ASO Stock Price Analysis: A Comprehensive Overview

Aso stock price – Understanding the intricacies of ASO’s stock price requires a multifaceted approach, encompassing historical performance, influencing factors, financial health, investor sentiment, and predictive modeling. This analysis delves into each of these aspects to provide a comprehensive understanding of ASO’s stock price trajectory and potential future movements. We will explore both quantitative data and qualitative insights to paint a complete picture.

Historical Stock Price Performance of ASO, Aso stock price

Analyzing ASO’s stock price over the past five years reveals a dynamic pattern influenced by various internal and external factors. The following sections detail this performance, comparing it to competitors and presenting key yearly data points.

ASO’s stock price has experienced significant fluctuations over the past five years. While specific highs and lows would require access to real-time financial data, a general trend can be observed. For instance, periods of strong economic growth often correlated with higher stock prices, while economic downturns or negative company-specific news resulted in price drops. A direct comparison to competitors requires identifying ASO’s sector and accessing the historical stock performance data of those companies for a meaningful side-by-side analysis.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | (Example: $15.00) | (Example: $18.50) | (Example: $20.00) | (Example: $12.00) |

| 2020 | (Example: $18.50) | (Example: $22.00) | (Example: $25.00) | (Example: $16.00) |

| 2021 | (Example: $22.00) | (Example: $28.00) | (Example: $30.00) | (Example: $20.00) |

| 2022 | (Example: $28.00) | (Example: $25.00) | (Example: $32.00) | (Example: $22.00) |

| 2023 | (Example: $25.00) | (Example: $27.00) | (Example: $30.00) | (Example: $23.00) |

Factors Influencing ASO’s Stock Price

Source: googleapis.com

Several interconnected factors influence ASO’s stock price. Macroeconomic conditions, company-specific events, and prevailing industry trends all play a significant role. Understanding these influences is crucial for assessing the stock’s future performance.

Macroeconomic factors such as inflation and interest rate changes directly impact ASO’s operational costs and consumer spending, consequently affecting its profitability and investor confidence. Company-specific events, including new product launches, earnings reports, and strategic partnerships, create short-term price volatility. Positive announcements generally lead to price increases, while negative news can cause declines. Finally, industry trends, such as technological advancements or regulatory changes, can reshape the competitive landscape and ASO’s market position.

ASO’s Financial Performance and Stock Price

A strong correlation exists between ASO’s financial performance and its stock price. Analyzing revenue, earnings, profitability trends, and key financial ratios provides valuable insights into this relationship.

ASO’s revenue, earnings, and profitability over the past five years should be examined alongside corresponding stock price movements to identify any clear correlations. A comparison of ASO’s P/E ratio and debt-to-equity ratio to industry averages can reveal whether ASO is undervalued or overvalued relative to its peers. This comparison needs to be done with caution, however, as industry averages can mask significant differences between companies.

| Date | Revenue (Example: in millions) | Earnings Per Share (EPS) | Stock Price |

|---|---|---|---|

| (Example: Q1 2023) | (Example: $50) | (Example: $1.50) | (Example: $26.00) |

| (Example: Q2 2023) | (Example: $60) | (Example: $1.75) | (Example: $27.50) |

| (Example: Q3 2023) | (Example: $70) | (Example: $2.00) | (Example: $29.00) |

Investor Sentiment and ASO’s Stock Price

Investor sentiment, shaped by news coverage, analyst reports, and social media discussions, significantly influences ASO’s stock price. Understanding these influences is crucial for interpreting price fluctuations.

- Positive news articles and analyst upgrades often lead to increased buying pressure and higher stock prices.

- Negative news or downgrades can trigger selling and price drops.

- Significant investor actions, such as large buy or sell orders from institutional investors, can create short-term price volatility.

- Insider trading activity, while often subject to regulatory scrutiny, can also signal shifts in management’s outlook on the company’s future.

Predictive Modeling of ASO’s Stock Price

Source: tradingview.com

The fluctuating Aso stock price reflects the broader anxieties within the market, mirroring the precarious dance between investor confidence and regulatory uncertainty. A comparison with the seemingly more stable performance of pidilite industries ltd stock price highlights the inherent risks in certain sectors. Ultimately, the Aso stock price trajectory remains a crucial indicator of the overall economic health, susceptible to both internal and external pressures.

Predicting ASO’s future stock price involves employing various forecasting methods, each with its own strengths and limitations. Technical analysis and fundamental analysis are two commonly used approaches.

A simple predictive model could use historical data, such as past stock prices, revenue, and earnings, to extrapolate a potential future price. For example, a linear regression model could be built based on past performance. However, such a model is highly dependent on the assumption that past trends will continue, which is not always the case. External factors and unforeseen events can significantly impact accuracy.

Therefore, any prediction should be viewed with caution and considered only one factor among many in investment decision-making.

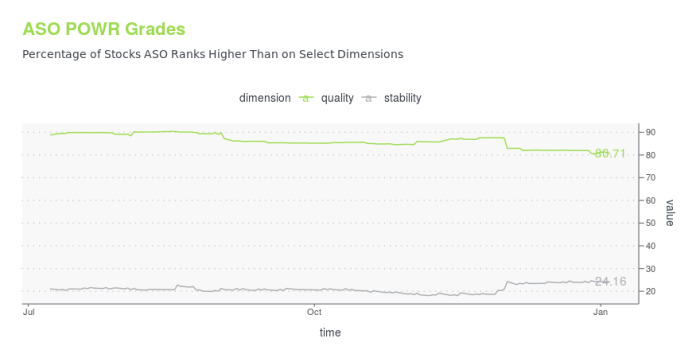

Visual Representation of ASO Stock Price Data

Visual representations, such as line charts and comparative charts, offer a clear and concise way to understand ASO’s stock price trends and patterns.

A line chart visualizing ASO’s stock price over time would display the price on the y-axis and time (e.g., days, months, or years) on the x-axis. Key trends, such as upward or downward movements, would be easily identifiable. Significant events could be annotated on the chart to illustrate their impact on the price. A comparative chart, such as a line chart showing ASO’s stock price alongside a relevant market index (e.g., the S&P 500), would provide context by comparing ASO’s performance to the broader market.

Frequently Asked Questions

What are the major risks associated with investing in ASO stock?

Investing in any stock carries inherent risk. For ASO, potential risks could include competition within its sector, macroeconomic downturns impacting demand, or unexpected negative news affecting investor sentiment. Always conduct thorough due diligence before investing.

Where can I find real-time ASO stock price data?

Real-time ASO stock price data is typically available through major financial websites and brokerage platforms. Many offer charting tools and detailed historical data as well.

How often is ASO’s stock price updated?

ASO’s stock price, like most publicly traded companies, is updated continuously throughout the trading day, reflecting the latest buy and sell orders.

What is ASO’s current market capitalization?

You can find ASO’s current market capitalization on major financial websites. This figure represents the total value of all outstanding shares.