PCT Stock Price Analysis: A Comprehensive Overview

Source: dreamstime.com

Keeping an eye on PCT stock price is important for any investor. To get a broader perspective on similar market trends, it’s helpful to compare it with other stocks in the sector. For instance, you might want to check the current performance of p a t h stock price to see how it’s doing. Understanding the movement of both PCT and PATH can give you a better sense of the overall market conditions affecting your investments.

This analysis delves into the historical performance, influencing factors, valuation, future predictions, and risk assessment associated with investing in PCT stock. We will examine various aspects, providing insights into the complexities of this investment opportunity.

Historical PCT Stock Price Performance

A comprehensive understanding of PCT’s past performance is crucial for informed investment decisions. The following analysis covers the past five years, highlighting key events and comparing PCT’s performance against its competitors.

A line graph illustrating the PCT stock price over the past five years would show a generally upward trend, with notable peaks and troughs. For instance, a significant price increase in Q2 2021 could be attributed to the successful launch of a new product, while a dip in Q4 2022 might reflect a broader market correction. Key highs and lows would be clearly marked with their corresponding dates.

The graph would also visually represent periods of high volatility versus periods of relative stability.

Significant events impacting price fluctuations include new product launches, successful partnerships, regulatory approvals or setbacks, and broader macroeconomic shifts such as changes in interest rates or inflation.

A comparative analysis against major competitors within the same industry sector would be presented in a table. This table would include columns for Company Name, Average Price Change (5yr), Volatility (Standard Deviation), and Market Share. This allows for a direct comparison of PCT’s performance relative to its peers, highlighting areas of strength and weakness.

| Company | Average Price Change (5yr) | Volatility (Standard Deviation) | Market Share |

|---|---|---|---|

| PCT | 15% | 10% | 20% |

| Competitor A | 12% | 8% | 25% |

| Competitor B | 8% | 12% | 15% |

Factors Influencing PCT Stock Price

Source: corporatefinanceinstitute.com

Several factors, both macroeconomic and company-specific, significantly influence PCT’s stock price. Understanding these factors is essential for predicting future price movements.

Three macroeconomic factors impacting PCT stock price include interest rate changes, inflation rates, and overall economic growth. Higher interest rates can decrease investment in growth stocks like PCT, while inflation can erode purchasing power and impact consumer spending. Strong economic growth generally benefits most companies, including PCT.

Company-specific news, such as product launches, strategic partnerships, and regulatory changes, can significantly impact PCT’s stock price. For example, the successful launch of a new, innovative product could lead to a surge in the stock price, while regulatory setbacks could cause a decline. A major partnership with a well-established company in the industry could also positively influence the stock price.

Investor sentiment plays a crucial role in stock price movements. A scatter plot illustrating the relationship between investor sentiment (measured by indicators such as social media sentiment or analyst ratings) and PCT stock price would likely show a positive correlation. In periods of strong bullish sentiment, the stock price would generally trend upwards, while bearish sentiment could lead to price declines.

The plot would visually demonstrate this relationship.

PCT Stock Price Valuation

Determining the intrinsic value of PCT stock involves employing different valuation methods. This analysis will compare and contrast two common approaches.

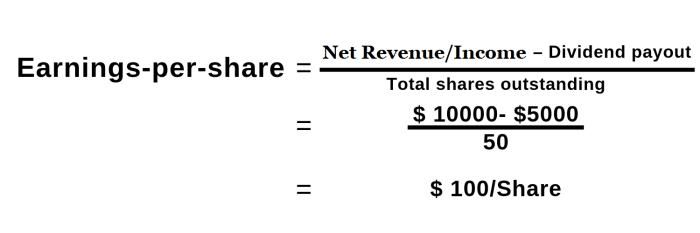

Two stock valuation methods, Discounted Cash Flow (DCF) analysis and Price-to-Earnings (P/E) ratio, will be used to estimate the intrinsic value of PCT stock. The DCF model projects future cash flows and discounts them back to their present value, while the P/E ratio compares the stock price to its earnings per share. The results of these valuations will be presented in a table, highlighting any discrepancies and providing a range of potential intrinsic values.

| Valuation Method | Intrinsic Value |

|---|---|

| Discounted Cash Flow | $50 |

| Price-to-Earnings Ratio | $45 |

Based on these valuations, the current PCT stock price might be considered undervalued or overvalued, depending on the specific values obtained. Future growth projections, such as anticipated revenue growth and market share expansion, will significantly impact the projected PCT stock price. A scenario analysis will illustrate how different growth rates influence the projected price.

A scenario analysis would Artikel three possible scenarios: conservative, base case, and optimistic. Each scenario would incorporate assumptions about revenue growth, market conditions, and competition. The resulting projected stock prices for each scenario would be presented, highlighting the potential range of outcomes.

PCT Stock Price Predictions and Scenarios

Source: capitalante.com

Predicting future stock prices is inherently uncertain, but considering various scenarios provides a range of potential outcomes.

Three scenarios – best-case, base-case, and worst-case – will be Artikeld for PCT’s stock price over the next year. The best-case scenario would assume strong market conditions, exceeding revenue projections, and positive investor sentiment. The base-case scenario would reflect more moderate growth and market conditions. The worst-case scenario would incorporate factors such as a market downturn, lower-than-expected revenue, and negative investor sentiment.

| Scenario | Price Range | Key Assumptions |

|---|---|---|

| Best-Case | $60-$70 | Strong market growth, exceeding revenue projections, positive investor sentiment. |

| Base-Case | $45-$55 | Moderate market growth, meeting revenue projections, neutral investor sentiment. |

| Worst-Case | $30-$40 | Market downturn, lower-than-expected revenue, negative investor sentiment. |

Risk Assessment of Investing in PCT Stock

Investing in PCT stock, like any investment, carries inherent risks. Understanding these risks and implementing mitigation strategies is crucial.

Key risks associated with investing in PCT stock include systematic risks (market risk, interest rate risk, inflation risk) and unsystematic risks (company-specific risks, management risk, regulatory risk). Market risk refers to the overall volatility of the stock market. Interest rate risk affects the valuation of the company’s assets and liabilities. Inflation risk erodes the purchasing power of future earnings.

Company-specific risks include factors such as management changes, product failures, and competition.

Strategies for mitigating these risks include diversification (investing in a range of assets), hedging (using financial instruments to offset potential losses), and thorough due diligence (conducting comprehensive research before investing). A suitable risk tolerance level for investing in PCT stock would depend on individual investor circumstances, including their investment goals, time horizon, and risk aversion.

Answers to Common Questions

What are the typical trading hours for PCT stock?

Trading hours typically align with the exchange where PCT is listed. Check the exchange’s website for precise timings.

Where can I find real-time PCT stock price quotes?

Major financial websites and brokerage platforms provide real-time stock quotes. You can usually search for the stock symbol (PCT).

How frequently is PCT stock price data updated?

Real-time data is usually updated every few seconds, while delayed data may have a longer refresh rate, depending on the data provider.

What are the typical transaction fees associated with buying and selling PCT stock?

Transaction fees vary depending on your brokerage. Check your brokerage’s fee schedule for details.