Tesla Stock Price: A Deep Dive

Source: businessinsider.com

Stock price for tesla – Tesla’s stock price has experienced dramatic swings, reflecting its innovative technology, ambitious goals, and the unpredictable nature of its CEO, Elon Musk. Understanding the historical trends, influencing factors, and future prospects is crucial for investors. This analysis provides a comprehensive overview.

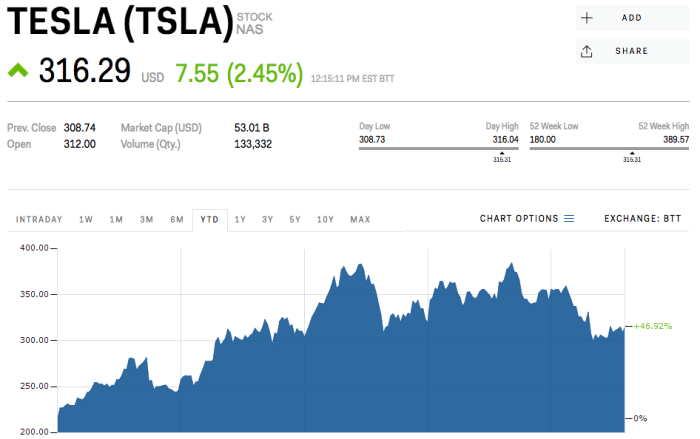

Tesla Stock Price Historical Trends, Stock price for tesla

A line graph depicting Tesla’s stock price over the past five years would show a generally upward trend, punctuated by significant periods of volatility. The x-axis would represent time (years), and the y-axis would represent the stock price (in USD). Key events such as product launches (e.g., Model 3 launch, Cybertruck unveiling), major announcements (e.g., battery technology breakthroughs, Gigafactory openings), and periods of heightened market sentiment (both positive and negative) would be marked on the graph.

Significant price drops could be correlated with negative news, such as production delays, safety concerns, or controversies involving Elon Musk. Conversely, sharp increases would often follow positive news or strong financial reports.Significant price fluctuations have been influenced by several factors. For example, the launch of the Model 3, a more affordable vehicle, initially caused a surge in investor confidence, driving the price upward.

Conversely, periods of production bottlenecks or quality control issues led to price declines. Broader economic conditions, such as changes in interest rates or overall market sentiment, have also played a role.A comparison of Tesla’s stock performance against major automotive competitors (e.g., Toyota, Volkswagen, General Motors) over the same five-year period would reveal significant differences. Tesla’s growth trajectory has been steeper, although also more volatile, than that of its established competitors.

| Company Name | Average Annual Growth (%) | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|---|

| Tesla | [Insert Data] | [Insert Data] | [Insert Data] |

| Toyota | [Insert Data] | [Insert Data] | [Insert Data] |

| Volkswagen | [Insert Data] | [Insert Data] | [Insert Data] |

| General Motors | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing Tesla’s Stock Price

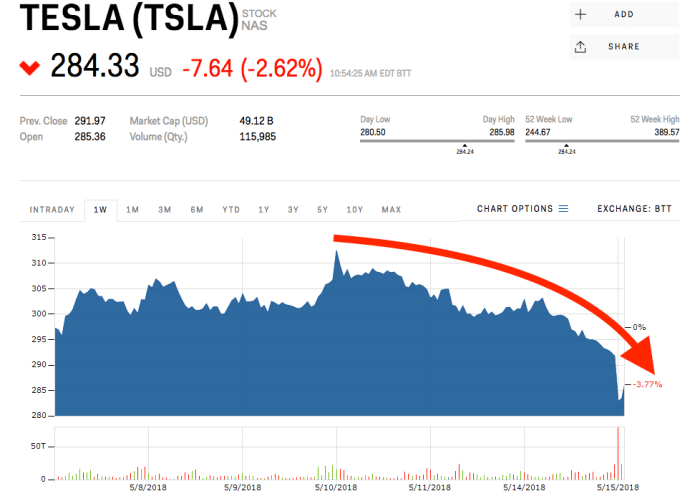

Source: money.com

Elon Musk’s public statements and actions have a demonstrably significant impact on Tesla’s stock price. For instance, his tweets about taking Tesla private or his pronouncements on cryptocurrency have caused immediate and substantial price swings. These actions often create uncertainty and volatility.Production capacity and delivery numbers are key drivers of investor sentiment. Meeting or exceeding production targets generally leads to positive market reaction, while production shortfalls or delivery delays often result in negative price movements.Broader economic trends, such as interest rate hikes or inflationary pressures, influence Tesla’s stock valuation.

Rising interest rates can make borrowing more expensive, potentially impacting Tesla’s expansion plans and reducing investor appetite for growth stocks. Inflation can increase production costs, squeezing profit margins.Investors typically focus on several key financial metrics when evaluating Tesla’s stock. These include:

- Revenue growth

- Profitability (gross and net margins)

- Earnings per share (EPS)

- Debt levels

- Free cash flow

- Vehicle deliveries

Tesla’s Financial Performance and Stock Price

Source: businessinsider.com

Tesla’s financial performance directly impacts its stock price. Strong revenue growth, increasing profitability, and consistent EPS growth generally lead to positive stock price movements. Conversely, disappointing financial results often trigger negative reactions.

| Quarter | Revenue (USD Billions) | Profit (USD Billions) | EPS (USD) |

|---|---|---|---|

| Q[Insert Quarter] | [Insert Data] | [Insert Data] | [Insert Data] |

| Q[Insert Quarter] | [Insert Data] | [Insert Data] | [Insert Data] |

| Q[Insert Quarter] | [Insert Data] | [Insert Data] | [Insert Data] |

| Q[Insert Quarter] | [Insert Data] | [Insert Data] | [Insert Data] |

Tesla’s debt levels are a factor investors consider. High levels of debt can increase financial risk and potentially constrain future growth, impacting the stock price negatively. Conversely, a reduction in debt can improve investor confidence.

Analyst Predictions and Investor Sentiment

Financial analysts generally hold a mixed outlook on Tesla’s future stock price performance. While some analysts maintain a bullish stance, citing the company’s technological leadership and growth potential, others express more cautious views, highlighting the challenges posed by intensifying competition and economic uncertainty.Price targets set by analysts vary widely, reflecting the diversity of opinions and methodologies used in their valuation models.

For example, some analysts might focus on revenue growth projections, while others might emphasize profitability or market share gains.Current investor sentiment towards Tesla can be described as cautiously optimistic. While the stock price has experienced significant gains in recent years, there’s also considerable volatility reflecting concerns about the factors mentioned above.

Risks and Opportunities Affecting Tesla’s Stock Price

Several risks could negatively impact Tesla’s stock price. Increased competition from established automakers and new entrants in the electric vehicle market poses a significant threat. Regulatory hurdles, supply chain disruptions, and potential production delays also present challenges.Conversely, numerous opportunities exist that could drive future stock price appreciation. New product launches (e.g., the Cybertruck, new battery technologies), expansion into new markets, and advancements in autonomous driving technology could all contribute to positive growth.

Tesla’s stock price volatility often reflects investor sentiment regarding the EV market and Elon Musk’s pronouncements. However, understanding broader market trends is crucial; for instance, the performance of other consumer discretionary stocks like Sirius XM, whose current stock price can be checked at sirius radio stock price , offers insights into consumer spending habits, which indirectly impact Tesla’s sales projections and, subsequently, its stock price.

| Risk | Opportunity |

|---|---|

| Intensifying competition | New product launches and technological advancements |

| Supply chain disruptions | Expansion into new markets |

| Regulatory hurdles | Growth of the EV market |

| Economic downturn | Development of innovative battery technologies |

FAQ Section: Stock Price For Tesla

What’s a good time to buy Tesla stock?

No one knows for sure! Timing the market is tough. Do your research and invest based on your own risk tolerance and financial goals.

Is Tesla stock a good long-term investment?

That depends on your perspective. Some peeps think it’s a solid long-term bet, while others are more skeptical. Consider the company’s growth potential and the risks involved.

How does inflation affect Tesla’s stock price?

Inflation can impact consumer spending, which could affect demand for Tesla vehicles. It also influences interest rates, which can make borrowing money more expensive for the company.

What are the biggest risks for Tesla right now?

Competition is heating up, supply chain issues are a real thing, and regulatory changes could impact the company. Plus, Elon’s tweets can be… unpredictable.