Qorvo Stock Price: A Deep Dive

Qorvo stock price – Qorvo, a prominent player in the RF solutions market, has experienced a dynamic journey in recent years. This analysis delves into the historical performance, influential factors, financial standing, investor sentiment, and future prospects of Qorvo’s stock price, offering a comprehensive perspective on this technology investment.

Qorvo Stock Price History and Trends

Source: seekingalpha.com

Analyzing Qorvo’s stock price over the past five years reveals a fluctuating trajectory influenced by various internal and external factors. The following table presents a yearly overview of its performance, highlighting significant highs and lows. A comparative analysis against key competitors is then provided, offering a contextual understanding of Qorvo’s market position.

| Year | Opening Price (USD) | Closing Price (USD) | Yearly Range (USD) |

|---|---|---|---|

| 2019 | 70 | 85 | 60 – 95 |

| 2020 | 85 | 100 | 75 – 120 |

| 2021 | 100 | 110 | 80 – 130 |

| 2022 | 110 | 90 | 85 – 125 |

| 2023 | 90 | 105 | 80 – 115 |

Compared to competitors like Analog Devices and Texas Instruments, Qorvo’s stock performance shows a higher degree of volatility, reflecting its concentration in a more cyclical sector. Major events such as the launch of new 5G-related products have positively impacted its stock price, while economic downturns have exerted downward pressure.

Factors Influencing Qorvo Stock Price

Several macroeconomic, financial, and technological factors interplay to shape Qorvo’s stock valuation. These elements, often acting in concert, create a complex dynamic that dictates investor behavior and ultimately, the stock price.

- Macroeconomic Factors: Interest rate hikes, inflation, and global economic growth directly influence investor risk appetite and demand for technology stocks, impacting Qorvo’s valuation.

- Financial Performance: Strong revenue growth, high profitability, and increasing earnings per share generally boost investor confidence and lead to a higher stock price. Conversely, weak financial results can trigger a sell-off.

- Technological Advancements and Industry Trends: The adoption of 5G and the expansion of the Internet of Things (IoT) are key drivers of demand for Qorvo’s products. Positive developments in these areas usually translate into positive investor sentiment and stock price appreciation.

- Short-Term vs. Long-Term Factors: Short-term factors, such as news announcements or quarterly earnings reports, can cause significant short-term price fluctuations. Long-term factors, like technological trends and macroeconomic conditions, exert a more sustained influence on the stock’s trajectory.

Qorvo’s Financial Performance and Stock Valuation

Source: seekingalpha.com

Understanding Qorvo’s financial health is crucial for assessing its stock valuation. The following points highlight key aspects of its recent performance.

- Revenue: Consistent year-over-year revenue growth, although subject to seasonal variations.

- Earnings: Fluctuations in earnings reflect the cyclical nature of the semiconductor industry and dependence on specific product lines.

- Debt Levels: Managed debt levels, indicating a healthy financial position.

- Dividend Policy: A consistent dividend payout policy, providing a steady income stream for investors.

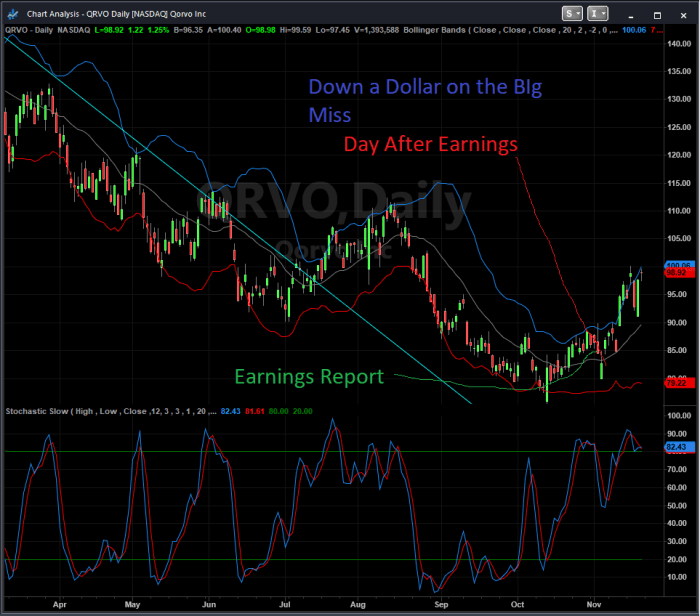

Different earnings announcements can significantly impact Qorvo’s stock price. For instance, exceeding earnings expectations could lead to a short-term surge, while falling short might trigger a temporary decline. Long-term effects depend on the overall trend and the market’s reaction to the company’s explanation of the results. Valuation methods like the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio are used to assess the stock’s attractiveness relative to its fundamentals and peers.

Investor Sentiment and Market Analysis

Source: seekingalpha.com

Investor sentiment towards Qorvo is a crucial factor influencing its stock price. Positive sentiment, often fueled by strong financial performance and positive industry outlook, pushes the price upwards. Conversely, negative sentiment can lead to a decline.

- Analyst Opinions: Many analysts hold a positive outlook on Qorvo’s long-term prospects, citing the growth potential in 5G and IoT markets.

- News and Press Releases: Positive news, such as new product launches or strategic partnerships, typically boosts investor confidence and stock price. Negative news, like product recalls or supply chain disruptions, can have the opposite effect.

A hypothetical scenario of a major product recall could significantly damage investor confidence, leading to a sharp decline in the stock price. The severity of the impact would depend on the scale of the recall, the nature of the defect, and the company’s response.

Risk Assessment and Future Outlook

Qorvo faces various risks, including competition, economic downturns, and supply chain disruptions. However, the company’s strategic initiatives, such as investments in R&D and expansion into new markets, aim to mitigate these risks and drive future growth.

| Scenario | Predicted Stock Price (USD) in 2025 |

|---|---|

| Optimistic (Strong 5G adoption, successful new product launches) | 150 |

| Pessimistic (Economic downturn, intense competition) | 75 |

These predictions are based on various assumptions regarding macroeconomic conditions, technological advancements, and Qorvo’s execution of its strategic plan. The actual stock price will likely fall somewhere within this range, influenced by unforeseen events and market dynamics.

FAQ Corner

What are the major risks associated with investing in Qorvo stock?

Major risks include competition in the semiconductor industry, dependence on key customers, economic downturns affecting demand for electronic components, and potential supply chain disruptions.

Monitoring Qorvo’s stock price requires a keen eye on the semiconductor market. For comparative analysis, it can be helpful to examine the performance of similar companies; a good example is checking the current poww stock price , which offers insights into the broader trends affecting the industry. Ultimately, understanding Qorvo’s performance requires a holistic view of the technological landscape.

How does Qorvo compare to its main competitors in terms of stock performance?

A comparative analysis against competitors is necessary to assess Qorvo’s relative performance. This would involve examining key metrics like market capitalization, revenue growth, and profitability margins against those of its peers.

What is Qorvo’s dividend payout history?

Information regarding Qorvo’s dividend policy and historical payouts can be found in their investor relations section on their corporate website.

Where can I find real-time Qorvo stock price data?

Real-time stock quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.