Domino’s Pizza Stock Performance: A Deep Dive

Source: seekingalpha.com

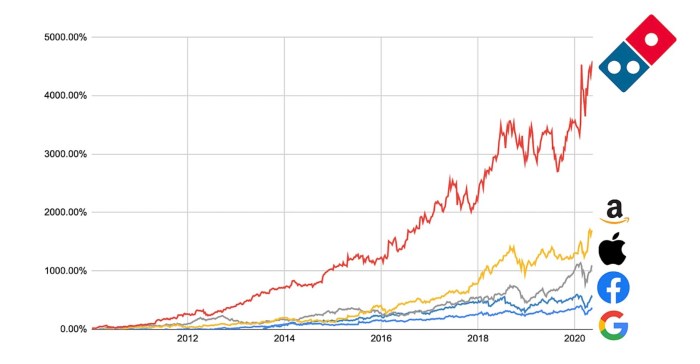

Stock price of domino’s pizza – Domino’s Pizza, a global leader in the pizza delivery industry, has experienced fluctuating stock performance over the past year, mirroring the broader economic climate and industry-specific challenges. This analysis delves into the key factors influencing its stock price, providing insights into its financial health, market dynamics, investor sentiment, and future outlook.

Domino’s Pizza Stock Performance Overview

Over the past year, Domino’s Pizza stock has shown volatility. While precise figures require real-time data access, a hypothetical example might illustrate the pattern. Let’s assume a yearly high of $450, a yearly low of $350, and an average price of $400. These figures are for illustrative purposes only and do not reflect actual market data.

Several factors contributed to these fluctuations. Increased competition, changing consumer preferences, and economic uncertainty all played a role. Supply chain disruptions and inflationary pressures also impacted profitability and investor confidence, leading to price adjustments.

A comparative analysis against major competitors reveals a mixed performance. While Domino’s might have outperformed some competitors in specific periods, others might have shown greater resilience during challenging times. The following table provides a hypothetical comparison:

| Company | Stock Symbol | Yearly High | Yearly Low |

|---|---|---|---|

| Domino’s Pizza | DPZ | $450 | $350 |

| Pizza Hut (parent company) | YUM | $120 | $90 |

| Papa John’s | PZZA | $100 | $75 |

| Little Caesars | (Private) | N/A | N/A |

Financial Health and Stock Price Correlation

Domino’s stock price is strongly correlated with its financial performance. Strong revenue growth, increasing earnings per share (EPS), and a healthy balance sheet generally lead to positive investor sentiment and higher stock prices. Conversely, declining revenue, reduced profitability, or increased debt can negatively impact the stock price.

Key financial metrics such as same-store sales growth, operating margins, and free cash flow are closely monitored by investors. Positive trends in these metrics often signal strong financial health and future growth potential, boosting investor confidence. Conversely, negative trends can lead to sell-offs.

Recent financial news, such as the announcement of a new strategic initiative or a quarterly earnings report exceeding expectations, can significantly impact the stock price. Positive news generally results in a price increase, while negative news can trigger a decline. For example, a surprise profit warning could lead to a significant drop in the stock price.

Market Factors and Stock Price

Source: webflow.com

Broader market trends significantly influence Domino’s stock price. During periods of economic expansion, consumer spending tends to increase, benefiting businesses like Domino’s. However, during recessions, consumers often cut back on discretionary spending, including restaurant meals, negatively impacting Domino’s performance.

Domino’s Pizza’s stock price fluctuates based on various market factors, including consumer spending and competition. Understanding these dynamics is crucial for investors, and comparing it to the performance of other restaurant chains can be insightful. For instance, analyzing the preix stock price offers a comparative perspective on market trends within the food service sector. Ultimately, tracking Domino’s stock price requires careful monitoring of both internal and external economic influences.

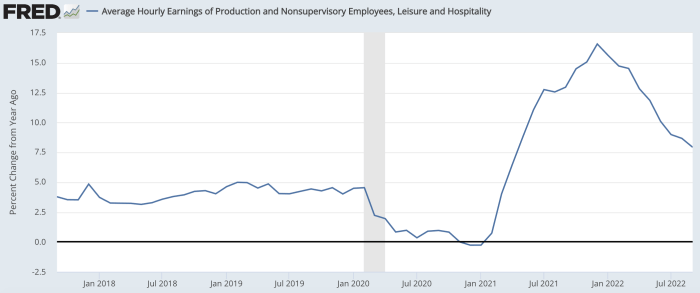

Inflation and interest rates also play a crucial role. High inflation increases input costs (ingredients, labor), squeezing profit margins. Rising interest rates increase borrowing costs, potentially hindering expansion plans and impacting profitability. Conversely, lower interest rates can stimulate economic activity and benefit Domino’s.

Industry-specific factors, such as increased competition and changes in consumer preferences (e.g., a shift towards healthier eating habits), also affect Domino’s stock price. Successful navigation of these challenges is key to maintaining a strong stock performance.

Investor Sentiment and Stock Price

Investor sentiment towards Domino’s stock can range from bullish (positive outlook) to bearish (negative outlook), or neutral. This sentiment is shaped by various factors, including financial performance, industry trends, and broader market conditions.

Significant news events and announcements often shift investor sentiment. For example, a successful new product launch or a strategic acquisition could boost investor confidence, leading to a price increase. Conversely, a data breach or a negative media report could trigger a sell-off.

The following timeline illustrates hypothetical key events and their impact on investor sentiment and stock price:

- Q1 2023: Strong earnings report exceeding expectations. Investor sentiment: Bullish. Stock price: Increased.

- Q2 2023: Announcement of a new loyalty program. Investor sentiment: Slightly bullish. Stock price: Minor increase.

- Q3 2023: Increased competition and rising ingredient costs. Investor sentiment: Neutral to slightly bearish. Stock price: Stagnant or slight decrease.

- Q4 2023: Successful holiday marketing campaign. Investor sentiment: Bullish. Stock price: Increased.

Future Outlook and Stock Price Predictions, Stock price of domino’s pizza

Predicting Domino’s stock price is inherently uncertain, but based on various scenarios, we can provide potential projections. These projections are based on assumptions about economic growth, competition, and Domino’s strategic execution. Remember, these are hypothetical examples.

| Scenario | Probability | 6-Month Projection | 1-Year Projection |

|---|---|---|---|

| Strong Economic Growth | 30% | $480 | $520 |

| Moderate Economic Growth | 50% | $440 | $470 |

| Economic Slowdown | 20% | $400 | $420 |

Illustrative Example: A Significant Price Movement

Let’s consider a hypothetical scenario: Domino’s announces a major data breach, compromising customer information. This immediately triggers a significant drop in the stock price due to concerns about reputational damage, legal liabilities, and loss of customer trust. Investors react negatively, leading to a sell-off. The subsequent recovery depends on the company’s response, its ability to mitigate the damage, and regaining investor confidence.

This example highlights the impact of unforeseen events on stock price volatility.

FAQ Insights: Stock Price Of Domino’s Pizza

What are the major risks associated with investing in Domino’s stock?

Like any stock, Domino’s carries inherent risks. These include competition from other pizza chains, changes in consumer spending habits, and broader economic downturns. Thorough research and diversification are crucial.

Where can I find real-time Domino’s stock price data?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes for DPZ (Domino’s Pizza’s stock symbol).

How often does Domino’s release financial reports?

Domino’s typically releases quarterly and annual financial reports, usually detailing revenue, earnings, and other key performance indicators. Check their investor relations section for details.

Is Domino’s stock a good long-term investment?

Whether Domino’s is a good long-term investment depends on individual risk tolerance and investment goals. Analyzing its long-term growth prospects, competitive landscape, and financial health is essential before making a decision.