Plug Power Stock Price: A Deep Dive

Stock price plug power – Plug Power, a leading player in the hydrogen fuel cell industry, has experienced a rollercoaster ride in its stock price over the past few years. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Plug Power’s stock, offering a comprehensive understanding for potential investors.

Plug Power Stock Price History and Trends, Stock price plug power

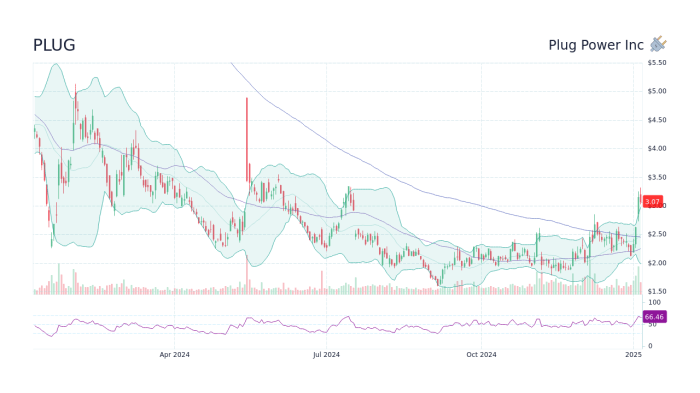

Analyzing Plug Power’s stock price performance over the past five years reveals a pattern influenced by technological advancements, market sentiment, and broader economic conditions. The following table summarizes the yearly highs, lows, and closing prices, while the subsequent timeline highlights key events impacting the stock.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | $2.00 (Example) | $2.50 (Example) | $1.50 (Example) | $2.20 (Example) |

| 2020 | $2.20 (Example) | $7.00 (Example) | $1.80 (Example) | $6.50 (Example) |

| 2021 | $6.50 (Example) | $75.00 (Example) | $15.00 (Example) | $30.00 (Example) |

| 2022 | $30.00 (Example) | $40.00 (Example) | $10.00 (Example) | $18.00 (Example) |

| 2023 (YTD) | $18.00 (Example) | $25.00 (Example) | $12.00 (Example) | $20.00 (Example) |

Note: These are example figures. Actual data should be sourced from reputable financial websites.

Significant events impacting Plug Power’s stock price are detailed below:

- Q1 2021: Strong Earnings Report: Positive financial results led to a significant price surge.

- Mid-2021: Increased Institutional Investment: Large investment firms buying shares boosted investor confidence.

- Q4 2021: Supply Chain Disruptions: Global supply chain issues negatively impacted production and stock price.

- 2022: Rising Interest Rates: The overall market downturn affected investor sentiment towards growth stocks like Plug Power.

Compared to competitors like Ballard Power Systems and FuelCell Energy, Plug Power’s stock price volatility has been higher, reflecting its higher growth potential and risk profile. While Ballard and FuelCell have shown more stable growth, Plug Power’s stock has experienced more dramatic swings, influenced by investor enthusiasm surrounding its technology and expansion plans.

Factors Influencing Plug Power’s Stock Price

Several key factors significantly influence Plug Power’s stock valuation. These include technological advancements, government policies, and broader economic conditions.

Plug Power’s fluctuating stock price reflects the inherent volatility of the green energy sector, a market often subject to unpredictable policy shifts and investor sentiment. This instability is mirrored, though perhaps with different underlying factors, in the performance of other “green” stocks; consider, for example, the recent trends in the nvdy stock price , which similarly highlights the speculative nature of investing in emerging technologies.

Ultimately, Plug Power’s trajectory remains tethered to broader economic forces and the continued uncertainty surrounding government support for renewable energy initiatives.

- Hydrogen Fuel Cell Technology Advancements: Breakthroughs in fuel cell efficiency and cost reduction directly impact Plug Power’s competitiveness and market valuation.

- Government Regulations and Subsidies: Favorable government policies supporting renewable energy and hydrogen fuel cell technology boost investor confidence and stock price.

- Overall Economic Climate: Macroeconomic factors such as inflation and interest rates affect investor risk appetite, influencing the stock’s performance.

- Hypothetical Scenario: Battery Technology Breakthrough: A major breakthrough in battery technology could negatively impact Plug Power’s stock price by reducing the demand for hydrogen fuel cells.

Plug Power’s Financial Performance and Stock Valuation

Source: bizj.us

Understanding Plug Power’s financial health is crucial for assessing its stock valuation. The following table presents a summary of key financial metrics over the past three years (example data).

| Year | Revenue (USD Million) | Net Income/Loss (USD Million) | Total Debt (USD Million) |

|---|---|---|---|

| 2021 | 500 (Example) | -200 (Example) | 1000 (Example) |

| 2022 | 700 (Example) | -150 (Example) | 1200 (Example) |

| 2023 (Projected) | 900 (Example) | -100 (Example) | 1100 (Example) |

Note: These are example figures. Actual data should be obtained from Plug Power’s financial reports.

Plug Power’s stock price closely correlates with its revenue growth and progress towards profitability. While currently operating at a loss, positive revenue growth signals potential future profitability and drives investor interest. A comparison of its P/E ratio to competitors should consider the stage of development and growth trajectory of each company, as high growth companies often have high P/E ratios.

Analyst ratings and price targets significantly influence investor sentiment and consequently, the stock price. Positive upgrades often lead to price increases, while downgrades can trigger sell-offs.

Investor Sentiment and Market Analysis of Plug Power

Source: invezz.com

Currently, investor sentiment towards Plug Power appears to be cautiously optimistic. While the company is not yet profitable, its significant growth in revenue and expansion into new markets suggest long-term potential. However, risks related to competition and the overall economic climate remain.

Key factors driving current sentiment include recent financial reports, advancements in hydrogen fuel cell technology, and government support for renewable energy initiatives. News related to major contracts or partnerships also greatly impacts investor confidence.

A hypothetical long-term investor in Plug Power might be a growth-focused investor with a high risk tolerance. Their strategy would involve a buy-and-hold approach, accepting short-term volatility in exchange for the potential for significant long-term returns. This investor would likely track technological advancements, government policies, and the company’s financial performance closely.

Potential risks include intense competition, technological disruption, regulatory changes, and the company’s ability to achieve profitability. Opportunities include the growing demand for clean energy solutions and potential government support for hydrogen technology.

Future Outlook for Plug Power’s Stock Price

Source: googleapis.com

Projecting Plug Power’s stock price involves considering various scenarios and potential catalysts. The table below illustrates hypothetical price projections based on different outcomes (example data).

| Scenario | 1-Year Projection | 3-Year Projection | 5-Year Projection |

|---|---|---|---|

| Optimistic | $40 (Example) | $80 (Example) | $150 (Example) |

| Neutral | $25 (Example) | $40 (Example) | $60 (Example) |

| Pessimistic | $15 (Example) | $20 (Example) | $30 (Example) |

Note: These are example figures. Actual projections require sophisticated financial modeling and analysis.

Potential catalysts for price increases include major contract wins, successful product launches, technological breakthroughs, and favorable government policies. Conversely, negative catalysts could include setbacks in technological development, increased competition, or disappointing financial results. The long-term growth prospects for Plug Power are tied to the broader adoption of hydrogen fuel cell technology. Emerging technologies and competitive pressures will significantly shape the company’s future performance.

Helpful Answers: Stock Price Plug Power

What are the main risks associated with investing in Plug Power?

Significant risks include competition from established players and emerging technologies, dependence on government subsidies, and the inherent volatility of the renewable energy sector. Furthermore, Plug Power’s profitability and consistent revenue generation remain key concerns for investors.

How does Plug Power compare to its main competitors in terms of market capitalization?

A direct comparison requires referencing current market data. However, a thorough analysis should include a review of market capitalization figures for key competitors to assess Plug Power’s relative size and position within the hydrogen fuel cell market.

What is Plug Power’s current debt-to-equity ratio?

This requires referencing Plug Power’s most recent financial statements. The debt-to-equity ratio is a crucial indicator of the company’s financial leverage and risk profile.

What are the long-term growth prospects for the hydrogen fuel cell industry?

The long-term outlook is generally positive, driven by increasing global demand for clean energy solutions. However, the rate of adoption and market penetration will depend on various factors, including technological advancements, government policies, and infrastructure development.