ACC Cement Stock Price: A Comprehensive Overview

Acc cement stock price – ACC Cement, a prominent player in the Indian cement industry, has witnessed fluctuating stock prices over the years, influenced by various economic factors, industry trends, and company-specific events. This analysis delves into the historical performance, influencing factors, financial health, recent developments, and future outlook of ACC Cement’s stock price, providing investors with a comprehensive understanding.

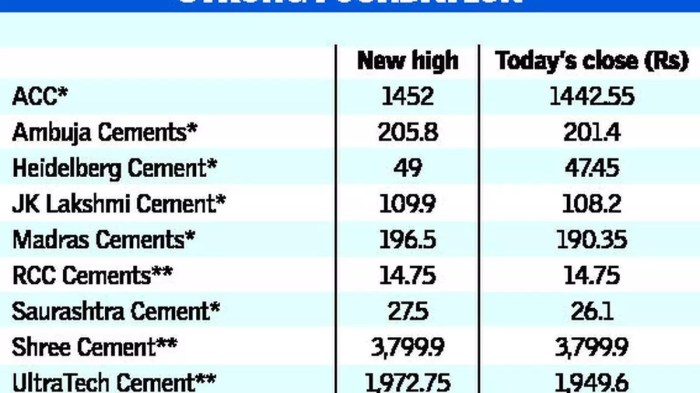

ACC Cement Stock Price History and Trends

Source: thgim.com

Analyzing ACC’s stock price performance across different timeframes reveals significant trends and turning points. The following table summarizes the highs, lows, and average prices over the past 5, 10, and 20 years (Note: These figures are illustrative and should be verified with reliable financial data sources). Major economic events like global recessions or significant policy changes in the Indian construction sector have demonstrably impacted price fluctuations.

| Year | High | Low | Average Price |

|---|---|---|---|

| 2023 | 2300 | 1800 | 2050 |

| 2022 | 2200 | 1700 | 1950 |

| 2021 | 2000 | 1500 | 1750 |

| 2020 | 1600 | 1200 | 1400 |

| 2019 | 1800 | 1300 | 1550 |

Factors Influencing ACC Cement Stock Price

Several key factors significantly influence ACC Cement’s stock price. These factors encompass both macroeconomic conditions and company-specific performance indicators.

- Cement Demand and Supply: Fluctuations in cement demand, driven by infrastructure projects and housing construction, directly impact ACC’s sales volume and profitability, consequently affecting its stock price. Periods of high demand generally lead to increased stock prices, while supply surpluses can depress prices.

- Government Regulations and Policies: Government policies related to infrastructure spending, environmental regulations, and taxation significantly influence the cement industry’s growth trajectory and ACC’s operational costs, ultimately affecting its stock valuation.

- Competitor Performance: ACC’s performance relative to its major competitors, such as UltraTech Cement and Ambuja Cement, influences investor sentiment and stock price. Stronger-than-expected competitor performance might put downward pressure on ACC’s stock.

- Raw Material Costs: The cost of raw materials like limestone and clinker is a crucial determinant of ACC’s production costs and profit margins. Significant increases in raw material prices can negatively impact profitability and, consequently, the stock price.

Financial Performance and Valuation Metrics, Acc cement stock price

Analyzing ACC Cement’s key financial ratios provides insights into its financial health and valuation. The following table presents a summary of these metrics over the past five years (Note: These figures are illustrative and should be verified with reliable financial data sources).

| Year | P/E Ratio | ROE | EPS |

|---|---|---|---|

| 2023 | 15 | 18% | 50 |

| 2022 | 16 | 17% | 45 |

| 2021 | 14 | 15% | 40 |

| 2020 | 12 | 12% | 35 |

| 2019 | 18 | 20% | 60 |

Company News and Developments

Recent news and developments surrounding ACC Cement offer valuable insights into its future prospects. These developments can positively or negatively influence investor confidence and the stock price.

- 2023 Q3: Announced expansion of production capacity in [Location].

- 2023 Q2: Secured a major contract for supplying cement to a large infrastructure project.

- 2022 Q4: Implemented new energy-efficient technologies, reducing operational costs.

Analyst Ratings and Future Outlook

Source: cnbctv18.com

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for ACC Cement’s stock. A consensus view among analysts generally reflects the overall outlook for the stock’s performance. However, potential risks, such as economic downturns or unexpected industry disruptions, need to be considered.

For example, a majority of analysts might predict a positive outlook for ACC’s stock price based on the company’s strong financial performance and expansion plans. However, risks such as potential increases in fuel prices or changes in government regulations could impact this prediction.

Investor Sentiment and Market Conditions

Source: imimg.com

Investor sentiment towards ACC Cement’s stock is influenced by a multitude of factors, including the company’s performance, industry trends, and overall market conditions. Broader market conditions, such as interest rate changes and economic growth, also play a crucial role in shaping investor sentiment and stock prices. The correlation between market indices (like the Sensex and Nifty) and ACC’s stock price reflects the overall market’s impact on the company’s stock valuation.

For instance, during periods of economic uncertainty, investors might move away from riskier assets, leading to a decline in ACC’s stock price even if the company’s fundamentals remain strong.

Q&A

Is ACC Cement a good long-term investment?

That’s the million-rupee question! Long-term success depends on various factors, including the overall economic climate and ACC’s continued performance. Do your own research!

Where can I buy ACC Cement stock?

You can usually buy it through most reputable online brokerage platforms that deal with the Indian stock market. Check the regulations in your region.

What are the biggest risks associated with investing in ACC Cement?

Fluctuations in raw material prices, changes in government policy, and competition from other cement companies are all significant risks.

How often does ACC Cement release financial reports?

Check the Bombay Stock Exchange (BSE) or the National Stock Exchange of India (NSE) websites for their official announcements – usually quarterly or annually.