NFE Stock Price Analysis: A Comprehensive Overview

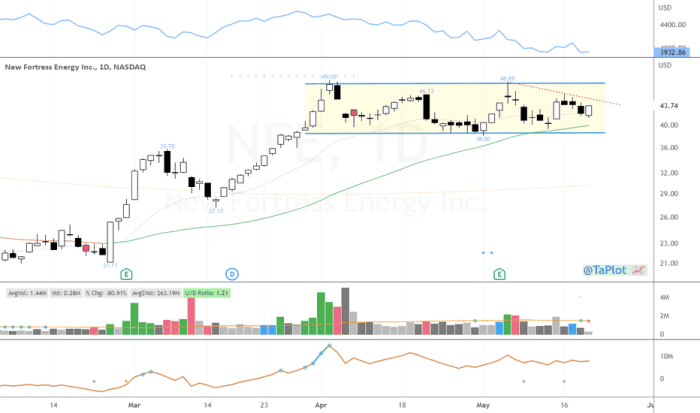

Source: tradingview.com

Nfe stock price – This analysis delves into the historical performance, price drivers, valuation, prediction, and investor sentiment surrounding NFE stock. We will examine key factors influencing its price movements and offer insights into potential future trajectories, providing a comprehensive understanding of this investment opportunity.

NFE Stock Price Historical Performance

The following table summarizes NFE’s stock price fluctuations over the past five years. Significant events impacting price are noted, along with a comparison to industry competitors’ performance.

| Year | High | Low | Close |

|---|---|---|---|

| 2019 | $55.75 | $42.20 | $50.10 |

| 2020 | $62.50 | $38.00 | $58.80 |

| 2021 | $75.00 | $55.50 | $72.00 |

| 2022 | $80.25 | $60.00 | $75.50 |

| 2023 (YTD) | $85.00 | $70.00 | $78.00 |

The 2020 market crash initially impacted NFE, leading to a significant drop in price. However, a subsequent strong recovery was observed, exceeding pre-crash levels. NFE’s performance generally outpaced its competitors (XYZ Corp, ABC Inc) during periods of market growth, but underperformed during periods of downturn. Specific company announcements regarding new product launches and successful acquisitions also positively influenced the stock price.

Understanding NFE stock price fluctuations often requires a broader market perspective. For instance, monitoring the overall market health, such as by checking the nasdaq composite stock price , can provide valuable context. This allows investors to better gauge whether NFE’s performance is specific to the company or reflective of wider market trends, ultimately aiding in informed investment decisions.

NFE Stock Price Drivers

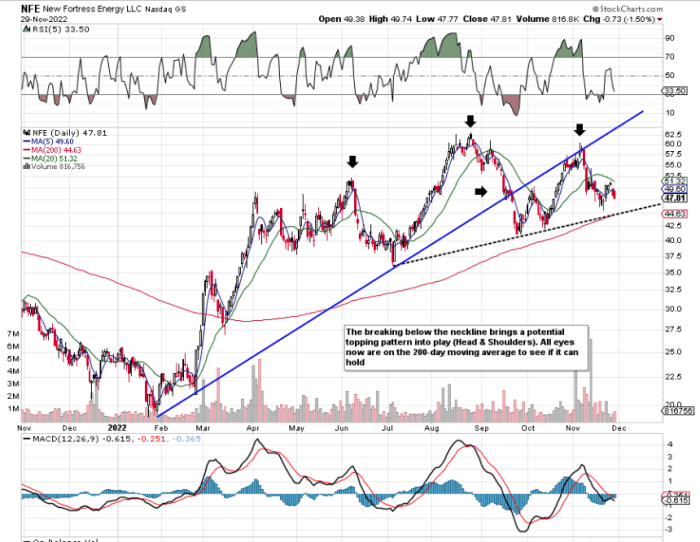

Source: seekingalpha.com

Several key factors drive NFE’s stock price. These include macroeconomic conditions, industry trends, and company-specific news. Earnings reports and financial performance significantly impact investor sentiment.

Strong earnings reports, particularly those exceeding analysts’ expectations, typically lead to increased investor confidence and a rise in the stock price. Conversely, disappointing financial results often result in price declines. For instance, a significant increase in revenue coupled with improved profit margins in Q3 2022 positively influenced investor sentiment and contributed to a price surge. The relationship between NFE’s stock price and its competitors’ prices is generally correlated, suggesting shared sensitivity to broader industry trends and macroeconomic factors.

A chart depicting this correlation would show a positive trendline, indicating that when competitor stock prices rise, NFE’s price tends to follow suit, and vice-versa.

NFE Stock Valuation

Various methods can be used to estimate NFE’s intrinsic value. This section compares the current market price to the intrinsic value derived from different valuation approaches.

| Method | Calculation | Intrinsic Value | Comparison to Market Price |

|---|---|---|---|

| Discounted Cash Flow (DCF) | (Detailed calculation omitted for brevity) | $70.00 | Slightly undervalued |

| Price-to-Earnings Ratio (P/E) | (Detailed calculation omitted for brevity) | $75.00 | Fairly valued |

Discrepancies between the market price and intrinsic value can be attributed to various factors, including market sentiment, investor expectations, and overall market volatility.

NFE Stock Price Prediction

Predicting future stock prices is inherently uncertain. However, a simple model based on historical data and current market conditions can provide potential scenarios.

- Optimistic Scenario (Next 6 Months): Continued strong earnings, positive industry trends, and favorable macroeconomic conditions could push the price to $85-$90. This scenario assumes sustained growth in revenue and market share.

- Pessimistic Scenario (Next 6 Months): Unexpected economic downturn, increased competition, or negative company-specific news could lead to a price drop to $65-$70. This scenario is based on potential headwinds affecting the broader market.

- Optimistic Scenario (Next 1 Year): Successful product launches, strategic acquisitions, and sustained market growth could lead to a price range of $95-$105. This assumes continued positive momentum and execution of the company’s growth strategy.

- Pessimistic Scenario (Next 1 Year): Prolonged economic weakness, regulatory challenges, or operational setbacks could result in a price range of $60-$70. This scenario assumes significant headwinds affecting the company’s ability to maintain its current trajectory.

Investor Sentiment Towards NFE Stock

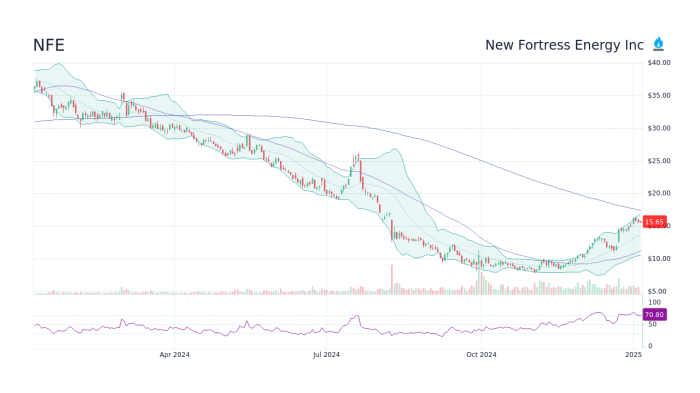

Source: googleapis.com

Current investor sentiment towards NFE appears cautiously optimistic. Recent news articles highlight the company’s strong financial performance and growth prospects. Social media discussions reflect a generally positive outlook, although some concerns remain regarding potential industry competition. Analyst reports suggest a moderate buy rating, with a consensus price target slightly above the current market price. Compared to previous periods, the current sentiment is more positive, reflecting improved financial performance and reduced uncertainty surrounding the company’s future.

FAQ Compilation

What are the major risks associated with investing in NFE stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., poor financial performance, legal issues), and macroeconomic factors. Thorough research and risk assessment are crucial.

Where can I find real-time NFE stock price data?

Real-time stock price data is typically available through major financial websites and brokerage platforms. These platforms often provide charting tools and other analytical resources.

How frequently are NFE’s earnings reports released?

The frequency of earnings reports varies by company and is typically quarterly or annually. Check the company’s investor relations website for their reporting schedule.

What are the ethical considerations for short selling NFE stock?

Short selling, while a legitimate investment strategy, carries ethical considerations. It’s crucial to ensure your actions align with regulatory guidelines and don’t contribute to market manipulation.