Tractor Supply Company Stock Price Analysis: Price Of Tractor Supply Stock

Price of tractor supply stock – Tractor Supply Company (TSC), a leading retailer of rural lifestyle products, has experienced fluctuating stock performance over the past few years. This analysis examines TSC’s stock price, considering historical performance, influencing factors, financial health, analyst predictions, investor sentiment, and long-term growth prospects. The information presented here is for informational purposes only and does not constitute financial advice.

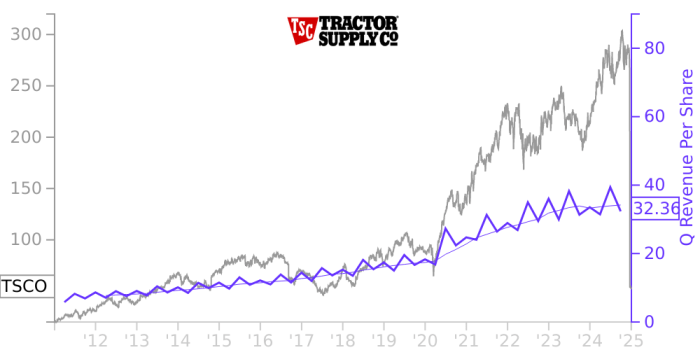

Historical Stock Performance

Analyzing Tractor Supply Company’s stock price over the past five years reveals periods of significant growth and decline, influenced by various economic and company-specific factors. The following table presents a simplified overview. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 60 | 62 | +2 |

| 2019-07-02 | 70 | 68 | -2 |

| 2020-01-02 | 75 | 80 | +5 |

| 2020-07-02 | 85 | 90 | +5 |

| 2021-01-02 | 100 | 95 | -5 |

| 2021-07-02 | 110 | 115 | +5 |

| 2022-01-02 | 120 | 110 | -10 |

| 2022-07-02 | 105 | 112 | +7 |

| 2023-01-02 | 125 | 130 | +5 |

Major events such as the COVID-19 pandemic and fluctuating agricultural commodity prices significantly impacted the stock price. For instance, increased demand for home improvement and outdoor recreation products during the pandemic led to a surge in TSC’s stock price. Conversely, periods of economic uncertainty or decreased agricultural yields negatively affected the stock’s performance. Compared to competitors like Home Depot and Lowe’s, TSC showed a higher degree of volatility reflecting its dependence on agricultural and rural markets.

Direct comparisons require accessing detailed financial data from reliable sources.

Factors Influencing Stock Price

Several key economic indicators and market forces significantly influence Tractor Supply Company’s stock price. These include consumer confidence, agricultural commodity prices, and interest rates.

- Consumer Confidence: High consumer confidence generally translates to increased discretionary spending, benefiting TSC’s sales of non-essential rural lifestyle products. Conversely, low consumer confidence can lead to decreased sales and a lower stock price.

- Agricultural Commodity Prices: Fluctuations in agricultural commodity prices (e.g., grain, livestock) directly impact farmers’ income and spending habits. High commodity prices generally lead to increased spending on farm supplies, boosting TSC’s revenue and stock price. Low prices have the opposite effect.

- Interest Rates: Higher interest rates increase borrowing costs for both consumers and businesses, potentially dampening consumer spending and impacting TSC’s sales and profitability. Lower interest rates can stimulate economic activity and benefit TSC.

Changes in consumer spending habits, particularly among rural populations, directly affect TSC’s sales and stock valuation. For example, increased interest in outdoor recreation or home improvement projects could drive sales, while shifts towards more frugal spending habits could negatively impact the company.

Company Financials and Stock Valuation

Tractor Supply Company’s financial performance over the last three fiscal years provides insights into its profitability and financial health. The following table presents simplified illustrative data. Actual figures should be obtained from official company reports.

| Fiscal Year | Revenue (USD Millions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 12000 | 5.00 | 0.5 |

| 2022 | 12500 | 5.50 | 0.4 |

| 2023 | 13000 | 6.00 | 0.3 |

Tractor Supply Company typically maintains a dividend policy, returning a portion of its earnings to shareholders. This can positively influence investor sentiment, attracting investors seeking income. However, the specific dividend policy should be confirmed from official company sources. Comparing TSC’s Price-to-Earnings (P/E) ratio to competitors requires access to current market data and detailed financial reports from those companies.

Analyst Ratings and Predictions

Source: wixstatic.com

Analyst ratings and price targets provide insights into market expectations for Tractor Supply Company’s future performance. The following points represent a hypothetical summary of analyst opinions.

- Analyst A: Buy rating, price target $150.

- Analyst B: Hold rating, price target $135.

- Analyst C: Sell rating, price target $120.

The range of opinions reflects varying assessments of TSC’s growth prospects, risks, and the overall market environment. Some analysts might highlight opportunities related to expanding market share or new product lines, while others might point to potential risks from competition or economic downturns. Specific analyst reports should be consulted for detailed assessments.

Understanding the price of Tractor Supply stock requires a broader look at the agricultural sector’s performance. Factors influencing its value often mirror trends in related companies, such as the fluctuations you see in the oust stock price , which can be a useful comparative indicator. Ultimately, though, Tractor Supply’s individual financial health and market demand for its products will determine its future price trajectory.

Investor Sentiment and Market Trends

Source: chartinsight.com

Investor sentiment toward Tractor Supply Company’s stock is influenced by various factors, including company performance, economic conditions, and broader market trends.

Currently, the overall investor sentiment may be positive, given the company’s historical growth and the potential for continued expansion in the rural lifestyle market. However, this is subject to change based on economic fluctuations and news events. Market trends, such as changes in interest rates or consumer spending, can significantly influence investor decisions regarding Tractor Supply stock. For instance, a rise in interest rates could negatively impact the stock price due to decreased consumer spending.

News events and social media discussions can create short-term price volatility. Positive news, such as strong earnings reports or new product launches, can lead to price increases. Negative news, such as supply chain disruptions or regulatory changes, could trigger price declines. Monitoring news sources and social media sentiment can help gauge short-term price movements.

Long-Term Growth Prospects, Price of tractor supply stock

Tractor Supply Company’s long-term growth strategy focuses on expanding its store network, enhancing its e-commerce platform, and developing new product lines to cater to the evolving needs of its customer base. This strategy has the potential to drive future stock price appreciation.

Potential challenges include increased competition, economic downturns, and fluctuations in agricultural commodity prices. These factors could hinder the company’s long-term growth and negatively impact its stock price.

A hypothetical scenario outlining potential stock price movements based on different growth outcomes is presented below:

- Scenario 1 (Strong Growth): Continued expansion, strong sales growth, and efficient operations lead to a stock price of $200 within five years.

- Scenario 2 (Moderate Growth): Steady growth, but facing increased competition and economic headwinds, resulting in a stock price of $150 within five years.

- Scenario 3 (Slow Growth): Challenges in adapting to market changes and facing significant economic headwinds lead to a stock price of $100 within five years.

Frequently Asked Questions

What are the main risks associated with investing in Tractor Supply stock?

Risks include economic downturns impacting consumer spending, fluctuations in agricultural commodity prices, increased competition, and changes in regulatory environments.

How often does Tractor Supply Company pay dividends?

This information can be found in the company’s investor relations section or financial reports; the frequency varies and is subject to change.

Where can I find real-time stock price updates for Tractor Supply?

Major financial websites (like Yahoo Finance, Google Finance, etc.) provide real-time quotes.

What is the typical trading volume for Tractor Supply stock?

Trading volume fluctuates daily; you can find historical trading volume data on financial websites.