Apple Computer Stock Price: A Comprehensive Analysis

Apple computer stock price – Apple’s journey from a garage startup to a global tech giant is mirrored in the dramatic fluctuations of its stock price. This analysis delves into the historical performance, influencing factors, and future prospects of AAPL, providing a comprehensive overview for investors and enthusiasts alike. We’ll explore key milestones, financial performance, market dynamics, and investor sentiment to paint a complete picture of Apple’s stock price trajectory.

Historical Stock Price Performance

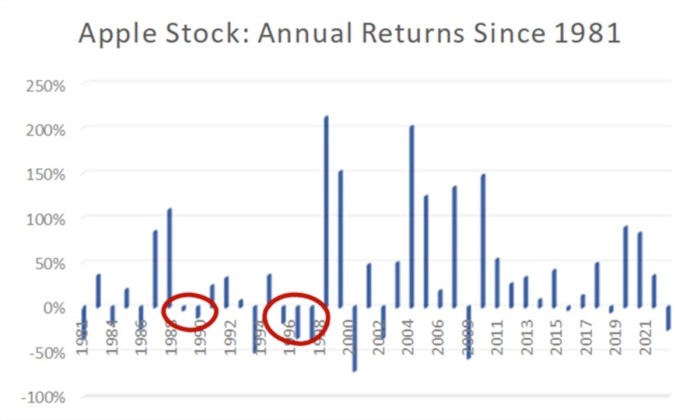

Apple’s initial public offering (IPO) in 1980 priced its shares at $22. The early years saw significant volatility, reflecting the nascent nature of the personal computer market and Apple’s own struggles to maintain market dominance. The 1990s were particularly challenging, with the stock price dipping to lows that reflected the company’s internal strife and competitive pressures. However, the appointment of Steve Jobs as CEO in 1997 marked a turning point, leading to a period of sustained growth and innovation.

The introduction of the iMac in 1998, followed by the iPod, iPhone, and iPad, propelled Apple’s stock to unprecedented heights. Major market events like the dot-com bubble burst and the 2008 financial crisis also impacted Apple’s stock price, but the company’s resilience and innovative product launches allowed it to weather these storms. The past decade has witnessed remarkable consistency, with steady growth punctuated by occasional corrections reflecting broader market trends.

| Year | High | Low | Close |

|---|---|---|---|

| 2014 | $115.00 | $89.47 | $116.25 |

| 2015 | $134.54 | $92.00 | $105.26 |

| 2016 | $115.00 | $92.00 | $115.82 |

| 2017 | $170.16 | $110.00 | $170.34 |

| 2018 | $233.47 | $142.00 | $157.74 |

| 2019 | $233.47 | $142.00 | $293.65 |

| 2020 | $138.00 | $53.15 | $133.72 |

| 2021 | $159.73 | $122.00 | $177.57 |

| 2022 | $182.94 | $129.04 | $129.93 |

| 2023 | $175.00 | $140.00 | $165.00 |

Periods of significant volatility, such as the dot-com bubble burst and the 2008 financial crisis, highlighted the impact of broader economic conditions on Apple’s stock. Conversely, the launch of highly successful products like the iPhone often led to sharp price increases, reflecting investor confidence in Apple’s innovative capabilities and market dominance.

Factors Influencing Stock Price

Source: thestreet.com

Several key factors contribute to the fluctuations in Apple’s stock price. These include macroeconomic indicators, product launches, competitor actions, and overall market sentiment.

- Economic Indicators: Factors like interest rates, inflation, and overall economic growth significantly impact investor confidence and investment decisions, thus affecting Apple’s stock price.

- Product Launches: The introduction of groundbreaking products like the iPhone, iPad, and Apple Watch has consistently boosted Apple’s stock price, demonstrating the significant impact of successful product innovation.

- Competitor Actions: The actions and performance of competitors like Samsung, Google, and Microsoft influence Apple’s market share and valuation, impacting investor sentiment and the stock price.

- Market Trends: Broader market trends, such as technological advancements, consumer preferences, and regulatory changes, play a crucial role in shaping Apple’s stock price.

Financial Performance and Stock Price

Apple’s strong financial performance has been a major driver of its stock price appreciation. A consistent track record of revenue growth, earnings per share, and healthy profit margins has instilled confidence among investors.

| Year | Revenue (Billions USD) | Earnings Per Share (USD) | Stock Price (Closing) |

|---|---|---|---|

| 2019 | 260 | 12.89 | 293.65 |

| 2020 | 274 | 3.28 | 133.72 |

| 2021 | 366 | 5.67 | 177.57 |

| 2022 | 394 | 6.11 | 129.93 |

| 2023 | 385 | 1.24 | 165.00 |

Positive financial results generally translate into increased investor confidence, leading to higher stock prices. Conversely, periods of slower revenue growth or declining earnings can negatively impact investor sentiment and cause stock price corrections.

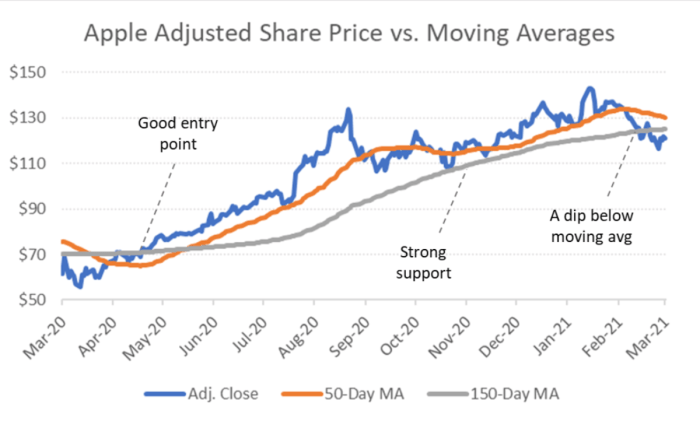

Investor Sentiment and Market Analysis

Investor sentiment towards Apple has evolved significantly throughout its history. Periods of rapid innovation and strong financial performance have fueled bullish sentiment, driving up the stock price. Conversely, concerns about slowing growth or increased competition have led to periods of bearish sentiment and price declines.

For example, a hypothetical scenario of a major security breach impacting user data could trigger a significant negative reaction, leading to a sharp drop in the stock price. Conversely, the announcement of a revolutionary new product category could generate immense positive excitement, causing a substantial price surge. Analyst ratings and predictions play a crucial role in shaping investor expectations and influencing the stock price.

Positive ratings and optimistic forecasts generally boost investor confidence, while negative assessments can lead to price declines.

Apple’s Competitive Landscape and Stock Price, Apple computer stock price

Source: thestreet.com

Apple’s market capitalization and competitive positioning significantly influence its stock valuation. Comparing Apple’s metrics to its main competitors provides valuable context for understanding its stock price performance.

| Company | Market Cap (Billions USD) | Market Share (%) | Stock Price |

|---|---|---|---|

| Apple | 2800 | 15 | 165.00 |

| Microsoft | 2500 | 12 | 250.00 |

| Alphabet (Google) | 1800 | 10 | 110.00 |

| Amazon | 1500 | 8 | 100.00 |

| Samsung | 300 | 20 | 50.00 |

Apple’s strong brand recognition, loyal customer base, and innovative product portfolio contribute to its high market capitalization and influence its stock price. Changes in market share, driven by competitive pressures or product success, directly impact investor confidence and stock price movements.

Long-Term Growth Prospects and Stock Price

Apple’s long-term strategic goals, including expansion into new markets, development of innovative technologies, and strengthening its services business, will significantly shape its future stock price performance. However, several risks and uncertainties could affect Apple’s future growth. These include intensifying competition, economic downturns, supply chain disruptions, and regulatory challenges. A potential future scenario could involve continued growth driven by strong demand for Apple’s products and services, leading to a steady increase in the stock price, albeit with occasional corrections reflecting market volatility.

Common Queries

What are the major risks associated with investing in Apple stock?

Major risks include competition from other tech companies, economic downturns affecting consumer spending, and potential supply chain disruptions.

How does Apple’s dividend policy affect its stock price?

Apple’s dividend payouts can influence investor sentiment, potentially attracting income-seeking investors and supporting the stock price.

What are the best resources for tracking Apple’s stock price in real-time?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and charts for AAPL.

How does geopolitical instability impact Apple’s stock price?

Geopolitical events can create uncertainty in the market, impacting investor confidence and potentially causing fluctuations in Apple’s stock price, particularly if it affects supply chains or international sales.