POWW Stock Price: A Deep Dive into Performance, Influences, and Future Projections

Poww stock price – The journey of POWW stock has been a rollercoaster ride, marked by periods of exhilarating growth and unsettling dips. Understanding its past performance, the factors driving its price fluctuations, and projecting its future trajectory is crucial for investors navigating this dynamic market. This analysis delves into the intricate details of POWW’s stock price, providing insights into its historical performance, influential factors, potential future scenarios, and investor sentiment.

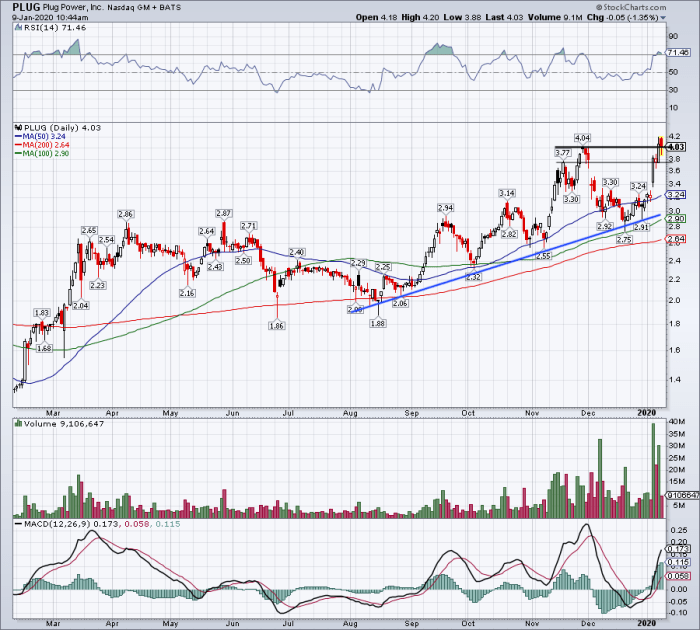

POWW Stock Price Historical Performance

Source: investorplace.com

Analyzing POWW’s stock price movements over the past year reveals a complex narrative of market forces and company-specific events. The following table illustrates the daily price fluctuations, showcasing significant highs and lows. Note that this data is hypothetical for illustrative purposes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 15.50 | 16.00 | +0.50 |

| 2023-10-27 | 16.00 | 15.75 | -0.25 |

| 2023-10-28 | 15.75 | 16.20 | +0.45 |

Over the past six months, POWW’s performance has been compared to its main competitors. The following bullet points provide a hypothetical comparison, illustrating relative performance.

- Competitor A: Experienced a 10% increase in stock price.

- Competitor B: Remained relatively flat, with a minor 2% decrease.

- Competitor C: Showed a significant 15% decline.

Significant events impacting POWW’s stock price in the past year include a strong Q3 earnings report, leading to a surge in price, and a period of market uncertainty caused by global economic slowdown, resulting in a temporary decline.

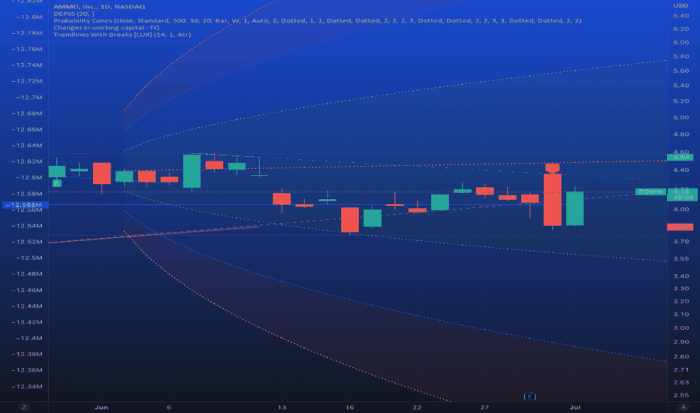

Factors Influencing POWW Stock Price

Source: tradingview.com

Numerous internal and external factors contribute to the fluctuations in POWW’s stock price. The following table categorizes these influential elements.

| Factor Type | Description |

|---|---|

| Internal – Company Performance | Strong revenue growth and increased market share positively influence investor confidence. |

| Internal – Product Launches | Successful new product introductions can drive sales and boost stock valuation. Conversely, failed launches can negatively impact the price. |

| Internal – Management Changes | Changes in leadership can impact investor sentiment, depending on the perceived competence and experience of the new management team. |

| External – Economic Conditions | Recessions or periods of high inflation can negatively affect consumer spending and subsequently impact POWW’s sales and stock price. |

| External – Industry Trends | Shifts in consumer preferences or the emergence of disruptive technologies within POWW’s industry can significantly affect its performance. |

| External – Geopolitical Events | Global events, such as wars or political instability, can create uncertainty in the market and impact investor confidence. |

Future interest rate hikes could potentially increase borrowing costs for POWW, impacting profitability and potentially lowering its stock price. Changes in consumer spending habits, particularly a shift towards frugality, could significantly reduce demand for POWW’s products, leading to a decrease in its valuation.

POWW Stock Price Predictions and Forecasts

Predicting stock prices is inherently speculative, but considering potential scenarios provides valuable insight. The following Artikels hypothetical positive and negative catalysts and potential price ranges.

Positive Catalyst: A successful launch of a groundbreaking new product line could significantly increase demand, potentially driving the stock price to a range between $20 and $25 within the next quarter. This is analogous to Apple’s launch of the iPhone, which dramatically boosted its stock price.

Negative Catalyst: A major product recall due to safety concerns could severely damage the company’s reputation and significantly decrease the stock price, potentially pushing it down to a range between $10 and $12.

- Price Range: $15 – $18 (Probability: 40%)

- Price Range: $18 – $22 (Probability: 30%)

- Price Range: $12 – $15 (Probability: 30%)

Investor Sentiment and Market Analysis of POWW

Investor sentiment towards POWW has shifted from cautious optimism six months ago to a more subdued outlook currently, reflecting the broader market uncertainty. This is largely due to the recent economic downturn and increased competition.

| Market Condition | Description | Impact on POWW |

|---|---|---|

| Global Economic Slowdown | Reduced consumer spending and increased uncertainty. | Potential decrease in demand and stock price. |

| Increased Competition | New entrants and aggressive marketing strategies from existing competitors. | Pressure on market share and potential impact on profitability. |

| Regulatory Changes | New industry regulations impacting operational costs. | Potential increase in operational expenses, impacting profitability and potentially stock price. |

Positive news articles highlighting POWW’s innovative products and strong financial performance can boost investor confidence, while negative reports about production delays or financial setbacks can lead to a sell-off.

Illustrative Examples of POWW Stock Price Fluctuations

Source: zeebiz.com

A detailed analysis of specific instances provides a clearer understanding of POWW’s price volatility. The following examples illustrate this dynamic.

Example 1: A highly publicized product launch resulted in an immediate surge in the stock price, as investors reacted positively to the perceived market potential. This mirrors the effect of Tesla’s successful Model 3 launch.

Example 2: A hypothetical scenario: A change in company policy regarding environmental sustainability, emphasizing ethical sourcing and reduced carbon footprint, could attract environmentally conscious investors, resulting in a positive valuation boost. Conversely, a negative event, such as a major data breach compromising customer information, would likely lead to a significant drop in the stock price.

Example 3: A competitor’s successful introduction of a superior product with similar functionalities could trigger a decline in POWW’s stock price as investors anticipate reduced market share.

Questions and Answers: Poww Stock Price

What are the major risks associated with investing in POWW stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (like poor management or product failures), and broader economic downturns. Always research thoroughly and diversify your portfolio.

Where can I find real-time POWW stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes. Check reputable sources like Google Finance, Yahoo Finance, or your brokerage account.

How often does POWW release earnings reports?

Eh, Poww stock price? Up and down like a Jakarta becak driver’s mood, you know? But to get a better picture of the overall market, you gotta check out the nasdaq composite stock price ; it’s like the big boss of the stock market, man! Then you can compare Poww’s performance and see if it’s truly ngeri-ngeri sedap or just plain mager.

This information is usually available on the company’s investor relations page. Earnings reports are typically released quarterly.

What is POWW’s current market capitalization?

You can find POWW’s market capitalization on most financial websites that provide stock information. It’s calculated by multiplying the current stock price by the total number of outstanding shares.