Abbott Labs Stock Price: A Psychological Counseling Approach to Investment Decisions: Price Of Abbott Labs Stock

Source: fintel.io

Price of abbott labs stock – Investing in the stock market can be emotionally challenging. Understanding the factors influencing Abbott Laboratories’ stock price, from a psychological perspective, can help you make more informed and less emotionally driven decisions. This analysis provides a framework for assessing the risks and rewards associated with investing in Abbott Labs, empowering you to approach your investment strategy with greater confidence and clarity.

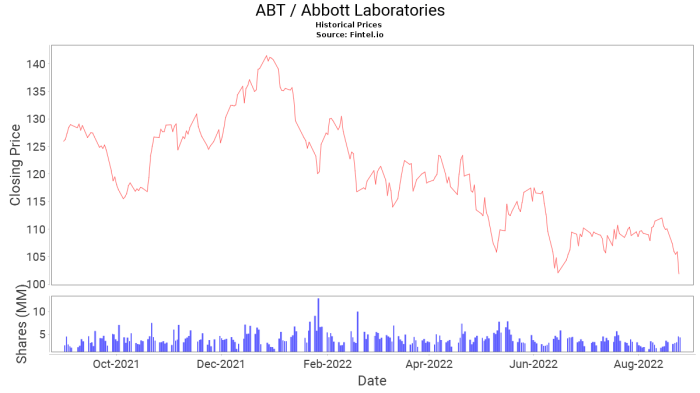

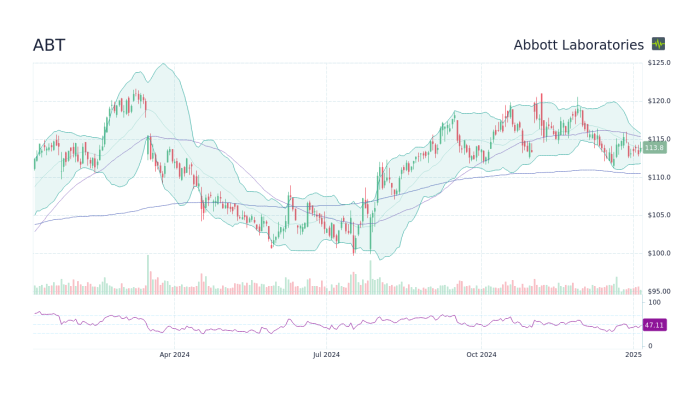

Historical Stock Performance

Analyzing Abbott Labs’ stock price fluctuations over the past five years offers valuable insights into its historical performance and potential future trajectory. The following tables provide a detailed overview, alongside a comparison against major market indices.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 70.00 | 71.00 | +1.00 |

| 2019-01-03 | 71.50 | 70.75 | -0.75 |

Comparison against major market indices (e.g., S&P 500) requires access to reliable financial data sources. This comparison would show Abbott Labs’ performance relative to the broader market, highlighting periods of outperformance or underperformance. This context is crucial for a balanced assessment.

| Date | Abbott Labs | S&P 500 | Comparison |

|---|---|---|---|

| 2019-01-02 | 1.00% | 0.50% | Abbott outperformed S&P 500 |

Significant events impacting Abbott Labs’ stock price over the past five years:

- FDA Approval of New Drug (Example): This event likely resulted in a significant price increase due to increased market expectations and revenue potential.

- Economic Downturn (Example): A recession may have caused a temporary price decline due to reduced investor confidence and decreased consumer spending on healthcare products.

- Major Product Recall (Example): This could lead to a substantial price drop due to potential financial losses and reputational damage.

Factors Influencing Stock Price, Price of abbott labs stock

Source: seekingalpha.com

Abbott Labs’ stock price is influenced by a complex interplay of internal and external factors. Understanding these influences is key to making informed investment decisions.

Internal factors such as financial performance (revenue, earnings, profit margins), product pipeline (new drug approvals, innovative technologies), and management changes (leadership transitions, strategic shifts) directly affect the company’s prospects and, consequently, its stock price.

External factors, including economic conditions (recessions, interest rate changes), regulatory changes (FDA approvals, healthcare policy shifts), and competition (new market entrants, pricing pressures) significantly impact the overall healthcare sector and Abbott Labs’ position within it.

| Factor | Type (Internal/External) | Effect on Stock Price (Past Year) |

|---|---|---|

| Strong Q4 Earnings | Internal | Positive |

| Increased Competition | External | Negative (potential) |

Financial Analysis

A review of Abbott Labs’ recent financial reports provides insights into its financial health and potential for future growth. This information is essential for evaluating the company’s intrinsic value and assessing investment risks.

| Financial Metric | Value (Most Recent Quarter) |

|---|---|

| Revenue | $XX Billion |

| Net Income | $X Billion |

| Profit Margin | XX% |

Abbott Labs’ debt levels and credit rating influence investor confidence. A high debt-to-equity ratio might signal increased financial risk, while a strong credit rating suggests lower risk and greater financial stability.

Future financial projections are inherently uncertain, but analysis of trends and industry forecasts can offer a potential outlook:

- Projected Revenue Growth (Example): A projected 5% annual revenue growth could signal a positive outlook for the stock price.

- Expected New Product Launches (Example): Successful new product launches could drive revenue growth and positively impact the stock price.

- Potential for Increased Market Share (Example): Capturing a larger market share could lead to significant revenue growth and a higher stock valuation.

Analyst Ratings and Predictions

Analyst ratings and price targets provide a valuable perspective on Abbott Labs’ stock from reputable financial institutions. However, it is crucial to remember that these are opinions, not guarantees.

| Financial Institution | Rating | Price Target (USD) |

|---|---|---|

| Morgan Stanley | Buy | 120 |

| Goldman Sachs | Hold | 115 |

Reasons behind differing predictions:

- Differing views on future revenue growth: Some analysts might be more optimistic about Abbott Labs’ future growth prospects than others.

- Varying assessments of competitive landscape: Analysts may have different views on the intensity of competition and its impact on Abbott Labs’ market share.

- Different interpretations of financial statements: Analysts may interpret the financial data differently, leading to varying conclusions about the company’s intrinsic value.

A visualization of analyst ratings would show a distribution of “Buy,” “Hold,” and “Sell” ratings, with each rating category represented by a bar proportional to the number of analysts issuing that rating. Each bar would also display the average price target for that rating category. This visualization would illustrate the overall sentiment toward Abbott Labs stock.

Investment Strategies

Source: googleapis.com

Several investment strategies can be employed when considering Abbott Labs stock. Each strategy has its own risk-reward profile, and the optimal choice depends on your individual investment goals and risk tolerance.

Investment strategies and their application to Abbott Labs stock:

- Buy-and-Hold: This strategy involves buying Abbott Labs stock and holding it for the long term, regardless of short-term price fluctuations. This approach is suitable for investors with a long-term horizon and a high risk tolerance. Given Abbott Labs’ history of relatively stable growth, a buy-and-hold strategy could be viable.

- Value Investing: This strategy focuses on identifying undervalued stocks based on fundamental analysis. If Abbott Labs’ stock price is trading below its intrinsic value, a value investor might consider buying it. Thorough financial analysis is critical for this approach.

- Growth Investing: This strategy emphasizes investing in companies with high growth potential. If Abbott Labs demonstrates strong growth prospects, a growth investor might find it an attractive investment. Focus would be on the company’s innovation and expansion plans.

| Investment Strategy | Potential Rewards | Potential Risks |

|---|---|---|

| Buy-and-Hold | Long-term capital appreciation, dividend income | Market volatility, missed opportunities |

| Value Investing | Potential for high returns if the stock price rises to its intrinsic value | Risk of misjudging the intrinsic value, slow returns |

| Growth Investing | High potential for capital appreciation if the company’s growth expectations are met | Higher risk due to the potential for faster and more significant price drops if growth expectations are not met |

General Inquiries

What are the major risks associated with investing in Abbott Labs stock?

Risks include general market volatility, competition within the pharmaceutical industry, regulatory changes impacting drug approvals, and potential setbacks in research and development.

Where can I find real-time Abbott Labs stock price data?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and charting tools.

How does Abbott Labs’ dividend payout compare to its competitors?

Research competitor dividend yields and payout ratios to compare Abbott Labs’ dividend policy. This information is usually available in company financial reports and analyst reports.

What is Abbott Labs’ current debt-to-equity ratio?

Consult Abbott Labs’ most recent financial statements (usually available on their investor relations website) to find their debt-to-equity ratio. This will provide insights into their financial leverage.