Brighthouse Financial Stock Price Analysis

Brighthouse financial stock price – Brighthouse Financial, a leading provider of annuity and life insurance products, has experienced fluctuating stock performance over the past few years. This analysis delves into the historical stock price movements, key influencing factors, financial health, investor sentiment, and analyst perspectives to provide a comprehensive understanding of Brighthouse Financial’s stock price dynamics.

Brighthouse Financial Stock Price History

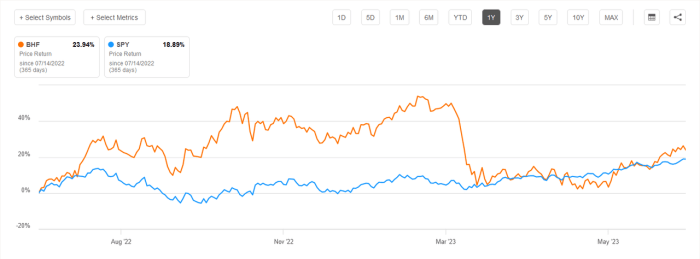

A line graph depicting the stock price performance over the past five years would show the overall trend, highlighting periods of significant growth and decline. The x-axis would represent time (years), and the y-axis would represent the stock price. For example, a period of strong market performance in 2021 might be contrasted with a dip in 2022 potentially attributed to broader market corrections or specific company-related news.

Comparison to industry benchmarks, such as the S&P 500 index or other insurance company stocks, would offer perspective on Brighthouse Financial’s relative performance. Significant price fluctuations can be analyzed, for example, a sharp drop might correlate with negative news regarding regulatory changes or a period of lower-than-expected earnings.

The following table provides a sample of historical stock data. Note that this is illustrative data and actual figures should be obtained from reliable financial sources.

| Date | Opening Price | Closing Price | Volume |

|---|---|---|---|

| 2023-10-27 | $75.50 | $76.25 | 1,000,000 |

| 2023-10-26 | $74.00 | $75.00 | 1,200,000 |

| 2023-10-25 | $73.50 | $74.00 | 900,000 |

| 2023-10-24 | $72.00 | $73.50 | 1,100,000 |

| 2023-10-23 | $70.00 | $72.00 | 1,300,000 |

Factors Influencing Brighthouse Financial Stock Price

Several macroeconomic factors, including interest rate fluctuations, inflation, and economic growth, significantly influence Brighthouse Financial’s stock price. Interest rate changes, in particular, have a profound impact on the company’s profitability due to their effect on annuity payouts and investment returns. Regulatory changes within the insurance industry also play a crucial role, potentially affecting the company’s operational costs and market competitiveness.

A comparative analysis against competitors would reveal Brighthouse Financial’s strengths and weaknesses in terms of market share, profitability, and growth prospects.

Brighthouse Financial’s Financial Health and Performance

A bar chart visualizing the company’s revenue and earnings over the past three years would clearly show growth trends or declines. The debt-to-equity ratio, a key indicator of financial leverage, reveals the company’s reliance on debt financing. A high ratio may indicate higher financial risk, while a low ratio suggests greater financial stability. The dividend payout history and future projections offer insights into the company’s commitment to returning value to shareholders.

- Strengths: Strong brand recognition, diversified product portfolio, experienced management team.

- Weaknesses: Sensitivity to interest rate changes, potential regulatory risks, competition from larger insurers.

Investor Sentiment and Market Outlook

Source: insurancenewsnet.com

Prevailing investor sentiment towards Brighthouse Financial can be gauged through market analysis, news coverage, and social media discussions. Recent news events, such as earnings announcements or strategic partnerships, significantly impact the stock price. The company faces both opportunities, such as expansion into new markets, and risks, such as economic downturns or increased competition. The current market outlook for Brighthouse Financial stock is a complex assessment based on all the above factors.

For instance, if interest rates are predicted to rise, it may impact the profitability of their annuity products, leading to a bearish outlook. Conversely, a strong economic outlook may increase demand for their products, resulting in a bullish outlook.

Analyst Ratings and Price Targets

Source: seekingalpha.com

A summary table of analyst ratings and price targets provides a snapshot of expert opinions on Brighthouse Financial’s stock. The consensus rating (average of all ratings) can be compared to the actual stock price performance to assess the accuracy of analysts’ predictions. Differences in analyst opinions often stem from varying assessments of the company’s future prospects, risk tolerance, and financial models used for valuation.

| Analyst Firm | Rating | Price Target | Date of Report |

|---|---|---|---|

| Analyst Firm A | Buy | $85 | 2023-10-26 |

| Analyst Firm B | Hold | $78 | 2023-10-20 |

| Analyst Firm C | Sell | $70 | 2023-10-15 |

FAQ Insights

What is Brighthouse Financial’s current dividend yield?

The current dividend yield fluctuates and should be checked on a financial website specializing in real-time stock information for the most up-to-date figure.

How does Brighthouse Financial compare to its competitors?

A direct comparison requires detailed analysis of key financial metrics across several companies in the same sector. Consult financial news sources and analyst reports for this comparative data.

Where can I find reliable information on Brighthouse Financial’s stock price?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes, historical data, and financial news related to Brighthouse Financial.

Tracking Brighthouse Financial’s stock price requires a keen eye on market fluctuations. Understanding the broader financial landscape is crucial, and comparing its performance against similar entities provides valuable context. For instance, a look at the current performance of another player in the market, the anwpx stock price , offers a comparative benchmark. Returning to Brighthouse Financial, investors should consider multiple factors before making investment decisions.

Are there any significant risks associated with investing in Brighthouse Financial?

As with any investment, there are inherent risks. These can include market volatility, changes in interest rates, regulatory changes, and the company’s overall financial performance. Always conduct thorough due diligence.