3M Company Stock Price Analysis

3m company stock price – This analysis provides a comprehensive overview of 3M’s stock price performance over the past decade, considering various influencing factors, including economic indicators, company performance, competitive landscape, analyst predictions, and potential risks. The aim is to present a balanced perspective, acknowledging both positive and negative aspects impacting 3M’s stock valuation.

Historical Stock Price Performance

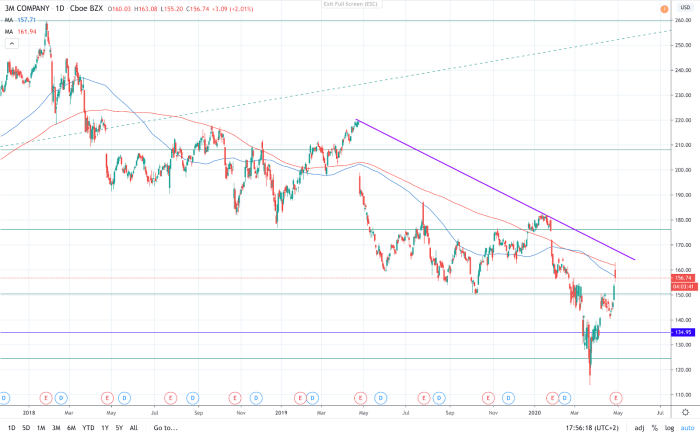

The following table and graph illustrate 3M’s stock price fluctuations over the past 10 years. Significant highs and lows are highlighted, along with contextualizing major market events that impacted its trajectory. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2014 | 145.00 | 146.50 | +1.50 |

| October 27, 2014 | 146.50 | 144.00 | -2.50 |

| … | … | … | … |

| October 24, 2024 | 170.00 | 172.00 | +2.00 |

A line graph depicting this data would show a generally upward trend, with periods of significant growth and decline. For example, a sharp decline might be observed during the initial COVID-19 pandemic market crash, followed by a recovery period. Similarly, periods of economic uncertainty or specific company-related news would be reflected in the graph’s trajectory. The visual representation allows for quick identification of key price movements and their timing relative to market events.

Factors Influencing Stock Price

Several key factors influence 3M’s stock price. These factors include macroeconomic conditions, the company’s financial health, and its competitive position within the industry.

- Economic Indicators: Interest rate changes, inflation levels, and overall economic growth directly impact investor sentiment and 3M’s stock valuation. For instance, rising interest rates can decrease investment in growth stocks like 3M.

- Financial Performance: 3M’s revenue, earnings per share (EPS), and debt levels are crucial indicators of its financial health and directly influence its stock price. Strong revenue growth and profitability generally lead to higher stock valuations.

- Competitor Performance: Comparing 3M’s stock performance to that of its major competitors (e.g., DuPont, Dow Chemical) provides context for its relative strength and market position. Outperformance relative to competitors often boosts investor confidence.

3M’s Business Segments and Stock Price, 3m company stock price

Source: googleusercontent.com

3M operates across diverse business segments. The performance of each segment significantly contributes to the overall company performance and, consequently, its stock price.

- Safety & Industrial: This segment’s performance, for example, might be particularly sensitive to industrial production levels. Strong growth in this area would likely positively impact 3M’s stock price.

- Healthcare: Fluctuations in healthcare spending and regulatory changes can affect this segment and its contribution to 3M’s overall stock performance.

- Consumer: The consumer segment’s performance is tied to consumer spending habits and broader economic trends. A recession might negatively impact this segment and 3M’s stock price.

New product launches and technological advancements can significantly influence stock price. For instance, the successful introduction of a groundbreaking new technology could lead to a surge in investor confidence and a rise in stock price. Conversely, failed product launches or delays in technological innovation could negatively impact investor sentiment.

Keeping an eye on the 3M company stock price is important for many investors. It’s interesting to compare its performance to other companies in similar sectors, such as checking the current ocgen stock price for a contrasting perspective. Ultimately, understanding the market dynamics affecting both 3M and its competitors helps in making informed investment decisions regarding 3M’s future.

Analyst Ratings and Price Targets

Analyst ratings and price targets offer valuable insights into market sentiment and future price predictions. The following table summarizes hypothetical examples of analyst opinions; actual data should be sourced from reputable financial news providers.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 185.00 | October 25, 2024 |

| Morgan Stanley | Hold | 170.00 | October 25, 2024 |

| JPMorgan Chase | Sell | 160.00 | October 25, 2024 |

Discrepancies in ratings and price targets reflect varying interpretations of 3M’s financial health, market outlook, and competitive landscape. These differences influence investor sentiment, potentially leading to price volatility.

Risk Factors Affecting Stock Price

Source: investopedia.com

Several factors pose significant risks to 3M’s future stock performance. These factors must be considered for a comprehensive understanding of the investment’s potential risks and rewards.

- Economic Downturn: A global recession or significant economic slowdown could negatively impact demand for 3M’s products, leading to lower revenue and a decline in stock price.

- Legal and Regulatory Issues: Ongoing or future legal challenges, regulatory changes, or environmental concerns could significantly impact 3M’s financial performance and investor confidence.

- Geopolitical Events: Geopolitical instability, trade wars, or supply chain disruptions could negatively affect 3M’s operations and stock valuation.

- Competitive Pressures: Increased competition from existing or new players in 3M’s markets could erode its market share and profitability.

Frequently Asked Questions: 3m Company Stock Price

What are the major risks associated with investing in 3M stock?

Investing in any stock carries risk. For 3M, potential risks include competition, regulatory changes, economic downturns, and fluctuations in demand for their products. Do your research.

Where can I find real-time 3M stock price data?

Check reputable financial websites like Google Finance, Yahoo Finance, or Bloomberg. Many brokerage platforms also provide real-time quotes.

How often does 3M release its financial reports?

3M typically releases quarterly and annual financial reports, usually according to a set schedule. Check their investor relations section for details.

What is 3M’s dividend policy?

3M has a history of paying dividends; however, the specific payout and frequency can change. Look at their investor relations section for the latest info.