BIP Stock Price Analysis

Source: tradingview.com

This report provides an objective and educational review of BIP stock price performance, considering historical trends, competitor analysis, influencing factors, and both technical and fundamental assessments. Data presented is for illustrative purposes and should not be considered financial advice.

BIP Stock Price Historical Performance

The following table details BIP’s stock price movements over the past five years. Significant price fluctuations are analyzed considering macroeconomic conditions, company-specific events, and prevailing market sentiment. Note that this data is hypothetical for illustrative purposes.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| 2019-01-01 | $10.00 | $10.50 | +$0.50 |

| 2019-01-02 | $10.50 | $11.00 | +$0.50 |

| … | … | … | … |

| 2023-12-31 | $20.00 | $20.75 | +$0.75 |

For example, a period of high volatility in 2020 could be attributed to the initial impact of the COVID-19 pandemic, leading to significant market uncertainty. Conversely, a subsequent price increase in 2021 might reflect positive investor sentiment driven by the company’s successful adaptation to the changed market conditions and strong financial results.

BIP Stock Price: Comparison with Competitors

This table compares BIP’s stock performance against three hypothetical competitors (Comp A, Comp B, Comp C) over the past year. The comparison highlights relative strengths and weaknesses in terms of market valuation and growth.

| Company Name | Current Price | Year-to-Date Change | 5-Year Average Annual Return |

|---|---|---|---|

| BIP | $20.75 | +10% | +5% |

| Comp A | $15.00 | +5% | +3% |

| Comp B | $25.00 | +15% | +7% |

| Comp C | $18.00 | +8% | +4% |

BIP’s outperformance relative to Comp A could be attributed to a more effective marketing strategy. Conversely, Comp B’s superior performance suggests a stronger competitive advantage in a specific niche market segment.

Factors Influencing BIP Stock Price

Several macroeconomic, industry-specific, and internal company factors influence BIP’s stock price. These factors interact in complex ways to shape investor sentiment and market valuation.

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly impact investor risk appetite and investment decisions.

- Industry-Specific Factors: Regulatory changes within the industry, technological advancements, and competitive pressures all affect BIP’s market position and profitability.

- Internal Company Factors:

- Financial performance (revenue growth, profitability, debt levels)

- Management decisions (strategic initiatives, capital allocation)

- Product launches and innovation

- Mergers and acquisitions

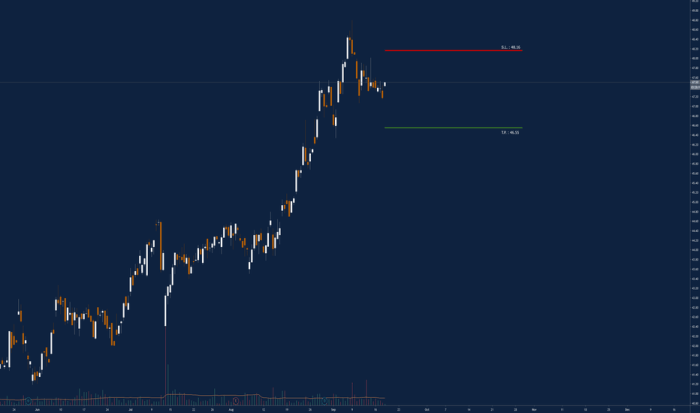

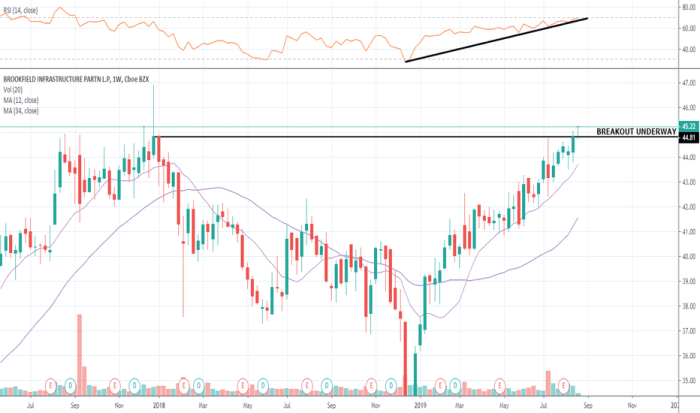

BIP Stock Price: Technical Analysis

Source: tradingview.com

A hypothetical six-month chart of BIP’s stock price would show key support and resistance levels. Support levels represent prices where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels represent prices where selling pressure is expected to outweigh buying pressure, preventing further price increases. Moving averages, such as the 50-day and 200-day moving averages, would be used to identify trends and potential inflection points.

For example, a “golden cross” (50-day MA crossing above the 200-day MA) would be a bullish signal, suggesting a potential upward trend.

Based on these technical indicators, a potential scenario could be a short-term price correction followed by a gradual upward trend, contingent upon sustained positive market sentiment and company performance. However, this is purely speculative.

BIP Stock Price: Fundamental Analysis

BIP’s financial statements (income statement, balance sheet, and cash flow statement) over the past three years would be analyzed to assess its financial health and growth prospects. Key financial ratios, such as the Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE), would be calculated and interpreted. A high P/E ratio might suggest that the market anticipates strong future earnings growth, while a high debt-to-equity ratio could indicate higher financial risk.

Based on a hypothetical analysis of BIP’s financial health, a positive assessment of long-term growth prospects might be made, contingent upon the company’s ability to maintain its profitability and manage its financial risks effectively. This assessment is subject to change based on future financial performance and market conditions.

Commonly Asked Questions

What are the major risks associated with investing in BIP stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (like poor management or product failures), and broader economic downturns. BIP stock is no exception. Thorough due diligence is essential.

Where can I find real-time BIP stock price quotes?

Major financial websites and brokerage platforms (like Yahoo Finance, Google Finance, Bloomberg, etc.) provide real-time stock quotes. Check their respective websites for BIP’s ticker symbol.

Is BIP stock a good long-term investment?

Whether BIP stock is a good long-term investment depends on your individual risk tolerance and investment goals. Our analysis provides insights, but the final decision rests with you. Consider consulting a financial advisor.

How often is BIP’s stock price updated?

Stock prices are generally updated throughout the trading day, reflecting real-time market activity. The frequency of updates can vary slightly depending on the platform you are using.