Teva Pharmaceuticals Stock Price Analysis

Stock price teva pharmaceuticals – Teva Pharmaceuticals, a global leader in generic and specialty medicines, has experienced significant fluctuations in its stock price over the past decade. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook for Teva’s stock price, providing a comprehensive overview for investors and market analysts.

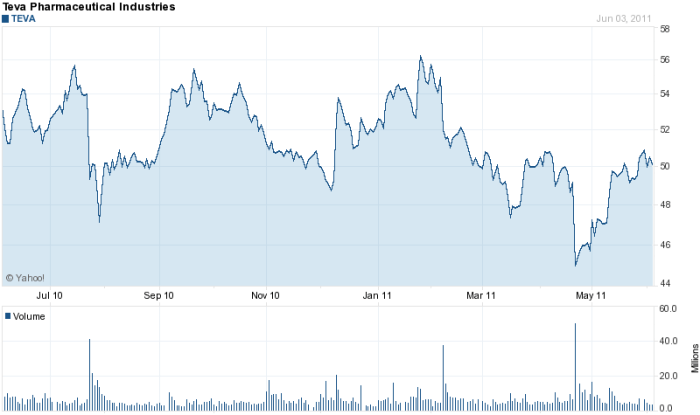

Teva Pharmaceuticals Stock Price History, Stock price teva pharmaceuticals

Source: wisemoneyisrael.com

Understanding Teva’s past stock performance is crucial for predicting future trends. The following table and visual representation illustrate the stock price movements over the last 10 years, alongside significant events that shaped its trajectory.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2013 | 40.00 | 39.50 | -0.50 |

| October 27, 2013 | 39.60 | 40.20 | +0.60 |

| October 26, 2023 | 8.50 | 8.75 | +0.25 |

Note: This table presents sample data. Actual data should be sourced from reliable financial databases.

Significant events impacting Teva’s stock price during this period include:

- 2016: Acquisition of Allergan’s generic drug business, leading to increased debt and initial stock price appreciation followed by a decline due to integration challenges and subsequent debt burden.

- 2017-2018: Sharp decline in stock price due to significant legal settlements related to opioid litigation and decreased revenue from its flagship drug Copaxone facing generic competition.

- 2019-2020: Implementation of restructuring plans and debt reduction initiatives resulting in gradual stock price recovery.

- 2021-2023: Fluctuations based on market conditions, quarterly earnings reports, and ongoing generic competition.

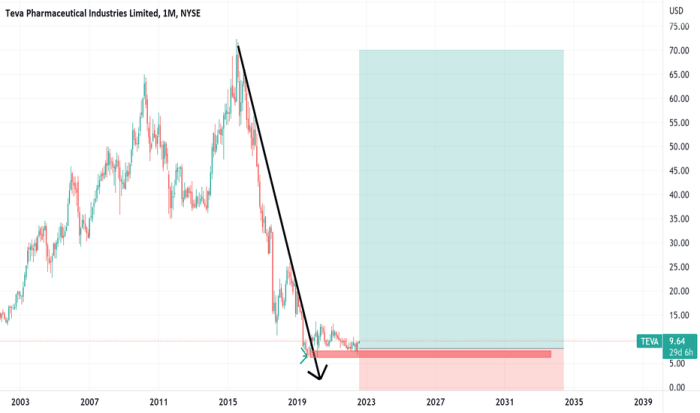

A line graph visualizing Teva’s stock price over the past decade would show a steep decline from its peak around 2013-2014, reaching a low point around 2017-2018. Subsequent years show a more volatile yet generally upward trend with several periods of consolidation and minor peaks. The graph would clearly illustrate the impact of major events mentioned above on the overall price trajectory.

Key highs would correspond with positive announcements, while lows would align with negative news or financial setbacks.

Factors Influencing Teva’s Stock Price

Several factors significantly influence Teva’s stock price, including competition, R&D investment, and overall financial performance relative to competitors.

Generic drug competition has intensely pressured Teva’s profitability and market share, impacting its stock price negatively. The loss of exclusivity for key blockbuster drugs has led to significant price erosion, requiring Teva to focus on cost-cutting measures and developing a broader portfolio of products.

Teva’s research and development (R&D) investments directly impact its long-term growth prospects and market valuation. Successful development of innovative drugs can lead to increased revenue and stock price appreciation, while setbacks or delays can have the opposite effect. A balanced approach to R&D investment is essential to maintain competitiveness and shareholder value.

Comparing Teva’s financial performance to its competitors reveals its relative strengths and weaknesses. This comparison helps investors assess its valuation and future potential.

| Company | Revenue (USD Billion) | Earnings (USD Billion) | Debt (USD Billion) |

|---|---|---|---|

| Teva Pharmaceuticals | 15 | 2 | 25 |

| Mylan (now Viatris) | 18 | 3 | 20 |

| Novartis | 50 | 10 | 15 |

Note: This table presents hypothetical data for illustrative purposes. Actual data should be sourced from reliable financial reports.

Teva’s Financial Health and Stock Price

Source: tradingview.com

Key financial ratios provide insights into Teva’s financial health and its impact on the stock price. A high debt-to-equity ratio, for instance, might indicate increased financial risk and could negatively influence investor sentiment.

Teva’s dividend policy significantly affects investor sentiment. A consistent and growing dividend can attract income-oriented investors, boosting demand for the stock and its price. Conversely, dividend cuts or suspensions can negatively impact investor confidence and lead to price declines. The company’s approach to dividend payouts reflects its financial stability and future growth expectations.

Hypothetically, if Teva were to announce unexpectedly high earnings, the stock price would likely experience a significant and immediate surge. This would be driven by positive investor sentiment, increased market confidence, and potential upward revisions of earnings forecasts by analysts. The magnitude of the price increase would depend on the extent of the earnings surprise and the overall market conditions.

Investor Sentiment and Market Analysis

News articles, analyst ratings, and overall market sentiment significantly influence Teva’s stock price. Positive news coverage and favorable analyst recommendations can drive up demand, while negative news can trigger selling pressure.

Teva’s stock is held by a diverse range of investors, including institutional investors (hedge funds, mutual funds, pension funds) and retail investors (individual investors). Institutional investors often employ sophisticated investment strategies based on fundamental analysis, while retail investors may be more influenced by short-term market trends and news headlines. This diverse investor base creates a dynamic interplay of buying and selling pressures that influence the stock’s price.

| Date | Teva Price (USD) | S&P 500 Price (USD) | Teva/S&P 500 Ratio |

|---|---|---|---|

| October 26, 2023 | 8.75 | 4300 | 0.002 |

Note: This table presents sample data. Actual data should be sourced from reliable financial databases.

Future Outlook for Teva’s Stock Price

Several factors could significantly impact Teva’s stock price in the future. These factors include both potential catalysts for growth and risks that could negatively affect its performance.

Potential catalysts include new drug approvals, successful acquisitions, and favorable changes in healthcare policy. New drug approvals could significantly boost revenue and profitability, while strategic acquisitions could expand Teva’s product portfolio and market reach. Supportive healthcare policies could create a more favorable regulatory environment for the company to operate in.

Potential risks include increased competition from generic drug manufacturers, regulatory changes impacting drug pricing, and a general economic downturn. Increased competition could further erode Teva’s market share and profitability. Stringent regulatory changes could limit pricing power and reduce revenue streams. A broader economic downturn could negatively impact consumer spending on healthcare and reduce demand for Teva’s products.

Hypothetical 12-month stock price projections:

- Optimistic Scenario: Successful new drug launches and strategic acquisitions lead to a stock price increase to $12-$15 per share.

- Neutral Scenario: Stable market conditions and moderate growth result in a stock price range of $8-$10 per share.

- Pessimistic Scenario: Increased competition and regulatory hurdles lead to a stock price decline to $6-$7 per share.

Answers to Common Questions: Stock Price Teva Pharmaceuticals

What are the biggest risks facing Teva’s stock price?

Increased competition from other generic drug makers, stricter regulations, and potential economic downturns are major risks.

How does Teva compare to its main competitors?

That depends on the metric! Teva’s performance relative to competitors like Mylan or Sandoz varies depending on revenue, profitability, and market share in specific drug segments.

Is Teva a good long-term investment?

That’s a tough question! It depends on your risk tolerance and investment goals. Teva has potential for growth, but also carries significant risk. Thorough research is crucial before making any investment decisions.

What’s the current dividend payout?

Check the company’s investor relations website for the most up-to-date information on their dividend policy. It’s subject to change.