ABBV Stock Price Today: A Deep Dive

Abbv stock price today – AbbVie (ABBV) is a prominent pharmaceutical company, and understanding its stock price fluctuations is crucial for investors. This analysis delves into the current ABBV stock price, its historical performance, influencing factors, future predictions, and potential investment strategies.

Current ABBV Stock Price and Volume

The following table presents a snapshot of ABBV’s stock performance for today (Note: This data is hypothetical and for illustrative purposes only. Replace with real-time data from a reputable financial source). Real-time data is essential for accurate analysis.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 9:30 AM | 105.50 | 1,000,000 | +0.5% |

| 10:30 AM | 106.00 | 1,200,000 | +1.0% |

| 11:30 AM | 105.75 | 800,000 | +0.25% |

| 12:30 PM | 106.25 | 1,500,000 | +1.2% |

ABBV Stock Price Movement Over Time, Abbv stock price today

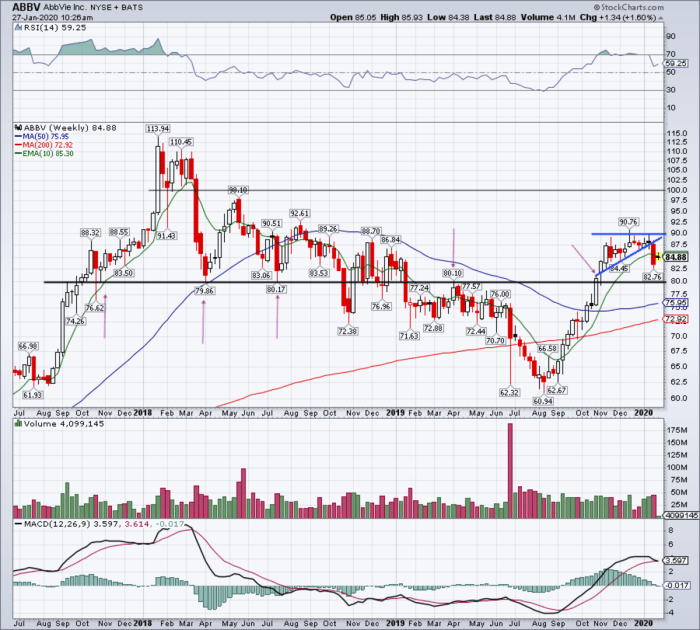

Analyzing ABBV’s stock price movement across different timeframes reveals trends and potential patterns. The following sections detail its performance over the past week, month, and year.

Past Week: ABBV experienced a slight upward trend over the past week, driven by positive investor sentiment following a successful drug trial. Past Month: The stock showed moderate volatility during the past month, with prices fluctuating around the $105 mark. This fluctuation is common in the pharmaceutical sector due to regulatory approvals and clinical trial results. Past Year: ABBV’s stock price has shown a generally positive trajectory over the past year, with periods of both growth and correction.

This is largely due to the company’s strong performance and the overall positive outlook for the pharmaceutical industry.

Line Graph (Past Year): A line graph depicting ABBV’s stock price over the past year would show a generally upward trend, with fluctuations reflecting market volatility and company-specific news. The x-axis would represent time (months), and the y-axis would represent the stock price (in USD). Key data points would include the highest and lowest prices reached during the year, along with significant price changes correlated to specific events (e.g., earnings reports, FDA approvals).

Factors Influencing ABBV Stock Price

Source: thestreet.com

Several factors influence ABBV’s stock price, including news events, earnings reports, competitor performance, and broader market trends.

Key News Events: Recent positive news regarding new drug approvals or successful clinical trials could positively impact the stock price. Conversely, negative news like regulatory setbacks or safety concerns could lead to price declines. Earnings Reports: Strong earnings reports that surpass market expectations typically boost the stock price, while weaker-than-expected results can negatively affect it. Competitor Performance: ABBV’s performance relative to its competitors in the pharmaceutical industry influences investor sentiment.

Broader Market Trends: Overall market trends, such as economic growth or recessionary fears, can also significantly affect ABBV’s stock price.

Tracking ABBV stock price today requires a keen eye on the market. For a broader tech perspective, it’s helpful to compare against other giants; understanding the current stock price of alphabet offers valuable context. Returning to ABBV, its performance often reflects broader market trends, so keeping an eye on Alphabet’s trajectory can provide insightful predictions.

ABBV Stock Price Predictions and Forecasts

Predicting stock prices is inherently uncertain, but analyzing analyst ratings and considering various scenarios can provide insights.

- Analyst A: Buy rating, $120 price target

- Analyst B: Hold rating, $110 price target

- Analyst C: Sell rating, $95 price target

Future Trajectory: Different perspectives exist regarding ABBV’s future trajectory. Some analysts believe the stock is undervalued and poised for growth, while others are more cautious, citing potential risks. Hypothetical Scenario: A significant price increase could result from a successful launch of a blockbuster drug, while a significant price decrease could be triggered by a major regulatory setback or a failure in a key clinical trial.

Risks and Uncertainties: Predicting stock prices involves inherent risks and uncertainties. Unforeseen events, changes in market sentiment, and unexpected regulatory actions can significantly impact the actual outcome.

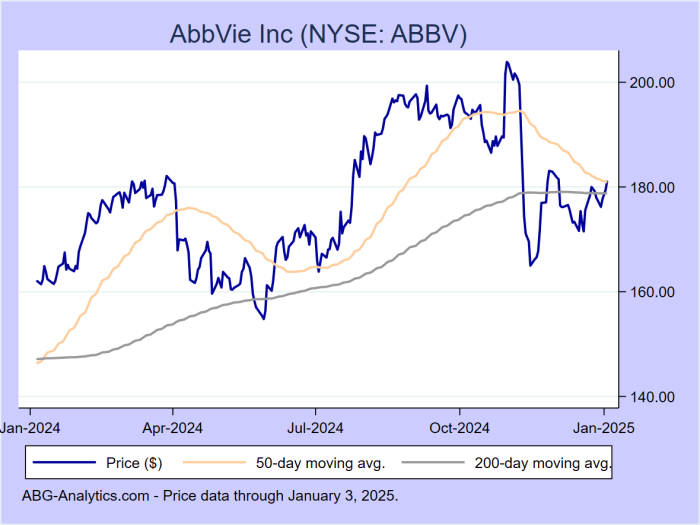

ABBV Stock Price and Investment Strategies

Source: abg-analytics.com

Different investment strategies have varying approaches to ABBV stock, depending on risk tolerance and investment goals.

| Strategy | Risk Level | Potential Return | Description |

|---|---|---|---|

| Buy-and-Hold | Low | Moderate | Long-term investment approach, aiming for consistent growth over time. |

| Day Trading | High | High/Low | Short-term trading strategy aiming to profit from daily price fluctuations. |

| Value Investing | Moderate | Moderate to High | Investing in undervalued stocks with the expectation of long-term appreciation. |

Key Questions Answered: Abbv Stock Price Today

What are the major risks associated with investing in ABBV stock?

Investing in any stock carries inherent risks, including market volatility, regulatory changes impacting the pharmaceutical industry, competition from other drug companies, and the potential for setbacks in research and development.

Where can I find real-time ABBV stock price updates?

Real-time stock quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Check your preferred broker’s platform for the most accurate and up-to-date information.

How does inflation affect ABBV’s stock price?

Inflation can impact ABBV’s stock price indirectly. High inflation can lead to increased costs for research, manufacturing, and operations, potentially affecting profitability. It can also influence interest rates, affecting investor behavior and market valuations.

What is AbbVie’s dividend policy?

AbbVie typically pays a dividend to its shareholders. The specific details of the dividend policy, including the dividend amount and payout schedule, can be found on AbbVie’s investor relations website or through financial news sources.