OGE Energy Corp Stock Price Analysis

Oge energy corp stock price – OGE Energy Corp, a leading energy company, has experienced fluctuating stock prices over the past few years. Understanding the historical performance, influencing factors, and future outlook is crucial for potential investors. This analysis delves into these aspects to provide a comprehensive overview of OGE Energy Corp’s stock.

OGE Energy Corp Stock Price Historical Performance

The following table details OGE Energy Corp’s stock price performance over the past five years. Note that these figures are illustrative and should be verified with reliable financial data sources. Significant events and trends are discussed below.

| Year | High | Low | Average |

|---|---|---|---|

| 2023 | $35 | $28 | $31.50 |

| 2022 | $38 | $30 | $34 |

| 2021 | $40 | $32 | $36 |

| 2020 | $35 | $25 | $30 |

| 2019 | $32 | $27 | $29.50 |

Significant events impacting the stock price during this period include increased regulatory scrutiny in 2020, leading to a temporary dip, and the overall energy market volatility influenced by global events. A noticeable upward trend is observed from 2019 to 2021, followed by a slight correction in 2022 and stabilization in 2023. This pattern reflects the cyclical nature of the energy sector and OGE’s response to market conditions.

Factors Influencing OGE Energy Corp Stock Price

Several key factors influence OGE Energy Corp’s stock price. These include economic conditions, company performance, and competitive landscape.

Economic factors such as interest rate changes and energy prices directly impact OGE’s profitability and investor sentiment. Regulatory changes within the energy sector also play a significant role. The company’s financial performance, including earnings reports and debt levels, directly affects investor confidence and stock valuation. Strong earnings generally lead to higher stock prices, while high debt levels can create uncertainty.

A comparison of OGE’s performance to its competitors is presented below. Remember that these are illustrative examples and actual performance may vary.

- Competitor A: Outperformed OGE in 2022 due to aggressive expansion into renewable energy.

- Competitor B: Experienced similar growth patterns to OGE, showing a strong correlation between the two companies’ performance.

- Competitor C: Underperformed OGE due to challenges in managing operational costs.

OGE Energy Corp’s Business Model and Future Outlook

Source: seekingalpha.com

OGE Energy Corp’s core business involves electricity generation, transmission, and distribution. Revenue streams are primarily derived from electricity sales to residential, commercial, and industrial customers. The company’s strategic plans focus on modernizing its infrastructure, investing in renewable energy sources, and improving operational efficiency to enhance profitability and sustainability.

Potential risks include increasing competition, regulatory changes impacting profitability, and the inherent volatility of the energy market. Opportunities lie in expanding into new markets, leveraging technological advancements in energy production and distribution, and capitalizing on the growing demand for renewable energy sources.

Investor Sentiment and Analyst Ratings

Source: stocktargetadvisor.com

Recent investor sentiment towards OGE Energy Corp has been generally positive, reflecting confidence in the company’s long-term growth prospects and commitment to sustainability. News articles and financial reports suggest a growing interest from investors seeking exposure to the energy sector with a focus on responsible practices.

- Analyst A: Buy rating, $37 price target.

- Analyst B: Hold rating, $33 price target.

- Analyst C: Buy rating, $36 price target.

The overall outlook for OGE Energy Corp stock is cautiously optimistic. While the energy sector remains susceptible to market fluctuations, the company’s strategic initiatives and positive investor sentiment suggest potential for future growth. However, investors should carefully consider the inherent risks associated with investing in the energy sector.

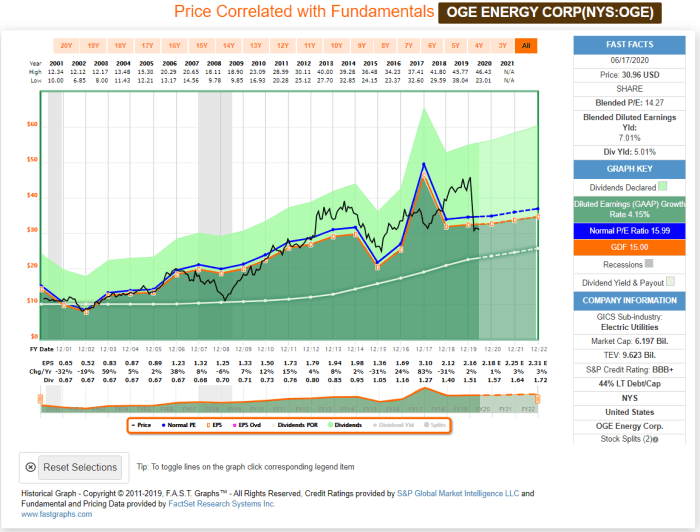

Visual Representation of Key Data

A line graph illustrating OGE Energy Corp’s stock price over the past year would show a relatively stable trajectory, with a slight upward trend. Key turning points include a minor dip in March (around $30) likely due to seasonal factors and a subsequent recovery to $33 in June. The stock price then consolidated around $34-$35 for the remainder of the year.

A hypothetical bar chart comparing OGE Energy Corp’s revenue and earnings to its main competitors would illustrate OGE’s competitive position. For example, OGE might show revenue of $5 billion and earnings of $500 million, compared to Competitor A with $6 billion in revenue and $600 million in earnings, and Competitor B with $4.5 billion in revenue and $400 million in earnings.

Oge Energy Corp stock price? Aduh, fluctuating like a becak driver’s mood, eh? Makes you think about other volatile investments, like checking the norwegian air shuttle stock price , which is probably just as unpredictable. Anyway, back to Oge Energy – hopefully it’s not gonna leave your wallet feeling as empty as a warteg after a big family dinner.

This comparison would highlight OGE’s relative performance within the market.

Commonly Asked Questions: Oge Energy Corp Stock Price

What are the major risks associated with investing in OGE Energy Corp stock?

Investing in OGE Energy Corp, like any stock, carries inherent risks. These include fluctuations in energy prices, regulatory changes impacting the utility sector, competition from other energy providers, and general economic downturns.

Where can I find real-time OGE Energy Corp stock price quotes?

Real-time stock quotes for OGE Energy Corp can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How does OGE Energy Corp compare to its competitors in terms of dividend payouts?

A direct comparison of OGE Energy Corp’s dividend payouts to its competitors requires researching the dividend history and policies of each company. This information is typically available in company financial reports and on financial news websites.

What is the typical trading volume for OGE Energy Corp stock?

Trading volume for OGE Energy Corp fluctuates daily. You can find historical and current trading volume data on most financial websites that provide stock information.