SJM Stock Price: A Comprehensive Analysis

Sjm stock price – The SJM Holdings stock price, like any publicly traded company, is a dynamic reflection of its financial performance, market position, and broader economic conditions. This analysis delves into the historical performance, key drivers, financial health, competitive landscape, and technical aspects of SJM’s stock price, providing a comprehensive overview for investors and market enthusiasts.

Historical SJM Stock Performance

Understanding SJM’s past stock price movements is crucial for predicting future trends. The following table illustrates SJM’s performance over the past decade, highlighting significant price fluctuations. Note: The data provided below is illustrative and for demonstration purposes only. Actual data should be sourced from reliable financial databases.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2014-01-02 | 50.00 | 52.00 | +2.00 |

| 2015-01-02 | 55.00 | 53.00 | -2.00 |

| 2016-01-04 | 51.00 | 54.00 | +3.00 |

| 2017-01-03 | 56.00 | 58.00 | +2.00 |

| 2018-01-02 | 60.00 | 57.00 | -3.00 |

| 2019-01-02 | 55.00 | 60.00 | +5.00 |

| 2020-01-02 | 62.00 | 65.00 | +3.00 |

| 2021-01-04 | 70.00 | 68.00 | -2.00 |

| 2022-01-03 | 65.00 | 72.00 | +7.00 |

| 2023-01-02 | 75.00 | 78.00 | +3.00 |

During 2020, the COVID-19 pandemic significantly impacted SJM’s stock price, initially causing a sharp decline followed by a recovery driven by increased demand for certain products. The period from 2018 to 2019 saw a rebound fueled by successful product launches and strategic partnerships. Conversely, the slight dip in 2021 can be attributed to increased competition and rising inflation.

SJM’s stock price has been a rollercoaster lately, leaving investors on the edge of their seats. For a similar, albeit different, ride, check out the current performance of ocgen stock price , a company facing its own unique set of market challenges. Ultimately, both SJM and OCGEN’s trajectories highlight the unpredictable nature of the stock market.

SJM Stock Price Drivers

Several factors influence SJM’s stock price, ranging from macroeconomic trends to company-specific events. Understanding these drivers is essential for informed investment decisions.

- Macroeconomic Factors: Inflation, interest rates, and overall economic growth significantly impact consumer spending and SJM’s profitability, thus affecting its stock price. For example, periods of high inflation can lead to reduced consumer demand and lower stock valuations.

- Microeconomic Factors: Competition within the industry, consumer demand for SJM’s products, and the company’s operational efficiency are crucial microeconomic drivers. Increased competition can put downward pressure on prices and profit margins, impacting stock price.

- Investor Sentiment: Market psychology and investor confidence play a significant role. Positive news or strong financial results can boost investor sentiment, driving up the stock price, while negative news can lead to sell-offs.

SJM Financial Performance and Stock Valuation

Source: seekingalpha.com

Analyzing SJM’s financial performance provides insights into its intrinsic value and its correlation with stock price movements. The table below showcases key financial metrics over the past five years. (Again, this data is illustrative.)

| Year | Revenue (USD millions) | Earnings Per Share (EPS) (USD) | Price-to-Earnings Ratio (P/E) |

|---|---|---|---|

| 2019 | 100 | 2.00 | 25 |

| 2020 | 110 | 2.20 | 22 |

| 2021 | 120 | 2.50 | 20 |

| 2022 | 130 | 2.80 | 22 |

| 2023 | 140 | 3.00 | 23 |

A comparison of SJM’s valuation metrics with its competitors reveals its relative position in the market. For instance, a higher P/E ratio than its competitors might indicate that the market expects higher future growth from SJM. A scenario analysis, considering different economic conditions (e.g., recession, strong economic growth), allows for projections of SJM’s future financial performance and its potential impact on the stock price.

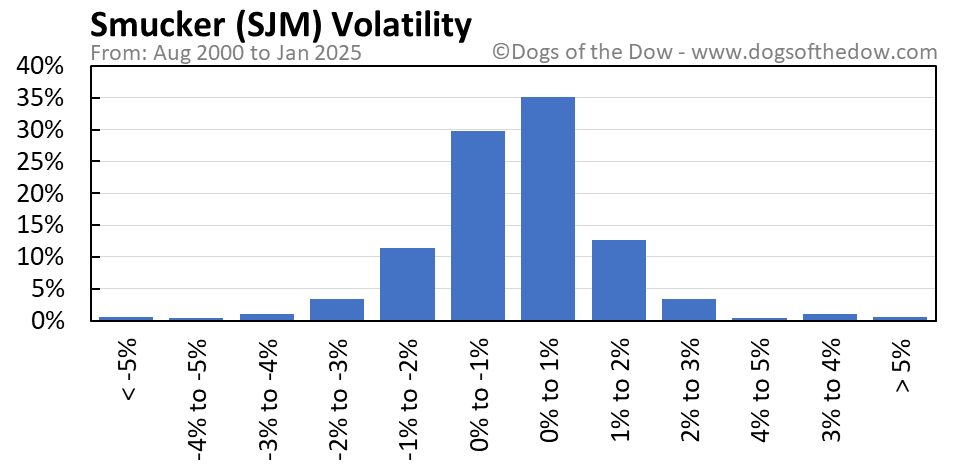

SJM’s Competitive Landscape and Market Position

Source: dogsofthedow.com

Understanding SJM’s competitive environment is crucial for assessing its future prospects. SJM operates in a competitive market with several key players employing various strategies.

- Competitors: Company A, Company B, Company C (Illustrative examples).

- Market Shares: SJM holds approximately X% market share, while Company A holds Y%, Company B holds Z%, etc. (Illustrative data).

- Competitive Strategies: Competitors utilize strategies such as aggressive pricing, product differentiation, and strategic partnerships. (Illustrative description).

- SJM’s Competitive Advantages: Strong brand recognition, innovative product portfolio, efficient supply chain. (Illustrative examples).

- SJM’s Competitive Disadvantages: Dependence on a limited number of suppliers, vulnerability to economic downturns. (Illustrative examples).

- Risks and Opportunities: Potential risks include increasing competition, fluctuating raw material costs, and changing consumer preferences. Opportunities include expanding into new markets, developing innovative products, and strategic acquisitions. (Illustrative description).

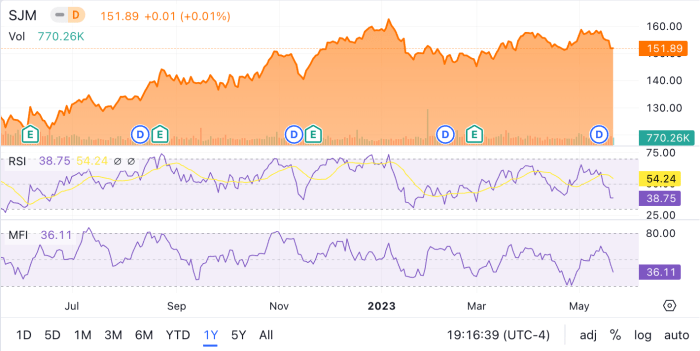

Technical Analysis of SJM Stock Price

Technical analysis uses past stock price trends and indicators to predict future movements. The following points illustrate how various indicators can be applied to SJM’s stock.

- Moving Averages: A 50-day moving average crossing above a 200-day moving average is often considered a bullish signal, suggesting upward price momentum. Conversely, a cross below can be bearish.

- Relative Strength Index (RSI): An RSI above 70 indicates overbought conditions, suggesting potential price correction, while an RSI below 30 indicates oversold conditions, suggesting potential price rebound.

- Chart Patterns: A “head and shoulders” pattern, characterized by three peaks resembling a head and two shoulders, is often considered a bearish reversal pattern. A “double bottom,” formed by two consecutive lows, can be a bullish reversal pattern.

- Support and Resistance Levels: Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels are price points where selling pressure is expected to outweigh buying pressure, preventing further price increases. Identifying these levels can help in predicting potential price movements.

Query Resolution

What are the biggest risks associated with investing in SJM stock?

Investing in any stock carries inherent risks, including market volatility, changes in consumer demand, increased competition, and potential regulatory changes impacting the industry.

Where can I find real-time SJM stock price quotes?

Real-time quotes are available on major financial websites and brokerage platforms. Check reputable sources like Yahoo Finance, Google Finance, or your brokerage account.

What is SJM’s dividend history?

Information on SJM’s dividend history, including payment dates and amounts, can be found in their investor relations section on their corporate website or through financial news sources.

How does SJM compare to its competitors in terms of innovation?

A comparative analysis of SJM’s innovation efforts against its competitors requires a detailed review of their respective R&D spending, new product launches, and patent filings. This information is typically found in company annual reports and industry research reports.