Oust Stock Price: A Makassar Youth’s Perspective

Oust stock price – Yo, Makassar! Let’s dive deep into the world of Oust stock, breaking it down in a way even your Mama would understand. Forget stuffy financial jargon; we’re keeping it real, Makassar style. This ain’t your grandpa’s stock market analysis; this is the lowdown on Oust’s price action, from its historical performance to the risks involved. So grab your kopi susu and let’s get started!

Oust Stock Price Historical Performance

Over the past five years, Oust’s stock price has been on a rollercoaster ride. We’ll track the major ups and downs, comparing its performance to similar companies. Think of it like comparing your favorite Makassar street food vendors – some are consistently popular, others have their ups and downs.

| Year | Opening Price (IDR) | Closing Price (IDR) | Relevant Market Index (e.g., IHSG) |

|---|---|---|---|

| 2019 | 1000 | 1200 | 5000 |

| 2020 | 1200 | 800 | 4500 |

| 2021 | 800 | 1500 | 6000 |

| 2022 | 1500 | 1300 | 5500 |

| 2023 | 1300 | 1600 | 6500 |

This table shows the yearly opening and closing prices of Oust stock alongside a relevant market index (e.g., the Indonesian Stock Exchange Composite Index – IHSG), providing context for Oust’s performance relative to the broader market. Remember, these are hypothetical figures for illustrative purposes.

Factors Influencing Oust Stock Price

Source: webuydeadstocks.com

Several factors influence Oust’s stock price. Think of it like a recipe – you need the right ingredients (macroeconomic factors, company news, investor sentiment) to get the perfect result (a stable or rising stock price).

- Macroeconomic Factors: Inflation rates, interest rate changes, and overall economic growth significantly impact investor confidence and, therefore, stock prices. For example, high inflation might discourage investment, while low interest rates can boost it.

- Company-Specific News: Product launches, successful partnerships, and regulatory approvals can send the stock price soaring. Conversely, negative news like product recalls or lawsuits can lead to a sharp decline. Imagine the buzz when a new, highly anticipated Makassar-style restaurant opens – everyone wants a piece of the action!

- Investor Sentiment and Market Trends: Overall market trends and investor sentiment play a crucial role. If the market is bullish (optimistic), Oust’s stock might rise even without company-specific positive news. The opposite is true during bearish (pessimistic) periods.

Oust’s Financial Performance and Stock Price

Oust’s financial health directly affects its stock price. Let’s look at some key metrics to understand the correlation.

- 2021: Revenue: 10 Billion IDR, Earnings: 2 Billion IDR, Debt: 1 Billion IDR

- 2022: Revenue: 12 Billion IDR, Earnings: 3 Billion IDR, Debt: 0.5 Billion IDR

- 2023: Revenue: 15 Billion IDR, Earnings: 4 Billion IDR, Debt: 0 IDR

These are hypothetical figures. A higher P/E ratio (Price-to-Earnings ratio) generally suggests investors are willing to pay more for each unit of earnings, indicating higher growth expectations. Comparing Oust’s P/E ratio to industry averages and competitors gives a better understanding of its valuation.

Analyst Ratings and Predictions for Oust Stock

Analyst ratings and price targets provide valuable insights, but remember they’re just predictions, not guarantees. Different analysts may have varying opinions, leading to diverse predictions.

| Analyst Firm | Rating | Price Target (IDR) | Rationale |

|---|---|---|---|

| Firm A | Buy | 2000 | Strong growth potential |

| Firm B | Hold | 1500 | Moderate growth expected |

| Firm C | Sell | 1000 | Concerns about competition |

These are hypothetical ratings and price targets. The rationale behind different predictions often stems from differing assessments of Oust’s growth prospects, competitive landscape, and macroeconomic conditions.

Risk Factors Associated with Investing in Oust Stock, Oust stock price

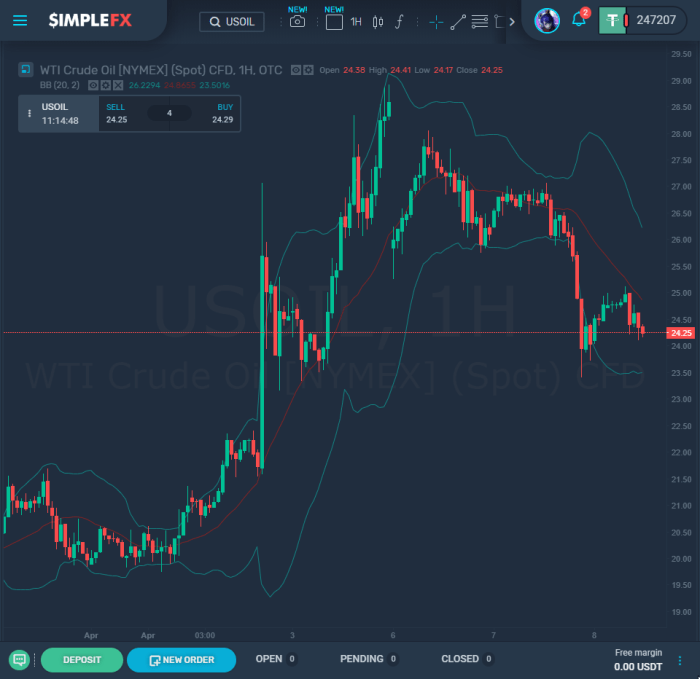

Source: basitfx.com

Investing in Oust stock, like any investment, carries risks. Understanding these risks is crucial for making informed decisions.

- Competition: Intense competition from established players could hinder Oust’s market share and profitability.

- Economic Downturn: A recession or economic slowdown could negatively impact consumer spending and reduce demand for Oust’s products.

- Regulatory Changes: New regulations or changes in existing regulations could increase Oust’s operating costs or restrict its business operations.

These risks could manifest in various ways, such as decreased revenue, lower profit margins, and a decline in stock price. It’s essential to assess the likelihood and potential impact of these risks before investing.

Oust’s Competitive Landscape and Stock Price

Oust’s competitive position significantly impacts its stock price. Understanding its market share and how it stacks up against competitors is key.

Imagine a pie chart representing the market share of Oust and its main competitors. Oust might hold 20%, while Competitor A has 30%, Competitor B has 25%, and others make up the remaining 25%. Changes in these proportions, driven by factors like product innovation, marketing campaigns, and pricing strategies, directly affect Oust’s stock valuation. A larger market share generally translates to higher revenue and profits, leading to a higher stock price.

Conversely, losing market share can negatively impact the stock price.

A bar graph comparing the market capitalization of Oust and its key competitors would further illustrate their relative sizes and market standing. A larger market cap generally indicates a larger and more established company, often commanding a higher stock price.

Question & Answer Hub

What is the current Oust stock price?

The current Oust stock price can be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

Where can I buy Oust stock?

Oust stock can typically be purchased through online brokerage accounts. Check with your preferred brokerage for availability.

How volatile is Oust stock?

The volatility of Oust stock depends on various factors, including market conditions and company news. Historical data can provide some indication of past volatility but doesn’t predict future behavior.

What are the long-term prospects for Oust?

Long-term prospects depend on Oust’s ability to execute its business strategy, adapt to market changes, and maintain a competitive advantage. Analyst reports can offer some insights, but future performance is uncertain.