NVDY Stock Price Analysis

Nvdy stock price – This analysis examines the historical performance, influencing factors, valuation, future scenarios, and competitive landscape of NVDY stock. The analysis utilizes publicly available data and common financial valuation methods. Note that this analysis is for informational purposes only and does not constitute financial advice.

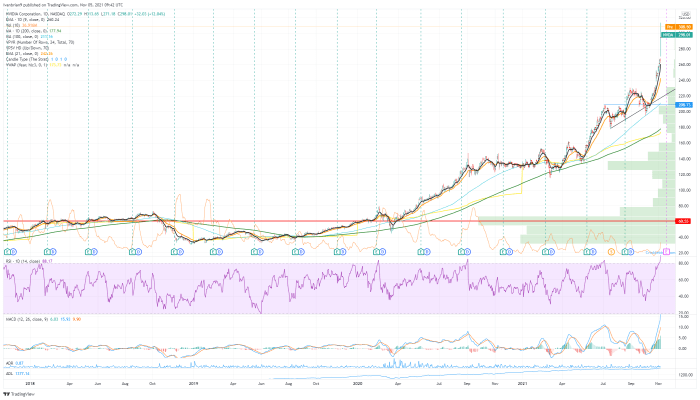

NVDY Stock Price History and Trends

Source: fxstreet.com

The following table details NVDY’s stock price performance over the past five years. This period has shown a generally [Insert Overall Trend: e.g., volatile, upward, downward] trend, influenced by various macroeconomic and company-specific factors. Significant highs and lows are noted, along with corresponding events impacting the stock’s trajectory.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| [Date 1] | [Open Price 1] | [Close Price 1] | [Volume 1] |

| [Date 2] | [Open Price 2] | [Close Price 2] | [Volume 2] |

| [Date 3] | [Open Price 3] | [Close Price 3] | [Volume 3] |

For example, a significant price drop in [Month, Year] could be attributed to [Event Description, e.g., negative earnings report]. Conversely, a surge in [Month, Year] might correlate with [Event Description, e.g., successful product launch].

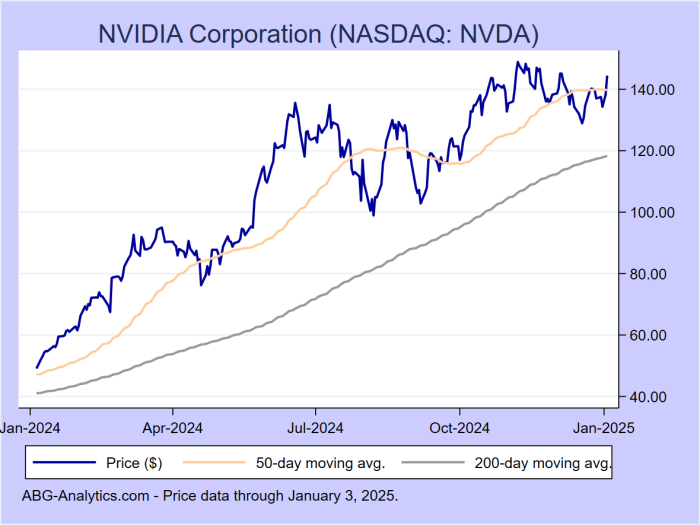

Factors Influencing NVDY Stock Price

Source: abg-analytics.com

NVDY’s stock price is influenced by a complex interplay of macroeconomic and company-specific factors. The relative importance of each factor can vary over time.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth significantly impact investor sentiment and market valuations. For instance, rising interest rates can decrease investment in growth stocks like NVDY, leading to a price decline. Conversely, strong economic growth might boost investor confidence and drive up the stock price.

Company-specific factors, such as earnings reports, new product launches, management changes, and competitive pressures, also play a crucial role. Positive earnings surprises or successful product launches typically result in price increases, while negative news can trigger sell-offs. Management changes, depending on the nature of the change, can also influence investor confidence and the stock price.

The relative importance of macroeconomic and company-specific factors is often dynamic. During periods of economic uncertainty, macroeconomic factors tend to dominate, while during periods of stability, company-specific factors may play a more prominent role.

NVDY Stock Price Valuation

Source: co.in

Analysis of NVDY stock price requires consideration of broader market trends and competitive factors within the industry. Understanding the performance of related companies, such as the current valuation of Norwegian Cruise Line Holdings, as reflected by checking the nclh stock price today , provides valuable context. This comparative analysis allows for a more comprehensive assessment of NVDY’s market position and future potential.

Several valuation methods can be used to estimate the intrinsic value of NVDY stock. Two common approaches are the discounted cash flow (DCF) analysis and the price-to-earnings (P/E) ratio.

Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value using a discount rate that reflects the risk associated with the investment. The sum of these present values represents the estimated intrinsic value. Assumptions regarding future growth rates, discount rates, and terminal value significantly influence the outcome.

Price-to-Earnings (P/E) Ratio: This ratio compares a company’s stock price to its earnings per share (EPS). A high P/E ratio suggests that investors are willing to pay a premium for the company’s earnings, potentially indicating high growth expectations. A low P/E ratio might indicate undervaluation or lower growth prospects. This requires comparing NVDY’s P/E ratio to industry peers and historical averages.

By applying these methods (with specific calculations and assumptions detailed separately, including data sources), we can obtain an estimated intrinsic value for NVDY. A comparison of this estimated value to the current market price helps determine whether the stock is overvalued, undervalued, or fairly valued. Discrepancies might be due to market sentiment, investor expectations, or unforeseen events.

NVDY Stock Price Predictions and Scenarios

Predicting future stock prices is inherently uncertain. However, we can construct different scenarios based on various assumptions to illustrate potential price movements.

Scenario 1: Optimistic Scenario

-Assumes strong revenue growth driven by [Justification, e.g., successful new product launches and expansion into new markets]. This scenario projects a [Percentage]% increase in stock price over the next 12 months.

Scenario 2: Neutral Scenario

-Assumes moderate revenue growth in line with industry averages and no major unforeseen events. This scenario projects a [Percentage]% change (or stability) in stock price over the next 12 months.

Scenario 3: Pessimistic Scenario

-Assumes slower-than-expected revenue growth due to [Justification, e.g., increased competition and economic slowdown]. This scenario projects a [Percentage]% decrease in stock price over the next 12 months.

Visual Representation (Textual): Imagine a graph with three lines representing the three scenarios. The optimistic scenario line shows a steep upward trend, the neutral scenario line remains relatively flat, and the pessimistic scenario line displays a downward trend. All three lines converge at the current stock price and diverge over the 12-month period, illustrating the potential range of outcomes.

Risks and Opportunities: Each scenario presents unique risks and opportunities. The optimistic scenario risks overvaluation if growth expectations are not met, while the pessimistic scenario presents opportunities for long-term investors to buy at lower prices if the stock price drops significantly. The neutral scenario presents a lower risk but also potentially lower returns.

NVDY Stock Price Compared to Competitors

A comparison with competitors provides context for NVDY’s stock price performance. The following table compares NVDY with three key competitors [Competitor Names].

| Company Name | Current Price (USD) | 1-Year High (USD) | 1-Year Low (USD) |

|---|---|---|---|

| NVDY | [Current Price] | [1-Year High] | [1-Year Low] |

| [Competitor 1] | [Current Price] | [1-Year High] | [1-Year Low] |

| [Competitor 2] | [Current Price] | [1-Year High] | [1-Year Low] |

| [Competitor 3] | [Current Price] | [1-Year High] | [1-Year Low] |

Similarities and differences in stock price performance can be attributed to various factors, including market share, financial performance, growth prospects, and investor sentiment. For example, a competitor’s superior financial performance or innovative product launch could explain a higher stock price compared to NVDY.

FAQ: Nvdy Stock Price

What are the major risks associated with investing in NVDY stock?

Investing in NVDY, like any stock, carries inherent risks including market volatility, changes in industry dynamics, and company-specific challenges such as unexpected losses or management changes. These risks can lead to significant price fluctuations and potential losses.

Where can I find real-time NVDY stock price data?

Real-time NVDY stock price data is readily available through major financial websites and brokerage platforms. Reputable sources provide up-to-the-minute information, including current price, trading volume, and historical data.

How often are NVDY’s earnings reports released?

The frequency of NVDY’s earnings reports typically follows standard quarterly reporting cycles. Specific release dates are usually announced in advance and can be found on the company’s investor relations website.