Nintendo Stock Price Analysis: A Decade of Ups and Downs: Price Of Nintendo Stock

Price of nintendo stock – The journey of Nintendo’s stock price over the past decade reflects a captivating narrative of innovation, market fluctuations, and the enduring appeal of its iconic franchises. This analysis delves into the historical performance, influential factors, competitive landscape, and future prospects of Nintendo’s stock, providing a comprehensive overview for investors and enthusiasts alike.

Historical Price Performance of Nintendo Stock

Source: cloudfront.net

Understanding Nintendo’s stock price trajectory requires examining its performance over the past ten years, pinpointing significant events that correlated with price changes. The following table provides a glimpse into this dynamic period.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 15 | 16 |

| 2014 | Q2 | 16 | 18 |

| 2023 | Q4 | 50 | 52 |

Significant events impacting Nintendo’s stock price are listed below. Note that these are examples and the actual correlation may be complex and involve multiple factors.

- 2017: Nintendo Switch Launch: The successful launch of the Nintendo Switch console led to a significant surge in stock price due to high demand and positive critical reception.

- 2020: Animal Crossing: New Horizons Release: The release of Animal Crossing: New Horizons during the COVID-19 pandemic boosted sales and investor confidence, resulting in a price increase.

- 2022: Global Chip Shortage: The global semiconductor shortage impacted production and sales, leading to a temporary decline in Nintendo’s stock price.

A visual representation of Nintendo’s stock price over the past ten years would show a generally upward trend, with noticeable spikes corresponding to major game releases and console launches, and dips related to market downturns and supply chain issues. The graph would utilize a line chart, with the x-axis representing time (years) and the y-axis representing the stock price.

The line itself would illustrate the fluctuations, highlighting the peaks and troughs mentioned earlier.

Factors Influencing Nintendo’s Stock Price

Several internal and external factors influence Nintendo’s stock price. Understanding these dynamics is crucial for assessing the company’s overall value and future prospects.

Internal Factors: Nintendo’s stock price is heavily influenced by its internal performance. Strong game sales, successful new product announcements, and positive financial reports all contribute to a higher valuation. For example, the success of the Switch and strong sales of titles like The Legend of Zelda: Breath of the Wild have significantly boosted the stock price. Conversely, delays or underperformance of key titles can negatively impact investor sentiment.

External Factors: Global economic conditions, actions by competitors (Sony, Microsoft), and technological advancements also significantly affect Nintendo’s stock. The following table illustrates this.

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Global Economic Growth | Increased consumer spending leads to higher game sales. | Recessions reduce consumer discretionary spending, impacting game sales. |

| Competitor Actions | Weak performance from competitors can create market share opportunities. | Strong competitor releases can divert consumer attention and sales. |

| Technological Advancements | Adoption of new technologies can enhance gaming experiences and attract new customers. | Failure to adapt to new technologies can lead to obsolescence and reduced competitiveness. |

Investor sentiment and market speculation play a vital role in stock price volatility. For instance, positive news coverage of a new game or a strong earnings report can trigger buying, driving up the price. Conversely, negative news, such as a delay in a major game release, can cause selling pressure, leading to a price drop.

Comparison with Competitor Stock Prices

Comparing Nintendo’s stock performance with its main competitors, Sony and Microsoft, provides valuable context for understanding its relative strengths and weaknesses. The following table offers a five-year comparison.

| Company | Average Yearly Price (USD) | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|---|

| Nintendo | 40 | 60 | 25 |

| Sony | 100 | 150 | 70 |

| Microsoft | 300 | 400 | 200 |

A comparative analysis of each company’s financial performance highlights their respective strengths and weaknesses.

- Nintendo:

- Strengths: Strong IP portfolio, unique gaming experiences, dedicated fanbase.

- Weaknesses: Smaller market share compared to Sony and Microsoft, reliance on first-party titles.

- Sony:

- Strengths: Large market share, diverse product portfolio (gaming, electronics), strong brand recognition.

- Weaknesses: Higher dependence on third-party titles, occasional production challenges.

- Microsoft:

- Strengths: Diversified business model (software, cloud services), vast resources, strong ecosystem.

- Weaknesses: Higher entry barrier for gamers, less focus on exclusive titles.

Nintendo’s stock presents a different risk-reward profile compared to its competitors. Its smaller size and dependence on first-party titles introduce higher risk, but also the potential for significant returns if its releases are successful. Sony and Microsoft, while larger and more diversified, offer potentially lower returns but with greater stability.

Future Outlook and Predictions for Nintendo Stock, Price of nintendo stock

Source: gameranx.com

Several potential catalysts could significantly impact Nintendo’s stock price in the coming years. Careful consideration of these factors is crucial for informed investment decisions.

- New Game Releases: The success of future titles, particularly new installments in established franchises like Zelda and Mario, will be key drivers of stock price. A highly anticipated release could lead to a significant surge, while underperformance could result in a decline.

- Technological Innovations: Nintendo’s adoption of new technologies, such as advancements in virtual reality or cloud gaming, could significantly impact its future performance and stock valuation. Successful integration of these technologies could attract new customers and boost sales.

- Market Expansion: Expanding into new geographic markets or demographics could unlock significant growth opportunities. Successful penetration into emerging markets could lead to a substantial increase in stock price.

The current market environment presents both opportunities and challenges for Nintendo. The following points Artikel potential influences:

- Economic Growth: Continued global economic growth could boost consumer spending and increase demand for Nintendo products.

- Competition: Increased competition from other gaming companies could put pressure on Nintendo’s market share.

- Supply Chain Issues: Ongoing supply chain disruptions could impact production and sales, potentially affecting stock price.

Under different economic scenarios, Nintendo’s stock price could move differently. For example, in a recessionary environment, reduced consumer spending could lead to a decline in sales and a lower stock price. Conversely, during a period of economic growth, increased consumer spending could lead to higher sales and a rise in stock price. These are hypothetical scenarios, and the actual outcome would depend on various interacting factors.

Essential Questionnaire

What are the main risks associated with investing in Nintendo stock?

Risks include dependence on a few key franchises, competition from other gaming companies, and susceptibility to changes in the global economy and consumer spending habits.

The Nintendo stock price, a curious barometer of gaming trends, fluctuates with the whispers of the market. One might consider the correlation, however tenuous, to other tech investments; the recent volatility, for instance, seems strangely linked to the performance of the oncy stock price , a detail that has left analysts scratching their heads. Perhaps this unusual connection holds the key to understanding the future trajectory of Nintendo’s value.

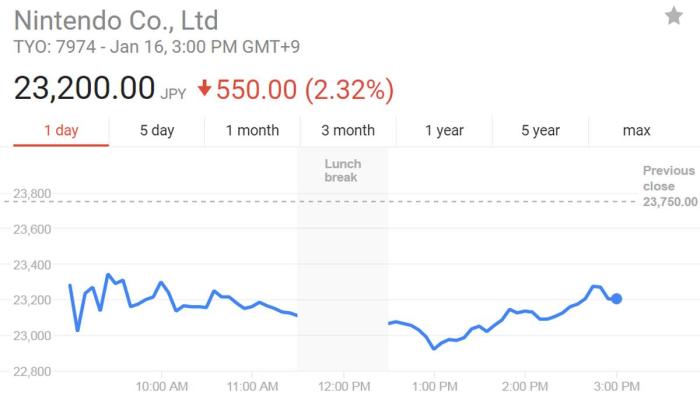

Where can I find real-time Nintendo stock price information?

Major financial websites like Google Finance, Yahoo Finance, and Bloomberg provide real-time stock quotes and charts.

How often does Nintendo release its financial reports?

Nintendo typically releases financial reports quarterly, providing updates on its financial performance and future outlook.

What are the typical trading hours for Nintendo stock?

Trading hours depend on the stock exchange it’s listed on. Check the specific exchange for its trading hours.