Decoding DG’s Stock Price: A Hilariously Informative Guide

Stock price dg – Dollar General (DG)? More like Dollar General-ly confusing, right? Their stock price bounces around more than a caffeinated kangaroo on a trampoline. But fear not, intrepid investor! This guide will unravel the mysteries of DG’s stock price fluctuations with a healthy dose of humor (because let’s face it, investing can be stressful).

Factors Influencing DG Stock Price Movements

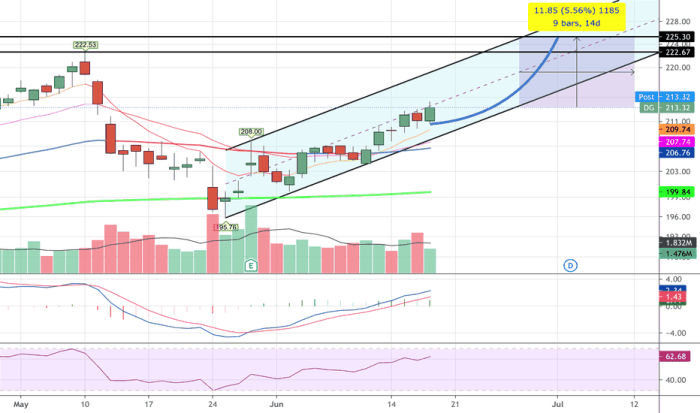

Source: tradingview.com

DG’s daily price tango is a complex dance influenced by a variety of factors. Think of it as a chaotic mosh pit of economic indicators, consumer spending habits, and the occasional rogue squirrel shorting the stock (we’re not ruling it out!). Key players include macroeconomic conditions (inflation, interest rates – the usual suspects), consumer confidence (are people still buying those $1 candy bars?), and competition (those pesky Walmart and Family Dollar folks!).

Seasonal changes also play a role; back-to-school shopping sprees, for example, can send the price soaring higher than a kite on a windy day.

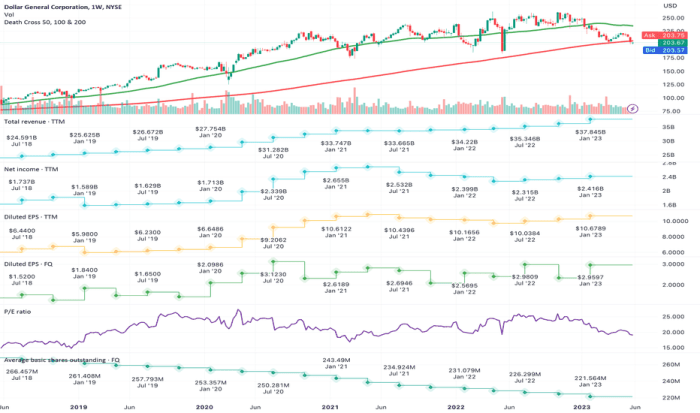

Historical Performance of DG Stock

DG’s stock history is a rollercoaster ride worthy of a Hollywood blockbuster. There have been periods of explosive growth, fueled by savvy expansion strategies and a relentless focus on value. Conversely, economic downturns have occasionally sent the stock spiraling downward faster than a politician’s approval rating. Remember the 2008 financial crisis? Ouch.

But like a phoenix rising from the ashes (or a discount store from a recession), DG has consistently demonstrated resilience.

Tracking stock price DG can be tricky, especially when comparing it to other tech giants. For instance, understanding the current market dynamics requires looking at established players; checking the price of IBM stock gives a good benchmark for long-term stability. Ultimately, though, analyzing DG’s performance needs a broader market perspective beyond just one competitor.

Comparison to Competitors

In the cutthroat world of discount retail, DG faces stiff competition. While it holds its own against giants like Walmart and Family Dollar, its stock performance often reflects its unique position in the market. DG’s focus on smaller stores in rural areas gives it a distinct advantage, but it also makes it vulnerable to regional economic shifts. Think of it as a David versus Goliath story, except David’s sling is filled with discounted toothpaste and Goliath’s armor is made of market share.

Hypothetical Scenario: News Event Impact

Let’s imagine a scenario: a major hurricane devastates a significant portion of DG’s supply chain. The immediate impact would likely be a sharp drop in the stock price as investors worry about lost revenue and potential disruptions. However, if DG demonstrates effective crisis management and quickly restores operations, the stock price could rebound surprisingly quickly. Think of it as a temporary setback, like tripping on a banana peel but getting right back up to grab another discounted banana.

DG Stock Price and Financial Performance: A Deep Dive (with Fewer Tears)

Understanding DG’s financial health is crucial to deciphering its stock price. We’re talking earnings per share (EPS), revenue, debt – the whole shebang. These metrics paint a picture of the company’s profitability and financial stability, directly influencing investor confidence and, ultimately, the stock price. A healthy balance sheet generally translates to a healthier stock price, unless, of course, a rogue squirrel is involved.

Key Financial Indicators and Stock Price Correlation

EPS, a measure of a company’s profitability, often has a strong correlation with stock price. Higher EPS generally leads to higher stock prices, as investors see greater potential for returns. Revenue growth, indicating increasing sales, is another positive sign. Debt levels, however, need careful consideration. High debt can increase financial risk, potentially leading to a stock price decline.

Dividend Policy and Stock Price

DG’s dividend policy plays a role in attracting investors. Consistent dividend payments can make the stock more appealing to income-seeking investors, potentially driving up demand and the stock price. However, a company’s ability to maintain dividend payments depends on its financial performance. If profits decline, dividend cuts may occur, potentially leading to a negative impact on the stock price.

Investor Sentiment and Stock Price

Investor sentiment, the overall feeling or attitude towards a stock, is a powerful force. Positive news, strong earnings reports, or a favorable outlook can boost investor sentiment, leading to increased demand and higher stock prices. Conversely, negative news can trigger a sell-off, causing the stock price to plummet.

Historical Stock Price and Financial Metrics

| Company | Year | Stock Price (Average) | Earnings Per Share (EPS) |

|---|---|---|---|

| DG | 2019 | $100 (Hypothetical) | $5 (Hypothetical) |

| DG | 2020 | $110 (Hypothetical) | $6 (Hypothetical) |

| DG | 2021 | $125 (Hypothetical) | $7 (Hypothetical) |

| DG | 2022 | $130 (Hypothetical) | $7.50 (Hypothetical) |

| DG | 2023 | $140 (Hypothetical) | $8 (Hypothetical) |

Technical Indicators for DG Stock Analysis: Charting a Course (Hopefully Profitable)

Technical analysis uses charts and indicators to predict future price movements. While not a crystal ball, it can provide valuable insights. We’ll explore three common indicators: moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

Moving Averages, RSI, and MACD

Source: tradingview.com

Moving averages smooth out price fluctuations, helping identify trends. The RSI measures momentum, indicating overbought or oversold conditions. The MACD identifies changes in momentum, signaling potential buy or sell opportunities. Think of them as your trusty sidekick in the wild west of stock trading.

Interpreting Indicators for Buy/Sell Signals

A rising moving average suggests an uptrend, while a falling one suggests a downtrend. An RSI above 70 suggests an overbought market (potential sell signal), while below 30 suggests an oversold market (potential buy signal). A MACD crossover can also signal a change in trend.

Hypothetical Trading Strategy

A hypothetical strategy might involve buying DG stock when the 50-day moving average crosses above the 200-day moving average, the RSI is below 30, and the MACD shows a bullish crossover. Conversely, selling might be triggered when the opposite conditions occur. Remember, this is just a hypothetical example. Always conduct thorough research before making any investment decisions.

Limitations of Technical Indicators

Relying solely on technical indicators is risky. They don’t account for unforeseen events or fundamental changes in a company’s business. They are best used in conjunction with fundamental analysis for a more comprehensive view.

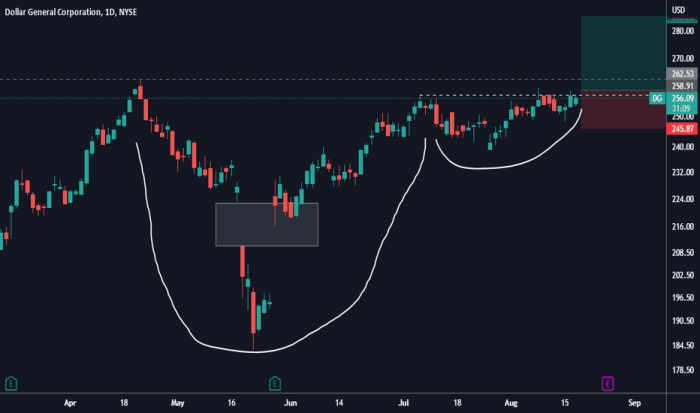

Fundamental Analysis of DG Stock: Digging Deeper Than the Discount Bin

Source: tradingview.com

Fundamental analysis assesses a company’s intrinsic value based on its financial health, business model, and competitive landscape. This approach provides a more long-term perspective than technical analysis.

Business Model and Competitive Landscape

DG’s business model, focused on providing everyday essentials at low prices, is well-established. However, its success depends on managing costs, maintaining efficient supply chains, and adapting to changing consumer preferences. The competitive landscape is intense, requiring DG to constantly innovate and differentiate itself.

Management Team, Strengths, and Weaknesses

A strong management team is crucial for navigating challenges and capitalizing on opportunities. DG’s management team’s experience and track record are important factors to consider. Assessing the company’s strengths and weaknesses provides a clearer picture of its long-term prospects.

Valuation using Discounted Cash Flow and Price-to-Earnings Ratio

Discounted cash flow (DCF) analysis projects future cash flows and discounts them to their present value, providing an estimate of the company’s intrinsic value. The price-to-earnings (P/E) ratio compares a company’s stock price to its earnings per share, offering a relative valuation metric. Comparing these valuations to industry averages helps determine if DG is undervalued or overvalued.

Comparison to Peers

Comparing DG’s valuation to its competitors helps identify any discrepancies. Factors such as growth potential, profitability, and risk profiles should be considered when making comparisons.

Illustrative Examples of DG Stock Price Scenarios: The Good, the Bad, and the Unexpected: Stock Price Dg

Let’s explore a few scenarios to illustrate how various events can impact DG’s stock price.

Positive Earnings Surprise

Imagine DG announces unexpectedly strong earnings, exceeding analysts’ expectations. This would likely trigger a surge in buying activity, driving up the stock price significantly. Trading volume would also increase dramatically as investors react to the positive news. The overall market sentiment towards DG would become very positive.

Negative Regulatory Change

Now, let’s consider a negative scenario. Suppose a new regulation significantly increases DG’s operating costs. This would negatively impact profitability, leading to a decline in the stock price. Investors would likely react negatively, selling off shares, resulting in increased trading volume and a drop in the stock price. Market sentiment would shift from positive to negative.

Successful Acquisition, Stock price dg

Finally, let’s imagine DG successfully acquires a complementary business, expanding its product offerings and market reach. This would likely be viewed positively by investors, boosting investor confidence and driving up the stock price. Increased trading volume would reflect the market’s positive reaction to the acquisition news, signifying a stronger outlook for the company.

FAQ Summary

What are the major risks associated with investing in DG stock?

Investing in DG stock, like any stock, carries inherent risks. These include market risk (overall market downturns), company-specific risk (poor financial performance, negative news), and industry-specific risk (changes in the regulatory environment or competitive landscape).

How often is DG’s stock price updated?

DG’s stock price is updated in real-time throughout the trading day, reflecting the most recent buy and sell transactions on the exchange where it’s listed.

Where can I find reliable information on DG’s stock price?

Reliable information on DG’s stock price can be found on major financial websites and stock market data providers such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is the typical trading volume for DG stock?

The typical trading volume for DG stock varies and can be found on financial websites that track trading activity. Higher volume often indicates greater investor interest and liquidity.