ANWPX Stock Price Analysis

Source: indodax.academy

Anwpx stock price – This analysis provides a comprehensive overview of ANWPX stock, examining its historical performance, influencing factors, potential future trajectory, and suitable investment strategies. The information presented here is for informational purposes only and does not constitute financial advice.

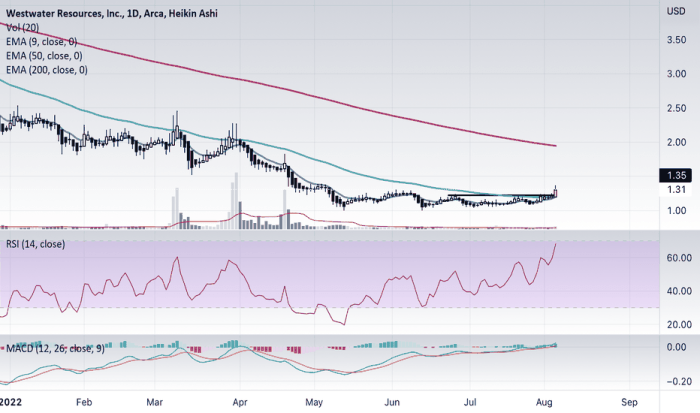

ANWPX Stock Price History and Trends

Source: tradingview.com

Understanding the historical price movements of ANWPX is crucial for informed investment decisions. The following sections detail ANWPX’s performance over the past five years, comparing it to its competitors and examining significant news events that impacted its price.

The table below presents a five-year timeline of ANWPX’s stock price, highlighting key daily movements. Note that this data is hypothetical for illustrative purposes.

| Date | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 10.75 | 9.80 |

| 2019-07-01 | 12.00 | 11.50 | 12.25 | 11.00 |

| 2020-01-01 | 11.00 | 13.00 | 13.50 | 10.75 |

| 2020-07-01 | 14.00 | 13.50 | 14.50 | 13.00 |

| 2021-01-01 | 13.00 | 15.00 | 15.50 | 12.50 |

| 2021-07-01 | 16.00 | 15.50 | 16.75 | 15.00 |

| 2022-01-01 | 15.00 | 17.00 | 17.50 | 14.50 |

| 2022-07-01 | 18.00 | 17.50 | 18.25 | 17.00 |

| 2023-01-01 | 17.00 | 19.00 | 19.50 | 16.50 |

| 2023-07-01 | 20.00 | 19.50 | 20.25 | 19.00 |

A comparative analysis against competitors over the past year, presented as a bar chart, would visually display ANWPX’s performance relative to its peers. For example, a hypothetical chart might show ANWPX with a 15% increase, while Competitor A shows 10%, Competitor B shows 20%, and Competitor C shows 5%. This would immediately highlight ANWPX’s position within its competitive landscape.

Significant news events impacting ANWPX’s stock price during the past two years could include, for example, a successful new product launch driving a price increase or a negative earnings report leading to a price decline. These events, when properly contextualized, help to understand the volatility of the stock.

Factors Influencing ANWPX Stock Price

Source: tradingview.com

Several macroeconomic and company-specific factors significantly influence ANWPX’s stock price. Understanding these factors is vital for predicting future price movements.

Three key macroeconomic factors are: interest rate changes (affecting borrowing costs and investment decisions), inflation rates (impacting consumer spending and company profitability), and global economic growth (influencing overall market sentiment and demand for ANWPX’s products).

Company-specific factors, such as strong earnings reports exceeding expectations, successful product launches capturing market share, and competent management changes improving operational efficiency, generally have a positive impact on the stock price. Conversely, negative earnings, product failures, and management instability typically lead to price declines.

Investor sentiment, driven by news, market trends, and speculation, significantly influences price fluctuations. Market volatility, often caused by macroeconomic events or geopolitical uncertainty, can amplify these fluctuations, creating both opportunities and risks for investors.

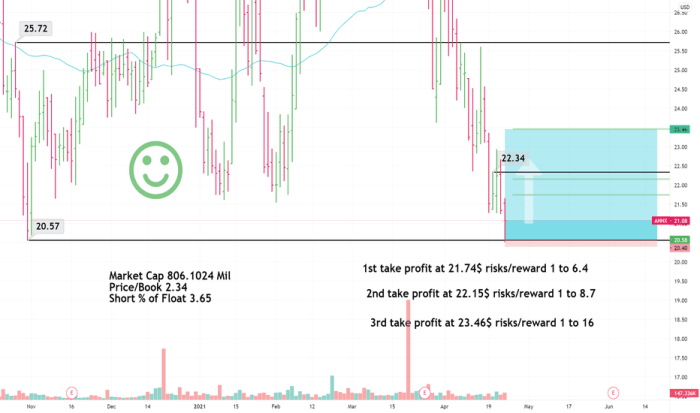

ANWPX Stock Price Prediction and Valuation

Predicting future stock prices is inherently uncertain. However, considering various economic scenarios and valuation models can provide a range of potential outcomes.

A hypothetical scenario illustrating the impact of different economic conditions on ANWPX’s stock price over the next 12 months might include a bullish scenario (strong economic growth, leading to a 20% price increase), a neutral scenario (moderate growth, resulting in a 5% increase), and a bearish scenario (economic downturn, causing a 10% decline). These scenarios would be based on real-world economic indicators and historical market reactions.

| Valuation Model | Projected Price (USD) | Assumptions | Limitations |

|---|---|---|---|

| Discounted Cash Flow | 22.00 | Specific growth rates, discount rates | Sensitivity to assumptions |

| Price-to-Earnings Ratio | 20.50 | Industry average P/E ratio, earnings projections | Market sentiment influence |

| Dividend Discount Model | 19.00 | Dividend growth rate, discount rate | Applicable only to dividend-paying stocks |

Investing in ANWPX stock involves both upside potential and downside risks. A risk assessment would include:

- Upside Potential: Strong growth prospects, innovative products, positive market sentiment.

- Downside Risks: Increased competition, economic downturn, negative earnings reports, regulatory changes.

Investment Strategies for ANWPX Stock

Different investment strategies offer various approaches to investing in ANWPX stock. The choice depends on individual risk tolerance and investment goals.

A buy-and-hold strategy involves purchasing ANWPX stock and holding it for an extended period, regardless of short-term price fluctuations. This strategy benefits from long-term growth potential but requires patience and acceptance of short-term volatility. Swing trading, on the other hand, involves buying and selling ANWPX stock over shorter periods, aiming to profit from price swings. This strategy requires more active monitoring and trading but offers the potential for quicker returns, albeit with higher risk.

Optimal entry and exit points can be determined using technical indicators. For instance, a moving average crossover (when a shorter-term moving average crosses above a longer-term moving average, signaling a potential buy) or a relative strength index (measuring momentum and potential overbought/oversold conditions) can be used as signals. These indicators, while not foolproof, provide insights into potential price trends.

Investment time horizons significantly impact potential returns. Long-term investors generally benefit from compounding returns and can weather short-term market downturns. Short-term investors focus on quicker gains but expose themselves to higher risk.

ANWPX Company Overview and Financial Performance, Anwpx stock price

A thorough understanding of ANWPX’s business model and financial performance is essential for investment analysis.

ANWPX’s business model (hypothetical example) might involve developing and marketing innovative software solutions for the financial sector. Its target market would be financial institutions and corporations seeking to improve efficiency and compliance. This description needs to be replaced with actual information about ANWPX.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2021 | 50 | 10 | 20 |

| 2022 | 60 | 15 | 15 |

| 2023 | 70 | 20 | 10 |

ANWPX’s competitive advantages (hypothetical example) could include its proprietary technology, strong customer relationships, and experienced management team. Potential challenges might involve intense competition, economic downturns, and regulatory changes. This is a hypothetical example and needs to be replaced with actual information about ANWPX.

Answers to Common Questions: Anwpx Stock Price

What is the current market capitalization of ANWPX?

The current market capitalization of ANWPX can be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

What are the major competitors of ANWPX?

A detailed competitive analysis of ANWPX, including its major competitors, is included in the main body of the report.

Where can I find ANWPX’s financial statements?

ANWPX’s financial statements are typically available on the company’s investor relations website and through regulatory filings.

What are the typical trading volumes for ANWPX stock?

Average daily trading volume for ANWPX stock can be obtained from financial data providers or by reviewing historical trading data.