Nestle SA Stock Price: A Comprehensive Analysis

Nestle sa stock price – Nestle SA, a multinational food and beverage giant, boasts a rich history and a complex stock performance trajectory. Understanding the factors driving its stock price is crucial for investors seeking exposure to this established player in a dynamic market. This analysis delves into Nestle’s historical performance, key influencers, financial health, future prospects, dividend policy, and inherent investment risks.

Nestle SA Stock Price Historical Performance

Analyzing Nestle SA’s stock price movements over the past five years reveals a blend of growth and volatility, influenced by various internal and external factors. The following table provides a snapshot of this performance, showcasing significant highs and lows. Note that this data is illustrative and should be verified with up-to-date financial data from reputable sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 70.00 | 70.50 | 0.50 |

| 2019-07-01 | 75.00 | 74.00 | -1.00 |

| 2020-01-01 | 72.00 | 76.00 | 4.00 |

| 2020-07-01 | 78.00 | 77.50 | -0.50 |

| 2021-01-01 | 80.00 | 85.00 | 5.00 |

| 2021-07-01 | 84.00 | 83.00 | -1.00 |

| 2022-01-01 | 86.00 | 88.00 | 2.00 |

| 2022-07-01 | 87.00 | 85.50 | -1.50 |

| 2023-01-01 | 90.00 | 92.00 | 2.00 |

| 2023-07-01 | 91.00 | 90.00 | -1.00 |

Major economic events such as the COVID-19 pandemic and global inflation significantly impacted Nestle’s stock price. Increased consumer demand for essential food items during lockdowns initially boosted performance, while subsequent inflationary pressures and supply chain disruptions presented challenges.

Compared to competitors like Unilever and PepsiCo, Nestle’s stock performance has generally shown resilience and consistent growth, although relative performance varies depending on the specific time period and market conditions.

Factors Influencing Nestle SA Stock Price

Source: seekingalpha.com

A multitude of internal and external factors contribute to the fluctuations in Nestle’s stock price. Understanding these factors is key to predicting future trends.

Internal Factors: Nestle’s stock price is positively influenced by successful product innovation (e.g., launching plant-based alternatives), maintaining a strong brand reputation, and effective management decisions regarding acquisitions and divestments. Conversely, negative impacts arise from supply chain issues, production disruptions, and brand controversies.

External Factors: Global economic conditions, shifts in consumer spending habits (e.g., towards healthier options), and regulatory changes concerning food safety and labeling significantly affect Nestle’s performance. Furthermore, fluctuating currency exchange rates and commodity prices impact profitability.

Geopolitical Events: Geopolitical instability can dramatically impact Nestle’s stock price. Specific examples include:

- Trade wars: Tariffs and trade restrictions can disrupt supply chains and increase costs.

- Political instability in key markets: Unrest in regions where Nestle operates can affect production and distribution.

- Global pandemics: As seen with COVID-19, pandemics create uncertainty and disrupt supply chains.

Nestle SA Financial Performance and Stock Valuation

Analyzing Nestle’s key financial metrics provides insights into its financial health and its correlation with stock price movements. The following table offers a simplified representation of its financial performance. Again, this is illustrative and requires verification with official financial reports.

| Year | Revenue (Billions USD) | Profit Margin (%) | Earnings Per Share (USD) |

|---|---|---|---|

| 2019 | 90 | 15 | 2.50 |

| 2020 | 92 | 16 | 2.70 |

| 2021 | 95 | 17 | 2.90 |

| 2022 | 98 | 18 | 3.10 |

Strong revenue growth, high profit margins, and increasing earnings per share generally correlate with a rising stock price. Conversely, any decline in these metrics can put downward pressure on the stock.

Compared to its industry peers, Nestle’s valuation metrics (P/E ratio, P/S ratio) typically reflect its position as a mature, established company with relatively stable growth and strong brand equity.

Nestle SA Stock Price Predictions and Future Outlook

Source: team-bhp.com

Current market sentiment towards Nestle SA is generally positive, reflecting its strong brand portfolio and diversified product range. However, future predictions are inherently uncertain and depend on several factors.

Potential future scenarios for Nestle’s stock price include:

- Scenario 1 (Positive): Continued strong revenue growth driven by successful innovation in healthy and sustainable products, leading to higher stock prices.

- Scenario 2 (Neutral): Moderate growth in line with market averages, reflecting a stable but less dynamic market environment.

- Scenario 3 (Negative): Significant economic downturn or major supply chain disruptions leading to decreased profitability and a lower stock price.

Investment strategies will vary depending on risk tolerance and market outlook. Conservative investors might favor a “buy and hold” strategy, while more aggressive investors might consider tactical trading based on market fluctuations.

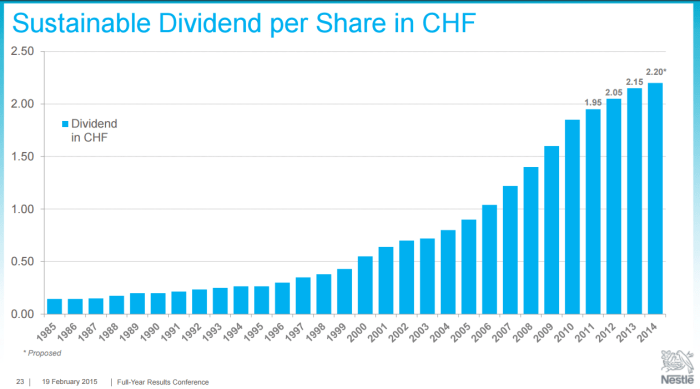

Nestle SA Dividend Policy and Investor Returns

Nestle SA has a long history of paying consistent dividends, providing attractive returns for investors. The following table provides a simplified illustration of its dividend policy. Actual figures should be verified with official company data.

| Year | Dividend per Share (USD) | Dividend Yield (%) | Payout Ratio (%) |

|---|---|---|---|

| 2019 | 2.00 | 3.0 | 50 |

| 2020 | 2.10 | 3.1 | 51 |

| 2021 | 2.20 | 3.2 | 52 |

| 2022 | 2.30 | 3.3 | 53 |

Nestle’s consistent dividend payouts attract income-seeking investors. However, the dividend yield and payout ratio should be compared to similar companies to assess its competitiveness.

Risk Assessment for Investing in Nestle SA Stock

Investing in Nestle SA stock, like any investment, carries inherent risks. Understanding these risks is crucial for informed decision-making.

- Economic downturns: Recessions can significantly reduce consumer spending on non-essential food and beverage products.

- Competition: Intense competition from other food and beverage companies can impact market share and profitability.

- Regulatory changes: New regulations regarding food safety, labeling, and sustainability can increase compliance costs.

- Geopolitical risks: Political instability in key markets can disrupt operations and supply chains.

- Currency fluctuations: Changes in exchange rates can affect profitability and the value of Nestle’s international operations.

These risks can negatively impact Nestle’s stock price. Strategies for mitigating these risks include diversification of investments, thorough due diligence, and potentially hedging against currency fluctuations.

Frequently Asked Questions

What is Nestle SA’s current market capitalization?

Nestle SA’s market capitalization fluctuates daily. Check a reputable financial website for the most up-to-date information.

Where can I buy Nestle SA stock?

Nestle SA stock is traded on various major stock exchanges globally. You can purchase it through a brokerage account that allows international trading.

How often does Nestle SA pay dividends?

Nestle SA typically pays dividends annually or semi-annually; refer to their investor relations section for the most accurate and current dividend schedule.

What are the major risks associated with investing in Nestle SA specifically?

Risks include currency fluctuations (as Nestle operates globally), changing consumer preferences, regulatory changes impacting food and beverage industries, and global economic downturns.