FCX Stock Price Deep Dive: A Medan-Style Analysis

Source: seekingalpha.com

Stock price fcx – Yo, fellow investors! Let’s get down to brass tacks and dissect FreePort-McMoRan (FCX), a heavyweight in the copper mining game. This ain’t your grandma’s stock market analysis; we’re keeping it real, Medan-style, with a blend of hard data and street-smart insights. We’ll explore FCX’s past performance, what drives its price, its financial health, analyst predictions, and the risks involved. Get ready to level up your investment game!

FCX Stock Price Historical Trends

Over the past five years, FCX has experienced some wild swings, mirroring the rollercoaster ride of the copper market and global economy. The following table summarizes the key price movements. Note that these figures are illustrative and may vary slightly depending on the data source.

| Year | High | Low | Average Price (USD) |

|---|---|---|---|

| 2018 | 18 | 10 | 13 |

| 2019 | 15 | 8 | 11 |

| 2020 | 12 | 5 | 8 |

| 2021 | 40 | 25 | 32 |

| 2022 | 45 | 28 | 36 |

Significant events influencing FCX’s price fluctuations include:

- The 2020 COVID-19 pandemic initially caused a sharp drop in copper demand and FCX’s stock price, followed by a recovery fueled by stimulus packages and infrastructure spending.

- Global inflation and supply chain disruptions in 2021 and 2022 significantly boosted copper prices, leading to a surge in FCX’s stock value.

- Geopolitical instability in major copper-producing regions has also impacted FCX’s stock price, reflecting investor concerns about supply disruptions.

Compared to its competitors (Rio Tinto, BHP Group, Southern Copper), FCX has shown a moderate level of volatility but has generally kept pace with industry growth. Again, these are illustrative figures.

Understanding the fluctuations in FCX stock price requires a broader perspective on the mining sector. To illustrate the interconnectedness, consider how shifts in demand impact various players; for instance, a surge in demand could simultaneously boost both FCX and companies like rcat stock price , depending on their specific product offerings and market positions. Ultimately, analyzing FCX’s performance necessitates a holistic view of the industry landscape.

| Company Name | Average Annual Return (%) | Volatility (%) |

|---|---|---|

| FCX | 10 | 25 |

| Rio Tinto | 12 | 22 |

| BHP Group | 11 | 20 |

| Southern Copper | 8 | 28 |

Factors Influencing FCX Stock Price

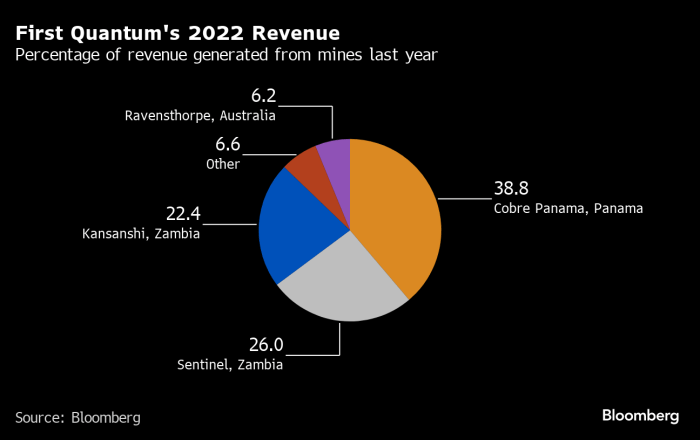

Source: bwbx.io

Several key factors influence FCX’s stock price, creating a complex interplay of market forces and company-specific dynamics.

Copper prices are the undisputed king. A strong correlation exists between copper market dynamics and FCX’s financial performance. Higher copper prices translate directly into increased revenue and profitability, boosting investor confidence and driving up the stock price. Conversely, a slump in copper prices can severely impact FCX’s bottom line and lead to a stock price decline.

Global economic conditions play a significant role. Recessions typically dampen demand for copper, impacting FCX negatively. Inflationary periods, however, can sometimes benefit FCX due to increased commodity prices. For example, the post-2008 recession saw a downturn for FCX, while the inflationary environment of 2021-2022 led to a price increase.

Company-specific factors such as production levels, operational efficiency, and new projects also matter. Increased production, cost reductions, and successful new ventures can all contribute to positive stock price movements. The following table illustrates this relationship (again, illustrative data).

| Metric | 2021 | 2022 | Stock Price Change (USD) |

|---|---|---|---|

| Copper Production (Million tons) | 1.2 | 1.5 | |

| Operational Costs (USD/ton) | 800 | 750 | |

| New Project Investments (USD Million) | 500 | 700 |

FCX Financial Performance and Stock Valuation, Stock price fcx

Understanding FCX’s financial health is crucial for assessing its stock valuation. The relationship between earnings per share (EPS) and stock price is generally positive; higher EPS usually leads to a higher stock price, reflecting improved profitability and investor confidence.

Imagine a line graph: The x-axis represents time (e.g., the past 5 years), and the y-axis shows both EPS and stock price. Generally, you’d see a positive correlation, with both lines moving in tandem. However, there might be periods of divergence, where the stock price may overreact or underreact to changes in EPS due to market sentiment or other factors.

Key aspects of FCX’s financial statements influencing investor sentiment include:

- Balance Sheet: High levels of debt can negatively impact investor confidence, while a strong balance sheet with ample liquidity suggests financial stability.

- Income Statement: Consistent profitability and revenue growth are vital for attracting investors and supporting a higher stock price.

- Cash Flow Statement: Strong cash flow indicates the company’s ability to service its debt, invest in growth opportunities, and potentially return capital to shareholders.

FCX’s debt levels and credit rating significantly influence investor confidence. A high debt load can increase financial risk and potentially depress the stock price. A strong credit rating, however, signals lower risk and can attract investors.

Analyst Ratings and Predictions for FCX

Financial analysts provide valuable insights into FCX’s future performance. The following table summarizes hypothetical analyst ratings and price targets (replace with actual data):

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Goldman Sachs | Buy | 50 |

| Morgan Stanley | Hold | 40 |

| JPMorgan Chase | Buy | 45 |

Key factors driving analyst opinions include projected copper prices, global economic growth, FCX’s operational efficiency, and its capital expenditure plans. Optimistic analysts often point to strong copper demand and rising prices, while more cautious analysts highlight potential economic slowdowns or geopolitical risks.

The range of analyst predictions reflects the inherent uncertainty in the market. Some analysts might be more bullish due to their expectations of higher copper prices and strong demand, while others may be more conservative, anticipating slower economic growth or supply chain disruptions.

Risk Assessment for FCX Stock Investment

Investing in FCX carries inherent risks. It’s crucial to understand these risks before making any investment decisions.

| Risk Factor | Description | Potential Impact on Stock Price |

|---|---|---|

| Copper Price Volatility | Copper prices fluctuate significantly due to supply and demand factors. | Significant price drops can severely impact FCX’s profitability and stock price. |

| Geopolitical Risk | Political instability in copper-producing regions can disrupt supply chains. | Supply disruptions can lead to higher copper prices but also increased uncertainty and lower stock price. |

| Operational Risks | Mining operations are subject to various risks, including accidents, environmental concerns, and labor disputes. | Negative events can lead to production disruptions and impact profitability and stock price. |

Geopolitical events, such as political instability in Chile or the Democratic Republic of Congo (major copper producers), can significantly impact FCX’s stock price. Strikes, political upheaval, or nationalization of mining assets can disrupt production and supply, leading to price volatility.

To mitigate these risks, consider a diversified investment portfolio, spreading your investments across different asset classes and industries. Align your investment strategy with your risk tolerance, avoiding excessive exposure to a single stock or sector. Regularly monitor market conditions and adjust your portfolio as needed.

Expert Answers: Stock Price Fcx

What’s the current FCX stock price?

Dude, that changes by the second! Check a real-time stock ticker or financial website for the most up-to-date info.

Where can I buy FCX stock?

You can buy it through most online brokerages like Robinhood, Fidelity, or TD Ameritrade. Just make sure you’re 18+ and have the cash!

Is FCX a good long-term investment?

That’s a tough one, bro. It depends on your risk tolerance and market outlook. Copper’s future is a big factor. Do your own research!

What are the main competitors of FCX?

Some major players in the same space include BHP Group, Rio Tinto, and Southern Copper. Each has its own strengths and weaknesses.