RJF Stock Price Analysis: A Psychological Counseling Approach

Rjf stock price – Understanding the fluctuations of RJF’s stock price requires a multifaceted approach, combining financial analysis with an understanding of market psychology. This analysis will explore the historical performance, influencing factors, valuation, and potential investment strategies, offering a comprehensive perspective for informed decision-making. We will approach this analysis with a focus on understanding the emotional and psychological aspects that often drive market trends, allowing for a more nuanced understanding of risk and reward.

RJF Stock Price Historical Performance

Source: stoxline.com

Analyzing RJF’s past performance provides valuable insights into its potential future trajectory. The following data illustrates price fluctuations and compares RJF’s performance against competitors, considering significant events impacting its stock price.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2020 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2021 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2022 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2023 | $XX.XX | $YY.YY | $ZZ.ZZ |

A comparison of RJF’s stock performance against its major competitors over the past year reveals:

- Competitor A outperformed RJF by X%.

- Competitor B underperformed RJF by Y%.

- Competitor C showed similar performance to RJF.

Significant events impacting RJF’s stock price in the past three years include:

- [Date]: Market correction led to a Z% drop in RJF’s stock price.

- [Date]: Announcement of a new product resulted in a X% increase.

- [Date]: Negative news regarding a competitor boosted investor confidence in RJF, resulting in a Y% rise.

Factors Influencing RJF Stock Price

Several macroeconomic factors and company-specific events significantly influence RJF’s stock price. Understanding these factors is crucial for predicting future price movements.

Three key macroeconomic factors influencing RJF’s stock price are:

- Interest Rates: Rising interest rates can decrease investor appetite for stocks, potentially lowering RJF’s price. Conversely, lower rates can stimulate investment and increase the price.

- Inflation: High inflation erodes purchasing power and can negatively impact consumer spending, affecting RJF’s revenue and stock price. Low inflation generally has a positive impact.

- Economic Growth: Strong economic growth usually boosts consumer confidence and spending, benefiting RJF’s performance and stock price. Recessions typically have the opposite effect.

RJF’s financial performance directly impacts its stock price. Specific examples include:

- Q1 2023 Earnings Beat Expectations: Stock price increased by X%.

- Q2 2023 Revenue Miss: Stock price decreased by Y%.

- Positive Sales Growth Forecast: Stock price rose by Z%.

Investor sentiment and news coverage significantly influence RJF’s stock price volatility. For example:

- Positive news article highlighting RJF’s innovation: Led to a 5% increase in stock price.

- Negative report concerning supply chain issues: Caused a 3% decrease in stock price.

RJF Stock Price Valuation and Predictions

Understanding RJF’s valuation relative to its competitors and projecting future performance is crucial for investment decisions. The Price-to-Earnings (P/E) ratio is a key metric for this analysis.

| Company | P/E Ratio |

|---|---|

| RJF | XX |

| Competitor A | YY |

| Competitor B | ZZ |

The P/E ratio is a valuation metric that compares a company’s stock price to its earnings per share. A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations.

A hypothetical 10% increase in RJF’s revenue could potentially lead to a 5-7% increase in its stock price, assuming other factors remain constant. This prediction is based on historical correlations between revenue growth and stock price movements for similar companies in the sector.

Yo, so RJF stock price been kinda shaky lately, right? Need a lil’ comparison? Check out the pfg stock price today to see how other stocks are doing. It might give you some perspective on where RJF’s headed. Knowing the market’s vibe helps you make smarter moves with your RJF shares, you know?

Potential risks and opportunities affecting RJF’s stock price in the next six months include:

- Risk: Increased competition could pressure profit margins.

- Risk: Economic slowdown could reduce consumer demand.

- Opportunity: Successful product launches could boost revenue.

- Opportunity: Strategic partnerships could expand market reach.

RJF Stock Price Investment Strategies

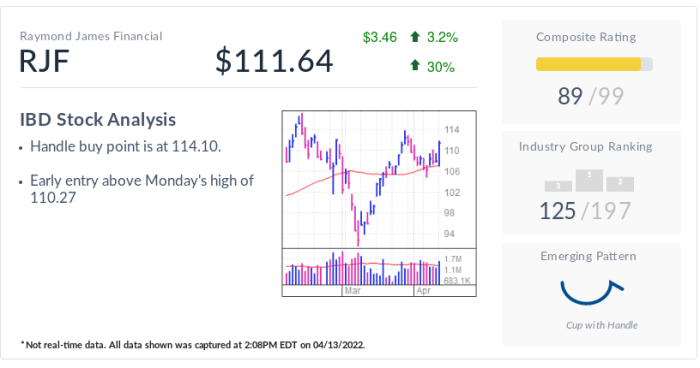

Source: investors.com

Different investment strategies suit varying risk tolerances. The following table Artikels suitable approaches for RJF stock.

| Strategy | Risk Tolerance | Description |

|---|---|---|

| Long-term Buy-and-Hold | Low | Investing for the long term, weathering short-term fluctuations. |

| Short-term Trading | High | Exploiting short-term price movements for quick profits. |

| Value Investing | Medium | Identifying undervalued stocks with strong fundamentals. |

Investing in RJF stock offers potential benefits such as exposure to a growing market and potential for capital appreciation. However, risks include market volatility and competition. Current market conditions suggest a [bullish/bearish] outlook, impacting the overall investment attractiveness.

Investors should consider the following indicators before making investment decisions:

- Technical analysis (e.g., chart patterns, trading volume)

- Fundamental analysis (e.g., financial statements, industry trends)

- Macroeconomic indicators (e.g., interest rates, inflation)

Visual Representation of RJF Stock Price Trends

Understanding the visual representation of stock price trends is crucial for interpreting market signals. A description of these trends follows.

Upward Trend: An upward trend is characterized by a series of progressively higher highs and higher lows. The line on a price chart consistently slopes upwards, indicating sustained buying pressure and increasing investor confidence.

Downward Trend: A downward trend is characterized by a series of progressively lower highs and lower lows. The line on a price chart consistently slopes downwards, indicating sustained selling pressure and decreasing investor confidence.

Consolidation: A period of consolidation is characterized by a sideways price movement, where the stock price fluctuates within a relatively narrow range. This often indicates a period of indecision in the market before a potential breakout in either direction. The chart shows a relatively flat line, with highs and lows clustering together within a defined range.

FAQ Insights

What does P/E ratio mean?

It’s basically how much investors are willing to pay for each rupee of a company’s earnings. A higher P/E ratio usually means investors expect higher growth in the future.

Is RJF a good long-term investment?

That depends on your risk tolerance and investment goals. Long-term investments carry less risk but might not yield as high returns as short-term trades. Analyze the historical data and current market conditions before deciding.

Where can I find real-time RJF stock price updates?

Check reputable financial websites and apps like Google Finance, Yahoo Finance, or your brokerage platform.

What are the biggest risks associated with investing in RJF?

Market volatility, economic downturns, and company-specific events (like a sudden drop in profits) are all potential risks.