BRK.A Stock Price Today: An In-Depth Analysis

Source: tosshub.com

Brk a stock price today – Berkshire Hathaway (BRK.A) is a widely followed stock, known for its long-term investment strategy and Warren Buffett’s leadership. This analysis provides a comprehensive overview of BRK.A’s current stock price, historical performance, influencing factors, short-term predictions, analyst opinions, and investor sentiment.

BRK.A Stock Price Overview Today

Source: redd.it

As of market close [insert time and date], BRK.A’s stock price stood at [insert current price]. The day’s trading volume was [insert trading volume], indicating [insert interpretation of trading volume, e.g., higher than average activity, lower than usual, etc.]. Compared to yesterday’s closing price of [insert yesterday’s closing price], BRK.A experienced a [insert percentage change] change.

| Time | Price | Volume | Percentage Change |

|---|---|---|---|

| [Time 1] | [Price 1] | [Volume 1] | [Percentage Change 1] |

| [Time 2] | [Price 2] | [Volume 2] | [Percentage Change 2] |

| [Time 3] | [Price 3] | [Volume 3] | [Percentage Change 3] |

| [Time 4] | [Price 4] | [Volume 4] | [Percentage Change 4] |

BRK.A Stock Price Historical Performance

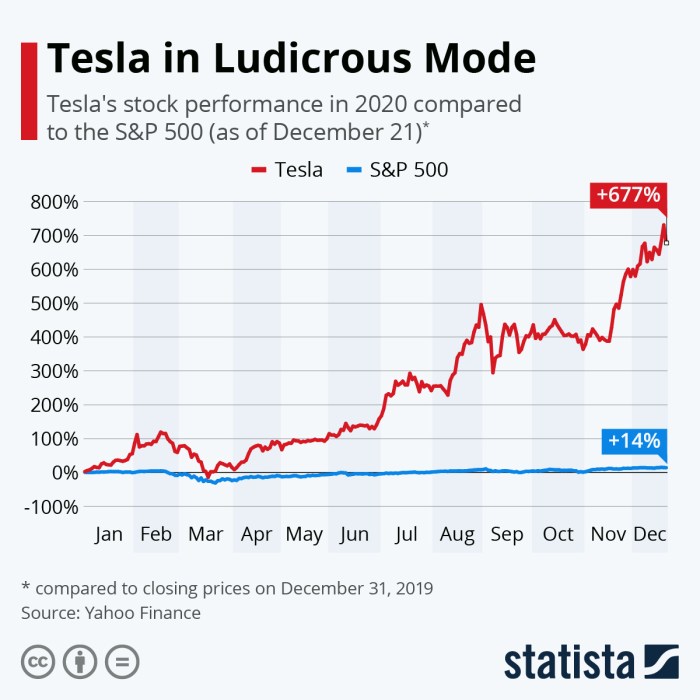

Over the past week, BRK.A’s price has [describe price movement, e.g., fluctuated within a range of X to Y, shown a general upward trend, etc.]. Compared to the S&P 500 over the past month, BRK.A’s performance has been [compare performance, e.g., relatively stable, outperformed the index, underperformed the index, etc.].

Significant price movements in the past year include [mention specific events and their impact on price, e.g., a sharp drop following a specific news event, a steady rise due to strong quarterly earnings, etc.].

A line graph illustrating BRK.A’s price trend over the past year would show [describe the graph, e.g., a generally upward sloping line with periods of consolidation and minor corrections, a more volatile pattern with significant peaks and troughs, etc.]. Key data points would include [mention specific high and low points and their corresponding dates].

Factors Influencing BRK.A Stock Price

Three key factors influencing BRK.A’s price today are likely [list three factors, e.g., overall market sentiment, performance of Berkshire Hathaway’s investments, and news related to the company’s operations].

Recent economic news, such as [mention specific news and its impact, e.g., interest rate hikes, inflation data, geopolitical events], has likely had [describe the impact, e.g., a negative impact, a positive impact, a neutral impact] on BRK.A’s stock price.

Berkshire Hathaway’s recent investment activities, including [mention specific investments and their potential effects, e.g., the acquisition of a new company, the sale of a significant holding, etc.], have contributed to [describe the impact, e.g., increased investor confidence, some uncertainty in the market, etc.].

Short-term factors, such as daily market fluctuations and news events, tend to have a more immediate impact on BRK.A’s price, while long-term factors, such as the overall health of the economy and Berkshire Hathaway’s long-term investment strategy, have a more sustained influence.

BRK.A Stock Price Prediction (Short-Term)

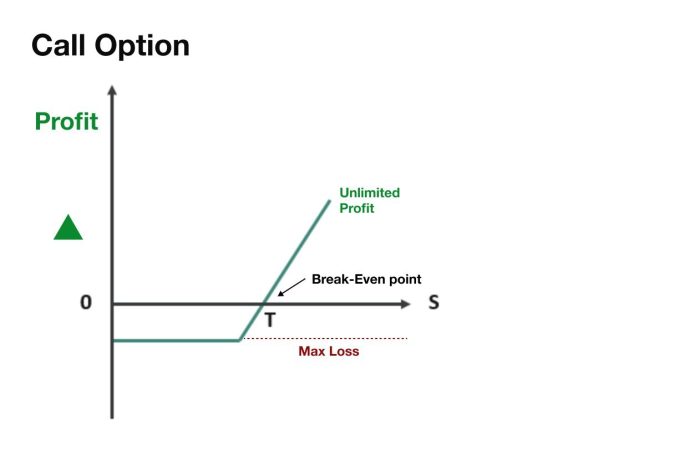

Several scenarios are possible for BRK.A’s short-term price movements. For example, a positive news event could lead to a short-term price increase, similar to what was seen after [mention a relevant past event], while negative news could trigger a decrease, as observed during [mention another relevant past event].

In the next 24 hours, BRK.A’s price could fluctuate within a range of [insert price range]. Over the next week, the price could range from [insert price range], based on the assumptions of [explain assumptions, e.g., continued positive market sentiment, no major news events, etc.].

| Scenario | Price in 1 Day | Price in 1 Week |

|---|---|---|

| Optimistic | [Price] | [Price] |

| Neutral | [Price] | [Price] |

| Pessimistic | [Price] | [Price] |

Analyst Ratings and Opinions on BRK.A

Source: cheddarflow.com

The consensus rating from major financial analysts for BRK.A is currently [insert consensus rating, e.g., “Buy,” “Hold,” “Sell”]. Analyst price targets range from [insert lowest price target] to [insert highest price target].

Differing opinions stem from varying assessments of [explain reasons for differing opinions, e.g., the company’s future growth prospects, the overall economic outlook, etc.].

| Analyst Firm | Rating | Price Target |

|---|---|---|

| [Analyst Firm 1] | [Rating 1] | [Price Target 1] |

| [Analyst Firm 2] | [Rating 2] | [Price Target 2] |

| [Analyst Firm 3] | [Rating 3] | [Price Target 3] |

Investor Sentiment Towards BRK.A, Brk a stock price today

Current investor sentiment towards BRK.A appears to be [describe sentiment, e.g., cautiously optimistic, generally bullish, somewhat bearish, etc.]. Recent news events such as [mention specific news events and their impact on sentiment, e.g., strong earnings report, concerns about a specific sector, etc.], have influenced this sentiment.

Positive social media sentiment might include comments praising Berkshire Hathaway’s long-term investment strategy or highlighting recent successful investments. Negative sentiment might express concerns about specific holdings or the company’s performance relative to market benchmarks. For example, a tweet mentioning [example of positive sentiment] could be contrasted with one expressing [example of negative sentiment]. The overall tone of social media posts provides valuable insights into current investor feeling towards BRK.A.

Clarifying Questions: Brk A Stock Price Today

What is the typical trading volume for BRK.A?

BRK.A’s trading volume varies considerably, influenced by market conditions and news events. It generally sees lower volume compared to more actively traded stocks due to its high share price and limited float.

How does BRK.A’s price compare to its 52-week high and low?

BRK.A’s stock price today is showing some interesting movement. It’s always useful to compare it to other established utilities; for instance, checking the performance of a company like National Grid can offer perspective, so take a look at the national grid plc stock price to see how it’s faring. Ultimately, though, BRK.A’s performance will depend on its own unique factors.

This requires referencing current financial data sources for the most up-to-date comparison of the current price to the 52-week high and low. These figures change constantly.

What are the major risks associated with investing in BRK.A?

Risks include the inherent volatility of the stock market, the concentration of holdings within Berkshire Hathaway’s portfolio, and the potential impact of macroeconomic events on the company’s performance. The high share price also limits accessibility for some investors.

Where can I find reliable real-time BRK.A price data?

Reputable financial websites and brokerage platforms provide real-time quotes and charts for BRK.A. Always verify the source’s reliability.