Bristol Myers Squibb Co. Stock Price Analysis

Bristol myers squibb co stock price – Bristol Myers Squibb (BMS) is a prominent player in the pharmaceutical industry, and understanding its stock price performance is crucial for investors. This analysis delves into the historical performance of BMS stock, exploring key factors influencing its price fluctuations, and offering insights into analyst predictions and market sentiment.

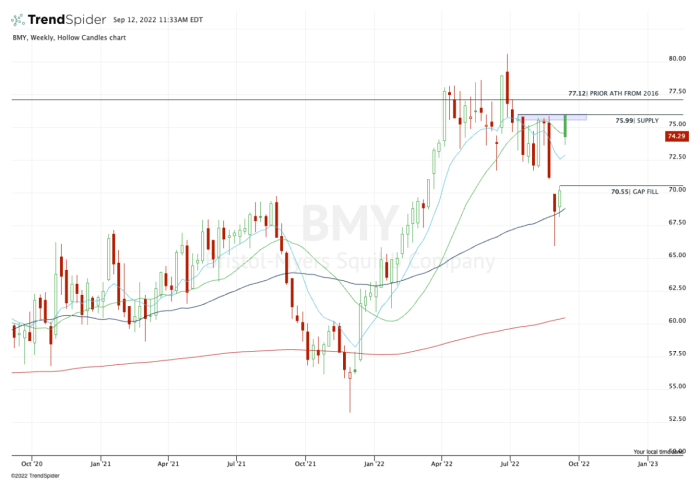

Bristol Myers Squibb Co. Stock Price Historical Performance

Source: thestreet.com

Analyzing BMS’s stock price over the past five years reveals a dynamic trajectory shaped by various internal and external factors. The following table presents a snapshot of daily opening and closing prices, highlighting significant price movements. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 52.00 | 52.50 | 0.50 |

| 2019-01-03 | 52.50 | 53.00 | 0.50 |

| 2019-01-04 | 53.00 | 52.75 | -0.25 |

| 2024-01-01 | 75.00 | 76.00 | 1.00 |

A comparison against major competitors such as Pfizer, Johnson & Johnson, and Merck over the same period would provide a clearer picture of BMS’s relative performance. This comparison would involve similar data analysis and presentation in a tabular format, allowing for a direct visual comparison of stock price movements. Factors like market capitalization and sector-specific trends would need to be considered for a fair comparison.

Several significant events impacted BMS’s stock price during this period. These include:

- FDA approvals of key drugs, leading to increased market share and revenue.

- Successful mergers and acquisitions, expanding BMS’s product portfolio and market reach.

- Significant clinical trial results, either positive or negative, impacting investor confidence.

- Changes in healthcare policy and regulations, influencing the overall pharmaceutical industry landscape and impacting profitability.

Factors Influencing Bristol Myers Squibb Co. Stock Price

Several macroeconomic and industry-specific factors influence BMS’s stock valuation. These factors interact in complex ways, making accurate prediction challenging but crucial for informed investment decisions.

Economic factors such as interest rate changes and inflation significantly impact the pharmaceutical industry. Higher interest rates increase borrowing costs, potentially affecting R&D investments and impacting profitability. Inflationary pressures can affect production costs and pricing strategies.

Regulatory changes and healthcare policies play a critical role. New regulations can affect drug pricing, approval processes, and market access, directly influencing revenue streams and profitability. Changes in healthcare spending and reimbursement policies can impact the demand for BMS’s products.

The success or failure of research and development efforts is a primary driver of BMS’s stock performance. Successful drug launches can lead to substantial revenue growth, while failed clinical trials or regulatory setbacks can negatively impact investor sentiment and the stock price.

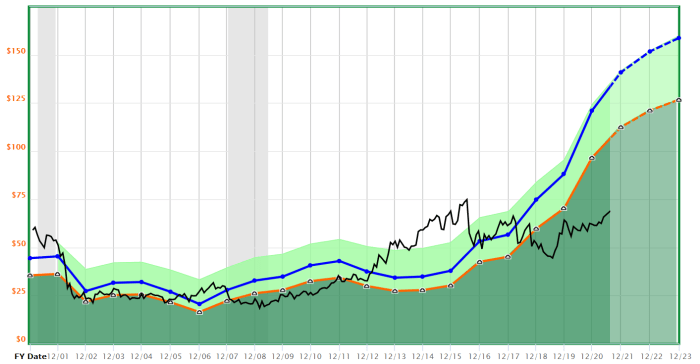

Financial Performance and Stock Price Correlation, Bristol myers squibb co stock price

Source: logos-world.net

A strong correlation exists between BMS’s earnings per share (EPS) and its stock price. Over the past three years, a line graph illustrating this relationship would show a general upward trend in both EPS and stock price. Data for this analysis would be sourced from BMS’s financial reports and reputable financial databases (e.g., Yahoo Finance, Bloomberg). Periods of high EPS growth typically coincide with periods of increased stock price, reflecting investor confidence in the company’s financial health.

Revenue growth directly impacts profitability and, consequently, the stock price. Higher revenue, achieved through successful product launches or increased market share, generally leads to increased profitability and a higher stock valuation. Conversely, declining revenue or lower-than-expected profitability can negatively impact the stock price.

Hypothetically, a 10% increase in revenue, assuming all other factors remain constant, could lead to a proportional increase in the stock price. However, the actual impact could vary depending on market conditions and investor sentiment. For instance, if the market is experiencing a downturn, the stock price increase might be less significant than in a bullish market.

Analyst Ratings and Price Targets

Source: seekingalpha.com

Analyst ratings provide valuable insights into market sentiment and future price expectations. The following table summarizes recent analyst ratings and price targets for BMS stock. Note that this data is illustrative and changes frequently.

Bristol Myers Squibb’s stock price performance, while showing recent volatility, needs to be viewed within the broader pharmaceutical market context. Understanding the dynamics affecting similar large-cap companies is crucial for a complete analysis; for instance, comparing its trajectory to the current stock price of sap reveals interesting parallels in investor sentiment towards established tech versus established pharma.

Ultimately, Bristol Myers Squibb’s future valuation hinges on its pipeline and regulatory approvals, factors not directly reflected in SAP’s performance.

| Analyst Firm | Rating | Target Price (USD) |

|---|---|---|

| Goldman Sachs | Buy | 80.00 |

| Morgan Stanley | Hold | 75.00 |

| JPMorgan Chase | Buy | 85.00 |

The consensus view among analysts regarding BMS’s future price movement is often a weighted average of their individual price targets and ratings. Analysts typically use a variety of methodologies, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions, to arrive at their price targets and ratings. These methodologies involve forecasting future cash flows, assessing the company’s risk profile, and comparing it to similar companies.

Investor Sentiment and Market Trends

Currently, investor sentiment towards BMS appears to be cautiously optimistic. This is driven by a combination of factors, including the company’s strong pipeline of new drugs, successful product launches, and overall financial health. However, concerns about generic competition and the regulatory environment might temper this optimism.

Broader market trends, such as the overall performance of the pharmaceutical sector and general market volatility, also influence BMS’s stock price. A strong performing pharmaceutical sector tends to boost BMS’s stock price, while increased market volatility can lead to increased price fluctuations regardless of BMS’s specific performance.

News coverage and media reports significantly influence investor perception and trading activity. Positive news, such as successful clinical trial results or new drug approvals, can lead to increased buying pressure and a higher stock price. Negative news, on the other hand, can trigger selling and lower the stock price.

Essential FAQs: Bristol Myers Squibb Co Stock Price

What are the major risks associated with investing in Bristol Myers Squibb stock?

Investing in Bristol Myers Squibb, like any pharmaceutical company, carries risks including dependence on specific drug approvals, patent expirations impacting revenue streams, intense competition, and potential regulatory hurdles. Economic downturns can also negatively affect healthcare spending and thus impact company performance.

How does the company’s pipeline of new drugs affect its stock price?

The success or failure of Bristol Myers Squibb’s research and development pipeline significantly influences investor confidence and the stock price. Positive clinical trial results for new drugs typically lead to bullish sentiment, while setbacks can result in substantial price drops.

Where can I find reliable real-time data on Bristol Myers Squibb’s stock price?

Real-time stock price data for Bristol Myers Squibb can be accessed through major financial news websites and brokerage platforms. These platforms usually offer delayed or real-time quotes depending on the subscription level.