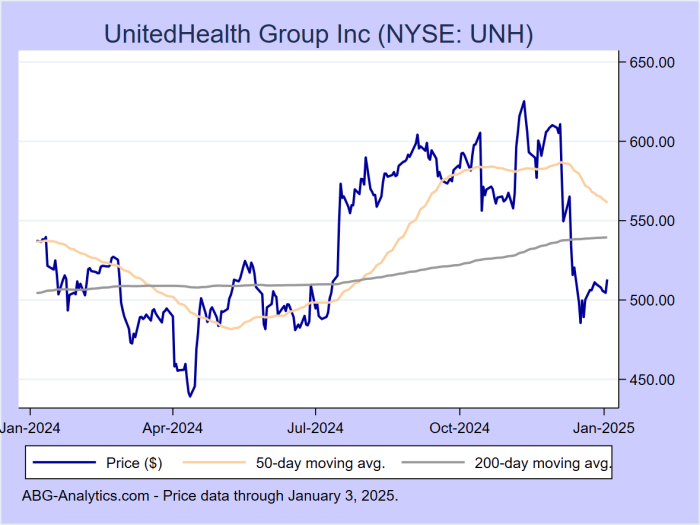

Source: abg-analytics.com

Over the past decade, UNH’s stock price has demonstrated a generally upward trend, punctuated by periods of both significant growth and correction. This reflects the company’s consistent expansion and market dominance, alongside the inherent volatility within the healthcare sector. Analyzing long-term trends reveals periods of accelerated growth driven by factors such as successful acquisitions, expansion into new markets, and technological advancements.

Understanding the fluctuations in UNH’s stock price requires a broad perspective on the market. For comparative analysis, consider tracking the performance of other major players in the industry, such as observing the stock price of Hindustan Zinc , which can offer insights into broader market trends. Ultimately, a thorough understanding of UNH’s stock price necessitates a comprehensive market analysis.

UNH Stock Price Performance (Past Five Years)

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2023 | $Example Data | $Example Data | $Example Data | $Example Data |

| 2022 | $Example Data | $Example Data | $Example Data | $Example Data |

| 2021 | $Example Data | $Example Data | $Example Data | $Example Data |

| 2020 | $Example Data | $Example Data | $Example Data | $Example Data |

| 2019 | $Example Data | $Example Data | $Example Data | $Example Data |

Note: This table presents example data. Actual figures should be sourced from reliable financial databases.

UNH’s Financial Performance and Stock Price

A strong correlation exists between UNH’s financial performance and its stock price. Understanding key financial metrics and their impact on investor sentiment is crucial for predicting future price movements.

Key Financial Metrics Correlating with UNH’s Stock Price

Several key financial metrics directly influence UNH’s stock price. Revenue growth, operating margins, earnings per share (EPS), and return on equity (ROE) are particularly important. Consistent growth in these areas generally signals strong financial health and future prospects, boosting investor confidence and driving up the stock price. Conversely, declines in these metrics often lead to negative market sentiment and price corrections.

Relationship Between UNH’s Earnings Reports and Stock Price Movements

UNH’s quarterly and annual earnings reports are closely scrutinized by investors. Positive surprises, exceeding market expectations, typically lead to significant price increases. Conversely, disappointing results often result in immediate sell-offs. The market’s reaction reflects the importance of these reports in shaping investor perceptions of the company’s future performance and profitability.

Influence of UNH’s Debt Levels on Investor Sentiment

UNH’s debt levels and its ability to manage this debt influence investor sentiment. High levels of debt can raise concerns about the company’s financial stability and its capacity to meet its obligations, potentially leading to negative market reactions. Conversely, prudent debt management and a strong balance sheet generally bolster investor confidence.

Correlation Between UNH’s Revenue Growth and Stock Price

A graph illustrating the correlation between UNH’s revenue growth and its stock price would show a generally positive relationship. The X-axis would represent UNH’s annual revenue growth (as a percentage), and the Y-axis would represent the corresponding year-end stock price. Data points would show that periods of higher revenue growth tend to coincide with higher stock prices, while slower growth or declines in revenue correlate with lower stock prices.

The graph would visually demonstrate the strong influence of revenue growth on investor sentiment and UNH’s valuation.

Investor Sentiment and UNH Stock Price

Investor sentiment plays a significant role in shaping UNH’s stock price. Understanding the key investor groups and their perspectives is essential for gauging market sentiment and potential price movements.

Major Investor Groups Influencing UNH’s Stock Price

Source: thecoinrepublic.com

UNH’s stock is held by a diverse range of investors, including institutional investors (mutual funds, pension funds, hedge funds), individual investors, and employees. The actions and decisions of these groups significantly influence the stock’s price. Institutional investors, due to their larger holdings, often have a more pronounced impact on price movements.

Summary of Analyst Ratings and Price Targets

Financial analysts regularly issue ratings and price targets for UNH stock. These assessments reflect their views on the company’s future prospects and provide valuable insights into market sentiment. A consensus of positive ratings and higher price targets generally suggests a bullish outlook, while negative ratings and lower targets indicate a more bearish perspective. These ratings should be viewed as professional opinions and not as guaranteed predictions.

Impact of News Articles and Social Media Sentiment

News articles and social media sentiment can significantly affect UNH’s daily trading volume. Positive news coverage and positive social media sentiment can lead to increased buying pressure and higher trading volume. Conversely, negative news or negative social media sentiment can trigger selling pressure and lower trading volume. The speed and reach of online information contribute to the rapid transmission of market sentiment.

Impact of Investor Confidence on UNH’s Stock Valuation

Investor confidence is a crucial factor influencing UNH’s stock valuation. High confidence, driven by positive financial results, strong industry outlook, and favorable regulatory environment, typically results in higher valuations. Conversely, decreased confidence, stemming from negative news or concerns about the company’s future, can lead to lower valuations and price declines. The market’s perception of risk significantly impacts the stock’s price.

External Factors Affecting UNH Stock Price

External factors beyond UNH’s direct control can significantly influence its stock price. Understanding these factors is crucial for a comprehensive analysis.

Impact of Healthcare Regulations on UNH’s Stock Price

Changes in healthcare regulations, such as alterations to reimbursement rates, mandated benefit expansions, or new regulatory approvals, can have a substantial impact on UNH’s profitability and stock price. Favorable regulations often lead to positive market reactions, while stricter regulations or increased compliance costs can negatively affect the stock price.

Influence of Macroeconomic Factors

Macroeconomic factors, such as interest rate changes and inflation, influence UNH’s stock price. Rising interest rates can increase borrowing costs, potentially impacting profitability. Inflation can affect operational expenses and consumer spending on healthcare services. These macroeconomic shifts impact investor sentiment toward the broader market and influence decisions on investments in sectors like healthcare.

Effects of Changes in Healthcare Consumer Spending

Changes in healthcare consumer spending significantly impact UNH’s performance. Increased consumer spending generally benefits UNH, while decreased spending can negatively affect its revenue and profitability. Economic downturns or shifts in consumer behavior can lead to reduced healthcare spending, influencing UNH’s stock price.

Impact of Geopolitical Events

Geopolitical events, such as international conflicts or significant global economic shifts, can indirectly influence UNH’s stock price. These events can create uncertainty in the market, impacting investor confidence and potentially leading to price volatility. Broader market trends, often triggered by geopolitical factors, can affect the valuation of even well-established companies like UNH.

Predicting Future UNH Stock Price Movements

Predicting future stock prices is inherently challenging, but analyzing current trends and potential catalysts can provide a framework for informed speculation.

Potential Scenarios for UNH’s Future Stock Price

Several scenarios could unfold for UNH’s stock price in the coming years. A bullish scenario involves continued revenue growth, strong earnings, and expansion into new markets, leading to sustained price increases. A neutral scenario suggests relatively stable performance, mirroring overall market trends. A bearish scenario considers factors such as increased regulatory scrutiny, economic downturn, or significant competition, potentially leading to price declines.

Risks and Opportunities Affecting UNH’s Stock Price

Several risks and opportunities could affect UNH’s stock price in the next year. Risks include regulatory changes, increased competition, and macroeconomic headwinds. Opportunities include expansion into new markets, technological advancements, and strategic acquisitions. Careful consideration of both risks and opportunities is crucial for assessing the potential future trajectory of the stock price.

Potential Catalysts for Significant Impact on UNH’s Stock Price

- Significant changes in healthcare regulations

- Major acquisitions or divestitures

- New product launches or technological advancements

- Significant shifts in macroeconomic conditions

- Unexpected financial results exceeding or falling short of expectations

Hypothetical Scenario Illustrating Impact of a Specific Event

Source: investopedia.com

Consider a hypothetical scenario where a major healthcare reform is implemented, leading to significant changes in reimbursement rates. If these changes negatively impact UNH’s profitability, it could trigger a sharp decline in the stock price. Conversely, if UNH adapts successfully and maintains its profitability, the impact might be minimal, or even positive if the company gains a competitive advantage.

Key Questions Answered: Stock Price Unh

What are the major risks associated with investing in UNH stock?

Risks include changes in healthcare regulations, competition within the healthcare industry, macroeconomic fluctuations, and shifts in investor sentiment.

How does UNH compare to its main competitors in terms of market capitalization?

A direct comparison requires reviewing current market data, as market capitalization fluctuates constantly. Resources like financial news websites provide this information.

What is UNH’s dividend payout history?

Information on UNH’s dividend history can be found on their investor relations website or major financial data providers.

Where can I find real-time UNH stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms.