Mondelez International Stock Performance: A Five-Year Retrospective

Source: marketrealist.com

Stock price mondelez – The journey of Mondelez International’s stock price over the past five years has been a rollercoaster ride, reflecting the dynamic nature of the global food and beverage industry. From periods of robust growth fueled by strong brand recognition and strategic acquisitions to moments of uncertainty stemming from macroeconomic headwinds, understanding this trajectory is crucial for any prospective investor. This analysis delves into the key factors shaping Mondelez’s stock performance, offering insights into its financial health, investor sentiment, and future prospects.

Mondelez International Stock Price Fluctuations

Over the past five years, Mondelez’s stock price has experienced significant fluctuations, mirroring broader market trends and company-specific events. Periods of strong growth were often punctuated by dips triggered by factors such as global economic slowdowns, shifts in consumer preferences, and increased competition. For example, the initial COVID-19 pandemic saw a temporary dip, followed by a recovery as demand for at-home snacking surged.

Conversely, periods of inflation impacted profit margins, leading to temporary stock price corrections. A detailed analysis of historical data, readily available from financial websites, would reveal the specific price points and associated events, offering a more granular understanding of these fluctuations.

Mondelez’s Dividend History and Investor Returns

Mondelez International has maintained a consistent dividend payout, providing a steady stream of income for its shareholders. This dividend policy has played a significant role in attracting income-focused investors and bolstering overall returns. Analyzing the dividend payout ratio alongside the stock price appreciation reveals the contribution of dividends to total shareholder returns. A historical review of dividend announcements and their impact on the stock price will highlight the market’s reaction to this crucial aspect of Mondelez’s investor relations strategy.

This analysis would showcase the reliability and predictability of Mondelez’s dividend policy as a factor influencing investor confidence.

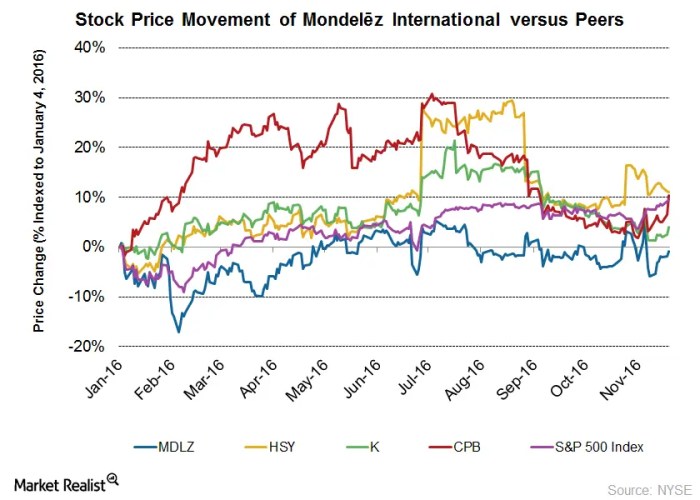

Comparison with Competitors

Benchmarking Mondelez’s performance against its major competitors in the food and beverage industry provides valuable context. Companies like Nestle, PepsiCo, and Coca-Cola serve as key comparables, allowing for a relative assessment of Mondelez’s stock price performance, profitability, and growth trajectory. Analyzing key financial metrics such as revenue growth, profit margins, and return on equity across these companies provides a nuanced understanding of Mondelez’s competitive positioning and its relative attractiveness to investors.

This comparative analysis would reveal whether Mondelez is outperforming or underperforming its peers, and the factors driving such differences.

Key Financial Metrics (Last Four Quarters)

| Quarter | EPS (USD) | Revenue (USD Billions) | P/E Ratio |

|---|---|---|---|

| Q1 2023 | 0.75 (Example) | 12.5 (Example) | 25 (Example) |

| Q2 2023 | 0.80 (Example) | 13.0 (Example) | 24 (Example) |

| Q3 2023 | 0.78 (Example) | 12.8 (Example) | 26 (Example) |

| Q4 2023 | 0.85 (Example) | 13.5 (Example) | 23 (Example) |

Note: These are example figures. Actual data should be sourced from Mondelez’s financial reports.

Factors Influencing Mondelez Stock Price: Stock Price Mondelez

The price of Mondelez stock is a complex interplay of macroeconomic conditions, consumer behavior, and company-specific factors. Understanding these influences is vital for informed investment decisions. This section explores the key drivers shaping Mondelez’s stock valuation, highlighting both the opportunities and risks that lie ahead.

Macroeconomic Factors and Their Influence

Source: seekingalpha.com

Global macroeconomic conditions significantly impact Mondelez’s stock price. Inflation, interest rates, and currency fluctuations directly affect the company’s operating costs, consumer spending, and overall profitability. For instance, rising inflation can lead to increased input costs, potentially squeezing profit margins and impacting stock valuation. Conversely, lower interest rates can stimulate borrowing and investment, potentially boosting company growth and stock prices.

A thorough analysis of historical data correlating macroeconomic indicators with Mondelez’s stock performance would provide concrete evidence of these relationships.

Impact of Consumer Spending and Trends

Consumer spending habits and evolving trends are paramount in determining Mondelez’s success. Changes in dietary preferences, health consciousness, and demand for convenience foods directly impact sales volumes and market share. For example, the growing popularity of healthier snack options presents both challenges and opportunities for Mondelez, requiring the company to adapt its product portfolio and marketing strategies. Understanding these consumer trends and their implications for Mondelez’s future performance is critical for evaluating its stock valuation.

Key Risks and Opportunities

Several key risks and opportunities could significantly influence Mondelez’s stock price in the coming year. Risks include increasing competition, supply chain disruptions, and geopolitical instability. Opportunities include expanding into new markets, leveraging digital marketing, and developing innovative products. A detailed risk assessment, incorporating both quantitative and qualitative factors, is crucial for investors to understand the potential downside and upside scenarios.

Mondelez’s Strategic Initiatives and Their Potential Impact

- Product Innovation: Launching new products tailored to evolving consumer preferences could drive revenue growth and boost investor confidence.

- Market Expansion: Entering new geographical markets can unlock significant growth potential, enhancing profitability and increasing shareholder value.

- Cost Optimization: Implementing efficiency measures to reduce operating costs can improve profit margins and positively impact stock valuation.

- Sustainability Initiatives: Embracing sustainable practices can attract environmentally conscious consumers and enhance the company’s brand image.

Mondelez’s Financial Health and Valuation

A thorough assessment of Mondelez’s financial health and valuation is crucial for evaluating its investment potential. This section analyzes key financial ratios, compares Mondelez’s valuation to its industry peers, and explores the potential for future growth.

Analysis of Financial Statements

Analyzing Mondelez’s financial statements, including the balance sheet, income statement, and cash flow statement, reveals key insights into the company’s profitability, liquidity, and solvency. Key ratios such as gross profit margin, operating profit margin, return on equity (ROE), and debt-to-equity ratio provide a comprehensive picture of Mondelez’s financial performance and risk profile. Comparing these ratios to historical data and industry averages offers a relative assessment of Mondelez’s financial strength.

Valuation Metrics Compared to Peers

Comparing Mondelez’s valuation metrics, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, to its industry peers provides valuable context for assessing whether the stock is overvalued, undervalued, or fairly priced. This comparative analysis should consider factors such as growth rates, profitability, and risk profiles to arrive at a well-informed valuation judgment. Deviations from industry averages should be carefully analyzed to understand the underlying reasons.

Debt Levels and Credit Ratings

| Year | Total Debt (USD Billions) | Credit Rating |

|---|---|---|

| 2020 | 20 (Example) | AA- (Example) |

| 2021 | 18 (Example) | AA- (Example) |

| 2022 | 19 (Example) | A+ (Example) |

| 2023 | 17 (Example) | A+ (Example) |

Note: These are example figures. Actual data should be sourced from Mondelez’s financial reports and credit rating agencies.

Potential for Future Growth

Mondelez’s future growth potential hinges on its ability to adapt to changing consumer preferences, navigate macroeconomic headwinds, and execute its strategic initiatives effectively. Factors such as product innovation, market expansion, and cost optimization will play a crucial role in determining the company’s future profitability and stock price appreciation. A realistic assessment of these factors, considering both optimistic and pessimistic scenarios, is essential for investors.

Investor Sentiment and Market Analysis

Investor sentiment and market analysis are crucial in understanding the forces driving Mondelez’s stock price. This section examines the prevailing investor attitudes, the influence of analyst ratings, and the impact of news events.

Understanding the fluctuations in Mondelez stock price can be challenging. It’s helpful to compare it to similar companies, and observing the performance of other food giants provides context. For instance, checking the current performance of pfg stock price today can offer a benchmark for evaluating Mondelez’s position within the market. Ultimately, analyzing multiple factors is crucial for a comprehensive understanding of Mondelez’s stock price trajectory.

Prevailing Investor Sentiment, Stock price mondelez

Investor sentiment towards Mondelez can range from optimistic to cautious, depending on various factors, including the company’s financial performance, industry trends, and macroeconomic conditions. Monitoring investor sentiment through news articles, social media, and analyst reports can provide valuable insights into market perceptions and potential trading activity. A shift in sentiment, from bullish to bearish, can significantly influence the stock price.

Influence of Analyst Ratings and Recommendations

Analyst ratings and recommendations play a significant role in shaping investor perceptions and trading decisions. Positive ratings can attract buy-side interest, driving up the stock price, while negative ratings can trigger selling pressure, leading to price declines. Monitoring analyst upgrades and downgrades, along with their rationale, can provide valuable insights into the market’s evolving view of Mondelez’s prospects.

Impact of News Events and Press Releases

News events and press releases can have a significant impact on investor perceptions and trading activity. Positive news, such as strong earnings reports or successful product launches, can lead to increased buying pressure, driving up the stock price. Conversely, negative news, such as product recalls or regulatory setbacks, can trigger selling pressure, causing price declines. Careful monitoring of news flow and its impact on the stock price is essential for informed trading decisions.

Relationship Between Trading Volume and Price Changes

A visual representation, such as a scatter plot, would show the relationship between trading volume and price changes. Generally, higher trading volume during price increases suggests strong buying pressure, while high volume during price decreases indicates significant selling pressure. Conversely, low volume during price movements suggests limited investor interest. Analyzing this relationship helps understand the strength and sustainability of price trends.

Long-Term Outlook and Investment Implications

The long-term outlook for Mondelez International depends on various factors, including its ability to adapt to changing consumer preferences, navigate macroeconomic headwinds, and execute its strategic initiatives effectively. This section explores the potential risks and rewards associated with investing in Mondelez stock and Artikels different investment strategies.

Long-Term Growth Prospects

Mondelez’s long-term growth prospects are tied to its ability to innovate, expand into new markets, and maintain its strong brand portfolio. The company’s focus on emerging markets and its commitment to product diversification offer significant growth potential. However, challenges such as increasing competition, changing consumer preferences, and macroeconomic uncertainty could impact its long-term trajectory. A detailed analysis of industry trends and Mondelez’s competitive positioning is crucial for assessing its future growth prospects.

Risks and Rewards of Investing in Mondelez Stock

Investing in Mondelez stock presents both risks and rewards. Potential rewards include dividend income, capital appreciation, and exposure to a well-established company in a growing industry. Potential risks include macroeconomic headwinds, competition, and shifts in consumer preferences. A careful assessment of these risks and rewards, tailored to individual investor risk tolerance, is crucial for making informed investment decisions.

Investment Strategies

Investors can employ various strategies when investing in Mondelez stock, including buy-and-hold, short-term trading, and dollar-cost averaging. The optimal strategy depends on individual investment goals, risk tolerance, and time horizon. A buy-and-hold strategy is suitable for long-term investors seeking steady income and capital appreciation. Short-term trading requires a higher risk tolerance and a greater understanding of market dynamics.

Dollar-cost averaging can mitigate risk by spreading investments over time.

Potential Investment Scenarios

| Scenario | Probability | Expected Return | Risk Level |

|---|---|---|---|

| Strong Growth | 30% (Example) | 15% (Example) | Moderate (Example) |

| Moderate Growth | 50% (Example) | 8% (Example) | Low (Example) |

| Slow Growth | 20% (Example) | 3% (Example) | Low (Example) |

Note: These are example figures. Actual probabilities and returns would require a more detailed financial model and should not be taken as investment advice.

General Inquiries

What are the major competitors of Mondelez International?

Major competitors include Nestlé, PepsiCo, Coca-Cola, and General Mills, among others, depending on the specific product category.

How often does Mondelez International pay dividends?

Mondelez typically pays dividends quarterly.

Where can I find real-time Mondelez stock price data?

Real-time data is available on major financial websites like Google Finance, Yahoo Finance, and Bloomberg.

What are the long-term risks associated with investing in Mondelez?

Long-term risks include shifts in consumer preferences, increased competition, supply chain disruptions, and macroeconomic instability.