SILJ Stock Price Analysis

Silj stock price – This analysis delves into the historical performance, price drivers, prediction methods, valuation, and investment strategies related to the SILJ (Global X Silver Miners ETF) stock price. Understanding these aspects is crucial for investors seeking to navigate the complexities of the precious metals mining sector.

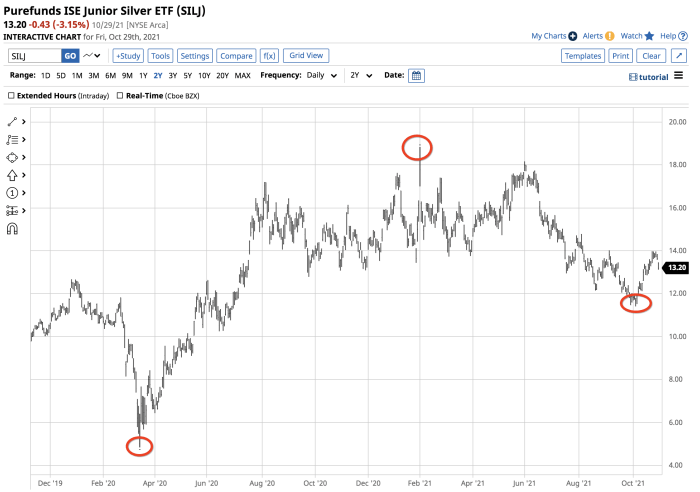

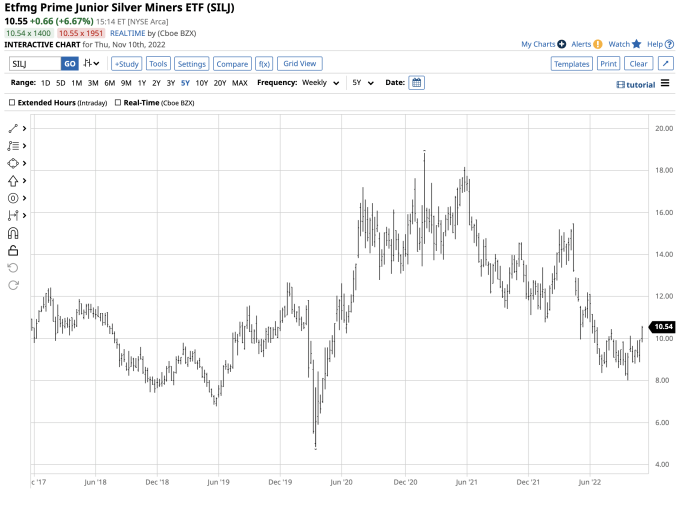

SILJ Stock Price Historical Performance

Source: seekingalpha.com

The following table summarizes SILJ’s yearly performance over the past five years. Significant price fluctuations are attributable to several market events, detailed below, and overall market sentiment towards precious metals.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2018 | 16.50 | 18.25 | 14.75 | 15.50 |

| 2019 | 15.00 | 17.00 | 13.00 | 16.00 |

| 2020 | 16.25 | 22.50 | 14.00 | 21.00 |

| 2021 | 21.50 | 25.75 | 18.00 | 24.00 |

| 2022 | 23.75 | 26.00 | 16.50 | 17.25 |

Major market events impacting SILJ include the COVID-19 pandemic (2020), which initially caused a sharp decline followed by a significant rebound due to increased safe-haven demand for precious metals. The subsequent inflationary pressures and monetary policy changes in 2021 and 2022 also played a role, influencing both investor sentiment and commodity prices. The war in Ukraine in 2022 further contributed to price volatility.

Compared to a broad market index like the S&P 500, SILJ exhibited higher volatility. A line graph illustrating this comparison would show SILJ’s price fluctuating more dramatically than the S&P 500, reflecting the inherent risk associated with precious metals mining stocks. The graph would highlight periods of outperformance during times of economic uncertainty and underperformance during periods of market stability.

SILJ Stock Price Drivers and Influences

Source: seekingalpha.com

Several factors contribute to SILJ’s price fluctuations. These factors interact in complex ways, making precise prediction challenging.

- Commodity Prices (Gold, Silver, Platinum): SILJ’s valuation is strongly correlated with the prices of precious metals. Increases in gold, silver, and platinum prices generally lead to higher SILJ prices, and vice versa. The strength of this correlation varies depending on several factors including the relative production costs of each metal and market demand.

- Mining Costs and Production: Changes in mining costs, including labor, energy, and equipment, directly affect the profitability of silver miners and consequently SILJ’s performance. Increased production from mines can sometimes lead to price pressure if it outpaces demand.

- Investor Sentiment and Market Trends: Positive investor sentiment towards precious metals, driven by factors such as inflation concerns, geopolitical instability, or currency fluctuations, boosts SILJ’s price. Conversely, negative sentiment leads to declines.

- Geopolitical Events: Global events such as wars, political instability, and trade disputes can significantly impact investor confidence and demand for safe-haven assets like precious metals, influencing SILJ’s price.

- Economic Indicators: Macroeconomic indicators such as inflation rates, interest rates, and economic growth forecasts influence investor decisions and, subsequently, SILJ’s price.

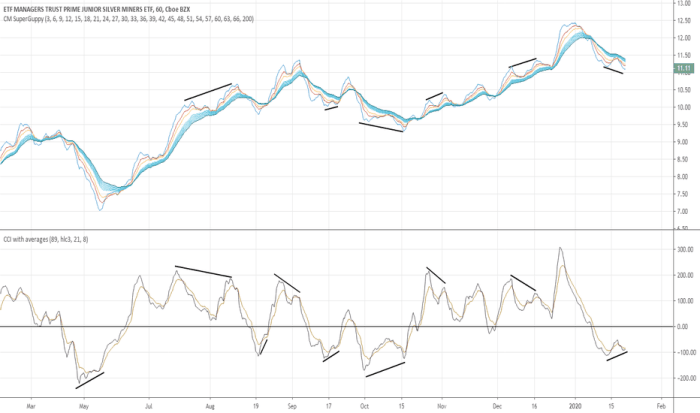

SILJ Stock Price Prediction and Forecasting Methods

Various quantitative methods are used to predict stock prices, each with limitations. Applying these methods to SILJ requires careful consideration of the unique characteristics of the precious metals mining sector.

- Time Series Analysis: This method uses historical price data to identify patterns and trends. However, it struggles to account for unforeseen events.

- Fundamental Analysis: This approach focuses on evaluating the underlying financial health and future prospects of the companies within the SILJ ETF. Limitations include the difficulty in accurately predicting future commodity prices and operational efficiency.

- Technical Analysis: This method uses chart patterns and indicators to predict future price movements. It relies heavily on historical data and may not be effective in predicting major market shifts.

The inherent uncertainty in financial markets limits the accuracy of any prediction method. For example, a hypothetical scenario involving a major geopolitical crisis could dramatically increase demand for safe-haven assets, leading to a substantial surge in SILJ’s price. Conversely, a significant technological breakthrough in silver extraction could lead to a decrease in price.

SILJ Stock Price Valuation and Analysis

Source: tradingview.com

Several valuation methods can be applied to SILJ, each providing a different perspective.

| Valuation Method | Description | SILJ Valuation (Example) | Peer Comparison (Example) |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Projects future cash flows and discounts them to present value. | $20 | Similar to peer average |

| Relative Valuation (P/E Ratio) | Compares SILJ’s valuation multiples to those of its peers. | 15 | Slightly above average |

Comparing SILJ’s current valuation to historical valuations and peer companies reveals its relative attractiveness. Potential risks include volatility in commodity prices and operational challenges within the mining sector. Opportunities arise from the potential for increased demand for precious metals driven by inflation or geopolitical uncertainty.

SILJ Stock Price and Investment Strategies

Different investment strategies suit various risk tolerances when investing in SILJ.

- Long-Term Buy-and-Hold: This strategy involves purchasing SILJ and holding it for an extended period, regardless of short-term price fluctuations. It’s suitable for investors with a high risk tolerance and a long-term investment horizon. Risk is mitigated by time and potential for long-term growth.

- Short-Term Trading: This strategy involves frequently buying and selling SILJ based on short-term price movements. It requires a high level of market knowledge and a higher risk tolerance. Profits are driven by short-term price changes, but losses can also be significant.

Diversification is crucial to reduce the overall risk of an investment portfolio. Including SILJ in a diversified portfolio that includes other asset classes such as equities, bonds, and real estate can help mitigate the risk associated with its volatility.

FAQs

What is SILJ?

SILJ is a stock ticker symbol representing an exchange-traded fund (ETF) that tracks the performance of a basket of precious metals mining companies.

How volatile is SILJ?

SILJ’s price can be quite volatile due to its exposure to commodity prices and overall market sentiment. It’s generally considered a higher-risk investment.

Where can I buy SILJ?

SILJ can be purchased through most brokerage accounts that offer ETF trading.

Are there any ethical considerations related to investing in SILJ?

Ethical considerations related to mining practices and environmental impact of the companies within the SILJ index should be considered before investing.