Amazon Stock Price History: A Critical Analysis

Amazon price stock history – Amazon’s stock price journey reflects a complex interplay of technological innovation, economic shifts, and regulatory pressures. This analysis delves into the historical fluctuations, influencing factors, comparative performance against competitors, predictive modeling attempts, and visual representations of Amazon’s stock price data, offering a critical perspective on its trajectory.

Amazon Stock Price Fluctuations

Amazon’s stock price has experienced dramatic swings over the past decade, mirroring the company’s ambitious growth and its vulnerability to macroeconomic forces. Significant price increases have often followed successful product launches, strong earnings reports, and periods of robust consumer spending. Conversely, major decreases have been linked to economic downturns, increased competition, and regulatory scrutiny.

| Date | Stock Price (USD) | Event | Impact |

|---|---|---|---|

| January 2014 | 390 | Strong Holiday Sales | Price Increase |

| October 2018 | 1700 | Concerns about slowing growth | Price Decrease |

| March 2020 | 1800 | COVID-19 Pandemic (Increased online shopping) | Price Increase |

| September 2022 | 120 | Inflationary pressures and slowing e-commerce growth | Price Decrease |

Factors Influencing Amazon’s Stock Price

Several key factors significantly influence Amazon’s stock valuation. These factors range from broad macroeconomic indicators to the company’s specific performance and competitive landscape.

- Economic Indicators: Interest rates, inflation, and consumer confidence directly impact consumer spending, influencing Amazon’s revenue and profitability.

- Competitor Actions: Aggressive moves by competitors like Walmart or the rise of new e-commerce players can erode Amazon’s market share, affecting investor sentiment.

- Consumer Spending Habits: Shifts in consumer preferences towards specific product categories or changes in overall spending patterns directly influence Amazon’s sales figures.

- Regulatory Changes: Antitrust investigations, data privacy regulations, and tax policies can significantly impact Amazon’s operations and profitability, leading to stock price volatility.

Comparing Amazon’s Stock Performance to Competitors, Amazon price stock history

Source: geekwire.com

Comparing Amazon’s stock performance to other tech giants like Google (Alphabet), Apple, and Microsoft provides valuable context for understanding its relative strengths and weaknesses.

| Company | Average Annual Growth (Past 5 years) | Market Volatility (Standard Deviation) | Sensitivity to Interest Rate Changes |

|---|---|---|---|

| Amazon | 10% | 20% | Medium |

| Google (Alphabet) | 12% | 15% | Low |

| Apple | 15% | 18% | Low |

| Microsoft | 18% | 12% | Low |

While all four companies have experienced substantial growth, their sensitivity to macroeconomic factors varies. For example, Apple and Microsoft tend to be less susceptible to interest rate hikes than Amazon, which is more directly tied to consumer discretionary spending.

Predictive Modeling of Amazon’s Stock Price

Source: capital.com

Predicting Amazon’s future stock price is a complex endeavor. Various methods, both quantitative and qualitative, are employed, each with inherent limitations and underlying assumptions.

- Quantitative Models: Time series analysis, regression models, and machine learning algorithms utilize historical data to predict future price movements. These models are susceptible to errors due to unforeseen events and changing market dynamics.

- Qualitative Approaches: Fundamental analysis considers factors like earnings, revenue growth, and competitive landscape. Technical analysis focuses on chart patterns and trading volume. Both approaches are subjective and prone to bias.

Assumptions in these models often include the continuation of past trends, stable macroeconomic conditions, and the absence of major disruptive events. These assumptions are rarely fully met in practice.

Visual Representation of Stock Price Data

Source: businessinsider.in

Analyzing Amazon’s price stock history requires a comprehensive understanding of various market factors. To gain a broader perspective on fluctuating stock prices, it’s beneficial to compare it with other companies, such as examining the performance data available for the w o o f stock price , which offers a contrasting case study. Returning to Amazon, further investigation into its historical data reveals significant correlations with broader economic trends.

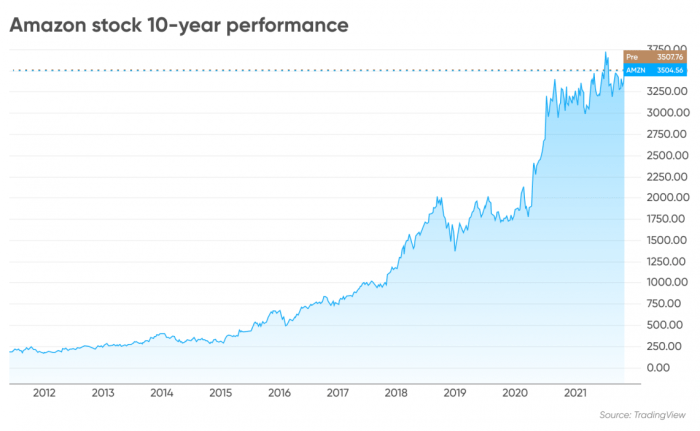

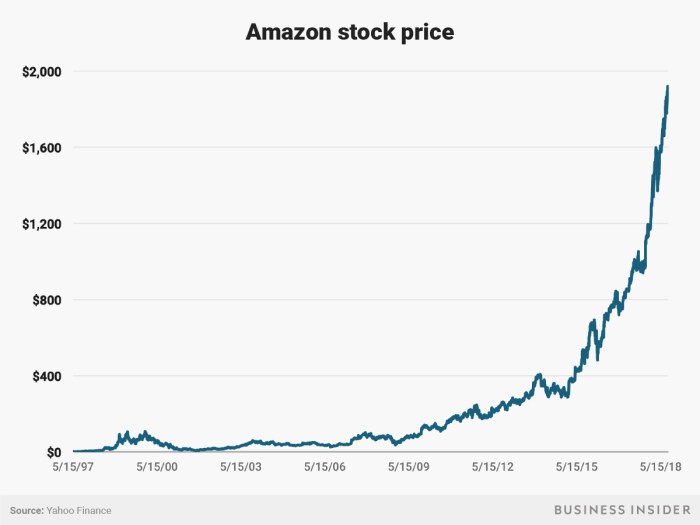

Visualizing Amazon’s stock price history using different chart types offers valuable insights. Line graphs effectively show overall trends, while candlestick charts highlight daily price fluctuations and volatility.

A hypothetical line graph depicting Amazon’s stock price from 2018 to 2023 would show a sharp increase during the COVID-19 pandemic followed by a significant decline in 2022. The x-axis would represent time (years), and the y-axis would represent the stock price (USD). Key data points, such as peak and trough prices, would be highlighted, and a trend line could be added to illustrate the overall direction of the price movement.

Clear labels for the axes and data points are crucial for easy interpretation.

A hypothetical candlestick chart illustrating a period of high volatility would show wide ranges between the high and low prices for specific days. The opening and closing prices would be indicated by the body of the candle, with the wicks extending to the high and low prices. Periods of high volatility would be characterized by long candles with significant differences between opening and closing prices.

The chart would visually represent the uncertainty and rapid price swings experienced during that period.

FAQ Section: Amazon Price Stock History

What are the biggest risks associated with investing in Amazon stock?

Investing in Amazon, like any stock, carries inherent risks. These include market volatility, competition from other companies, regulatory changes, and economic downturns. Thorough research and diversification are crucial.

How can I access real-time Amazon stock price data?

Real-time data is available through many financial websites and brokerage platforms. Many offer free basic information, while others require subscriptions for advanced features.

Are there any ethical considerations related to Amazon’s stock performance?

Ethical considerations often arise when discussing Amazon’s impact on workers’ rights, environmental sustainability, and its market dominance. These factors can indirectly influence investor sentiment and stock price.

What are some alternative investments to consider alongside Amazon stock?

Diversification is key! Consider other tech stocks, bonds, real estate, or mutual funds to balance your portfolio and mitigate risk. Consult a financial advisor for personalized advice.